There is a mistake I repeatedly catch on Trading Twitter and even to a lesser degree on our proprietary trading desk. From my seat, this is the #1 mistake traders make before leaving a trading session. Let me share this #1 mistake. And then challenge the trading community for all of us to be better…together.

I was scrolling through Trading Twitter recently when I noticed a beginner trader being unusually transparent about a big trading loss. As my friend Joe Fahmy joked at Traders4ACause, “I am on Twitter so I don’t take losses.” That is what I mean by this trader was being unusually transparent.

And this unusually transparent trader was met with the “you will be back stronger(s)” and “hang in there(s)” and “sorry bro(s)” responses. And after reading this transparent trader’s tweet, I thought to myself “no he won’t”. And this trader seemed like a nice guy. And I am certainly not rooting against him. And I don’t mean to be overly harsh, but rather helpful. This trader was NOT going to get better. And the well-intentioned responses were NOT actually gonna help this trader. There was something severely lacking in this unusually transparent trader’s tweet.

On this topic, recently, I challenged the trading community with this tweet:

The responses were so interesting. And they highlighted an important difference between the elite trader from the fledging trader. Traders were so observant of what they did poorly. They spotted their problems so well. They were transparent in a public forum about their weaknesses, which takes guts. But their answers to the question posed by me above were as incomplete and PNL stifling as the unusually transparent trader above.

What mistake did that unusually transparent trader make? What mistake did the respondents to my questions above make? What is one difference between the elite trader from the fledging trader?

The unusually transparent trader identified what he did wrong. He did this well. But he NEVER posed a solution for his trading underperformance. Traders who answered my tweets questions spotted their trading issues remarkable well. But, almost all, FAILED to answer that second part of my question: How can you solve this trading issue? They just shared what they needed to work on. And they skipped over the most important part- solving the problem.

Yikes! We have to stop doing this in the trading community.

Elite traders identify their trading issue and then develop a solution to improve their underperformance immediately. They do not leave a trading session without their solution (see tweet below).

Nightly, many traders on our desk send me their Daily Report Card, reviewing their trading day. Often I mentor to these traders:

Good job observing a trading challenge. Even better if you offer a solution.

How the Daily Report Card Helped Legend Become the #1 Trader (Prop Firm)

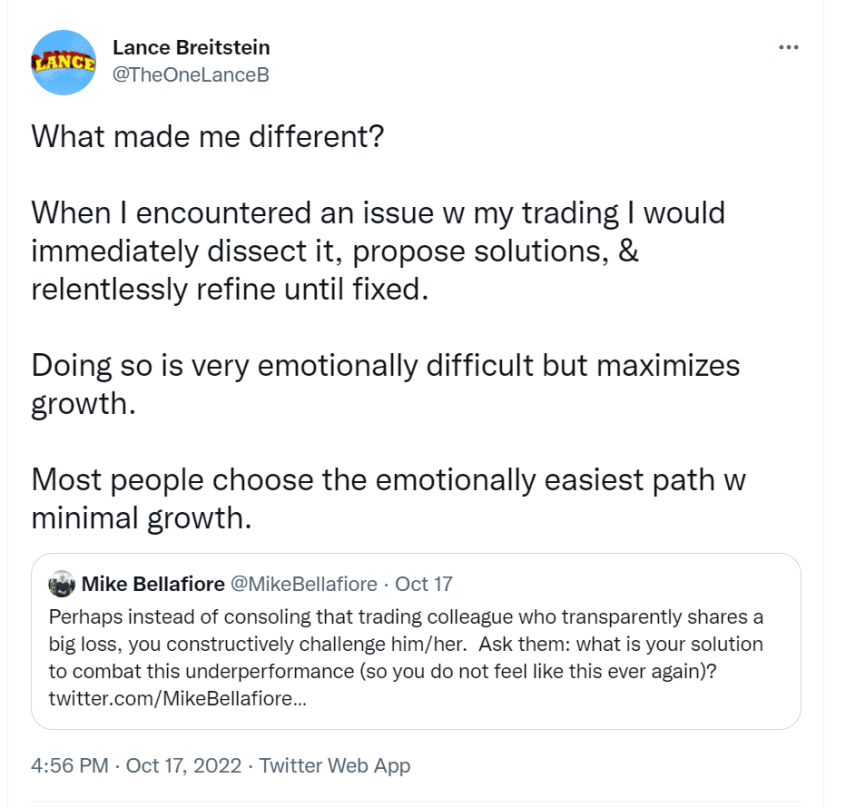

Further, @TheOneLanceB the #1 trader at a tier 1 proprietary trader, shares with the trading community what made him different and confirms the importance of finding solutions to your trading issues (see below).

Also, this is why when I moderated a chat between four elite traders at Traders4ACause, we focused on offering solutions to trading challenges to the attendees to thrive in 2022 (see below).

Also, this is why when I moderated a chat between four elite traders at Traders4ACause, we focused on offering solutions to trading challenges to the attendees to thrive in 2022 (see below).

Let’s be more constructive as a trading community…together. I propose three solutions:

a) When you transparently tweet sharing a losing day or trade, add a solution to your trading underperformance. And seek feedback on this solution.

b) When you spot a trader sharing a big loss, challenge them to suggest a solution to their trading underperformance.

c) Applaud the traders both sharing AND offering solutions. Let’s stop applauding the traders who are just sharing big losses. Let’s push them to be better…together.

From all of us at SMB, train and trade well.

Mike Bellafiore is the Co-Founder of SMB Capital, a proprietary trading desk, and SMB Training, which provides trading education in stocks, options, and futures. Bella is the author of One Good Trade and The PlayBook. He welcomes your trading questions at [email protected].