Tuesday October 30, 2012 at 5:00 PM Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options … Read More

The Chicken or the Egg?

Hi Mike, First of all, I want to thank you for being such a great mentor. I’ve learned so much by reading SMB Capital blogs. I’m currently working a full time job as a Mechanical engineer and have taken trading four years ago, fascinated by this machine we call Mr Market. Obviously due to my day time job, I consider … Read More

Spencer’s Trade Preview $CAT $SPY – 10.22.12

In this 1 minute video Steve explains his thought process with respect to trading CAT when the market opens. Key levels are discussed with price targets. In this 2 minute video Steve discusses recent price action in the SPY and key levels to watch in the next few days. Steven Spencer is the co-founder of SMB Capital and SMB University … Read More

Forex Introducing Brokers: Bad or Value Add?

Ask most new forex traders if they know what an introducing broker is and the answer you get is usually a blank stare. If you want to get somewhere in any business, it really pays to be familiar with even the smallest of details. In the retail forex business, understanding the role of your forex broker can affect what strategy … Read More

The Apple Story

There have been very competent traders discussing signs of weakness in AAPL since it failed at 680ish. And since then there have been several excellent swing shorts AND swing longs. The price action has loosened up as the debate continues on where it should be priced coming into its earnings release this week and after its disappointing Iphone 5 release. … Read More

The Trend: Is it Your Friend or Just an Acquaintance?

We’ve heard it a billion times: The most effective way to trade the forex market is to trade with the trend. Like 80 years ago some fast talking high pants guy probably at the New York Stock Exchange said, “The trend is your friend, seee?” So now what do we do? Find a chart that looks bullish and press the … Read More

Forex Trading Room Recap 10.18.12

In this segment, Marc Principato, CMT, explains why larger time frames are so important to analyze before taking day trades or even scalps. He examines the EUR/USD as well as the S&P 500 futures. — Marc Principato, CMT Risk Disclaimer *No Relevant Positions

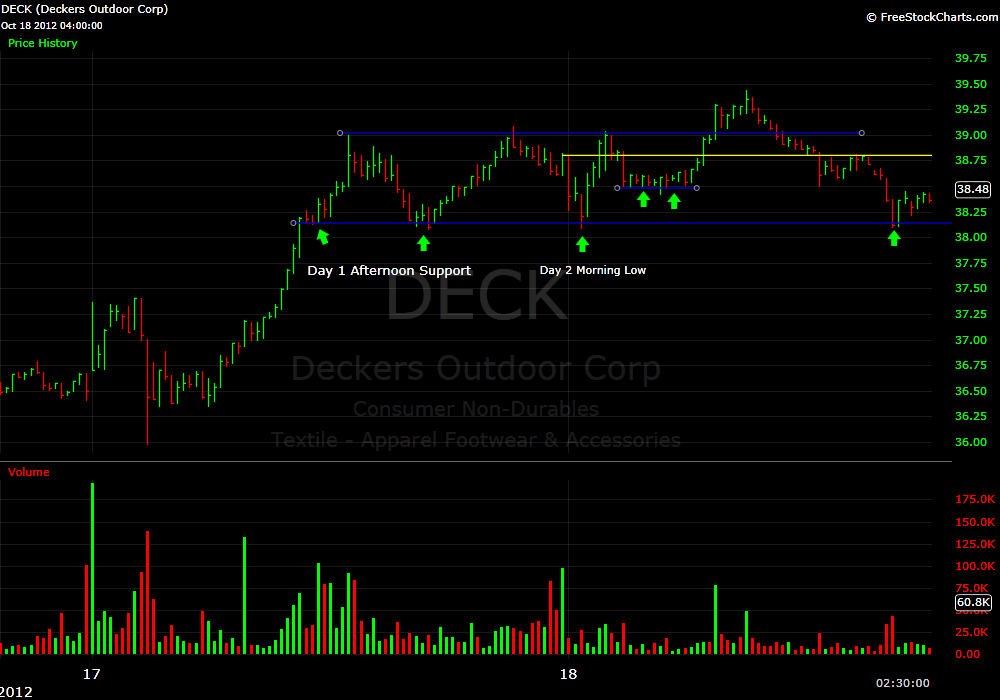

Trading Lesson #1 (Again): Buying A Strong Stock At Prior Day’s Afternoon Support

About a year ago I wrote Trading Lesson #1 offering a safe way to buy stocks that had shown strength the prior trading day. Let’s take a look at the price action from DECK today, which was discussed in a separate post yesterday on information flow. DECK showed huge relative strength yesterday to the market taking out two important resistance areas from … Read More