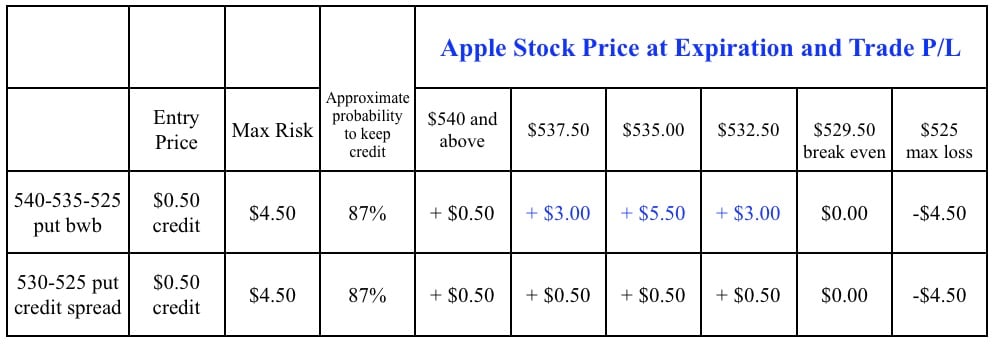

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. A week doesn’t go by when I’m not asked a question about selling a put spread (credit spread) on a particular stock, especially before earnings when the implied … Read More

The SPX fly makes it 5 for 5.

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. Over the past several weeks I’ve been selecting broken wing butterfly trades on AAPL and the SPX using weekly options and then tracking the hypothetical P/L of those … Read More

Learning Some More–Day 2 SXCI

I spent some time yesterday writing how exciting it was to see some traders on the desk add to their game a new trade. Instead of only looking for the quick profit taking a scalp short in a stock gapping higher they looked to capture the larger move to the upside. Here is what I wrote: We urge our desk … Read More

Learning

This morning it was announced that SXCI was buying CHSI in a cash and stock deal (story from Benzinga). Both stocks were gapping up significantly. It is unusual for the acquirer to gap higher in a merger that involves stock as a major component of the transaction. There is usually a huge amount of selling pressure from the “merger arb” … Read More

The Trading Elite: Discussions With Top Financial Traders

What do professional traders do day-in and day-out to beat the markets? What separates the amateur from the professional? Why is it that some traders make millions while others can’t even get their account into the green? Those are the questions I set out to answer when I decided to get in touch with several of the top financial traders … Read More

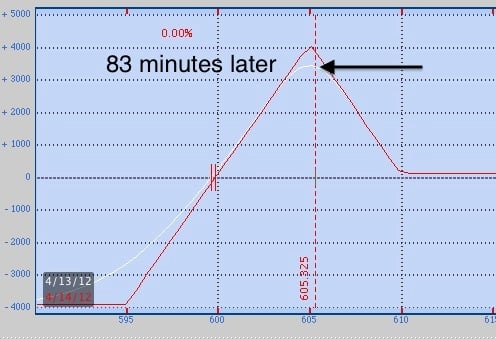

What a difference 83 minutes can make.

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. If you were following along last week with the hypothetical AAPL 610-605-595 put broken wing butterfly, then you saw how that example returned a profit of 31% (calculated … Read More

Buy, sell, move on

Below is an argument from a trader on our desk not to hold stocks during this earnings season. The trader suggests to get in and out and not expect much follow through with stocks to the upside. Kind of a frustrating market day because the market is slowly grinding higher throughout the day but individual stocks don’t really make hods. … Read More

Midday Idea – April 17th 2012

Disclosure: Short $CIE and $ECYT