Richard Chignell from Embrace the Trade on the fourth of his series of posts has been asking Pro Traders about their psychological processes. From Mr. Chignell: The fourth in my series of posts asking Pro Traders about their psychological processes. Delving a little into how it feels to them when trading. The good and the bad. How this has changed … Read More

Stopped Out!

I was writing this before the close because I stopped trading and I walked out to clear my head. After I came back and saw how FB and GRPN traded into the close I am very upset with the way I handled my trading today. Both stocks traded right to my target but I was stopped out of both. My … Read More

Are you guilty of Negative Self Talk?

I received this Daily Trading Review from one of our traders. It highlights the importance of learning to combat Negative Self Talk. I am an (expletive deleted). I had a comeback going, at 2:20pm I was down $23 after being down all day.I was calm and selective and thoughtful all mid day and into the 2:30 hour. I lost $250 … Read More

One Good Trading Day

I received this Daily Review yesterday from one of our traders. I highlight in this blog because it represents One Good Trading day. If you get as much as this trader during each trading day you will grow as a trader. If you are not improving as much as this trader each trading then you have some work to get … Read More

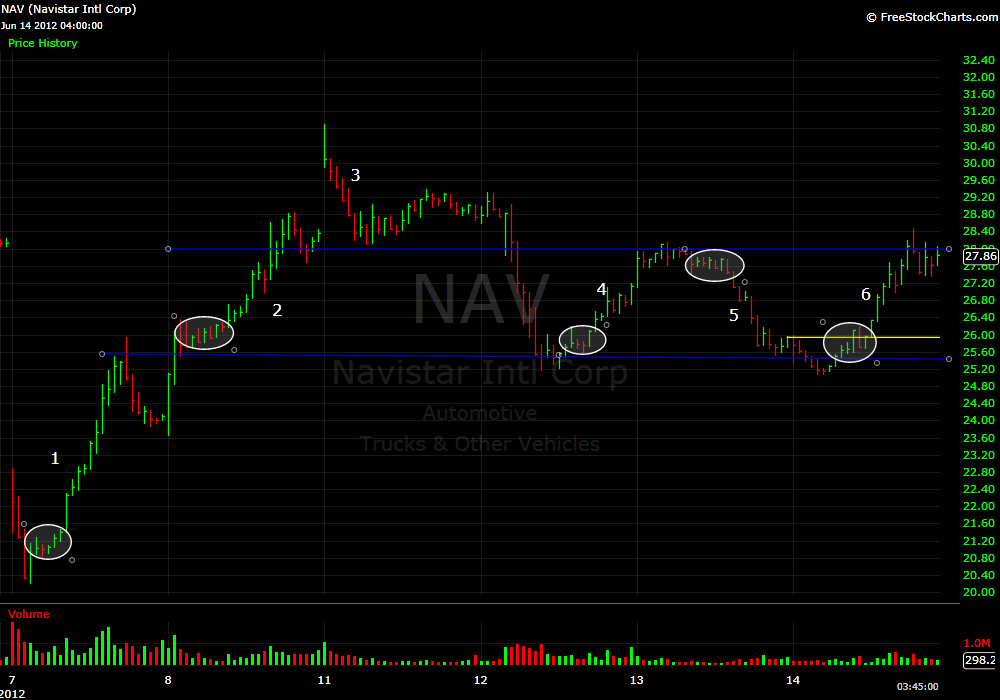

“NAV Again?”

Yes. As long as a stock is offering excellent risk/reward setups over and over I will keep talking about it. And for those of you who don’t know me personally it is not in my nature to repeat myself. I prefer to explain a concept once and then move on to something else. But apparently two blog posts, 5 mentions … Read More

Finding Repeatable Patterns

After the close we discussed some plays from Stocks In Play yesterday. When we look at a stock we search for patterns. Patterns that repeat. Patterns that make sense to us. Patterns that we can work at to master. So for these three stocks we are making risk/reward trades with the patterns we see. We have a full playbook of … Read More

Reversal Rehearsal

I have noticed recently a lot of money being made on the desk via reversal patterns. A reversal pattern is when a stock that has trended in one direction stops trending and then begins a new trend in the opposite direction. Reversal patterns can be much easier to trade than the initial trend as they usually unfold over a longer … Read More

Have you seen the new weeklies?

This post is another in a series tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. A simple return of 9% per week on average. That’s what my hypothetical trades in this blog over the past two months or so have done. And although hypothetical in nature these trades were all identified and tracked … Read More