In this discussion, we’ll discuss the example of the incorrect entry using an option strike with lots of time to expiration -and different ways we can employ damage control on a trade that looks to be upside down for a time. All commentary is hypothetical, and solely my opinion and what I might potentially do if I had this position.

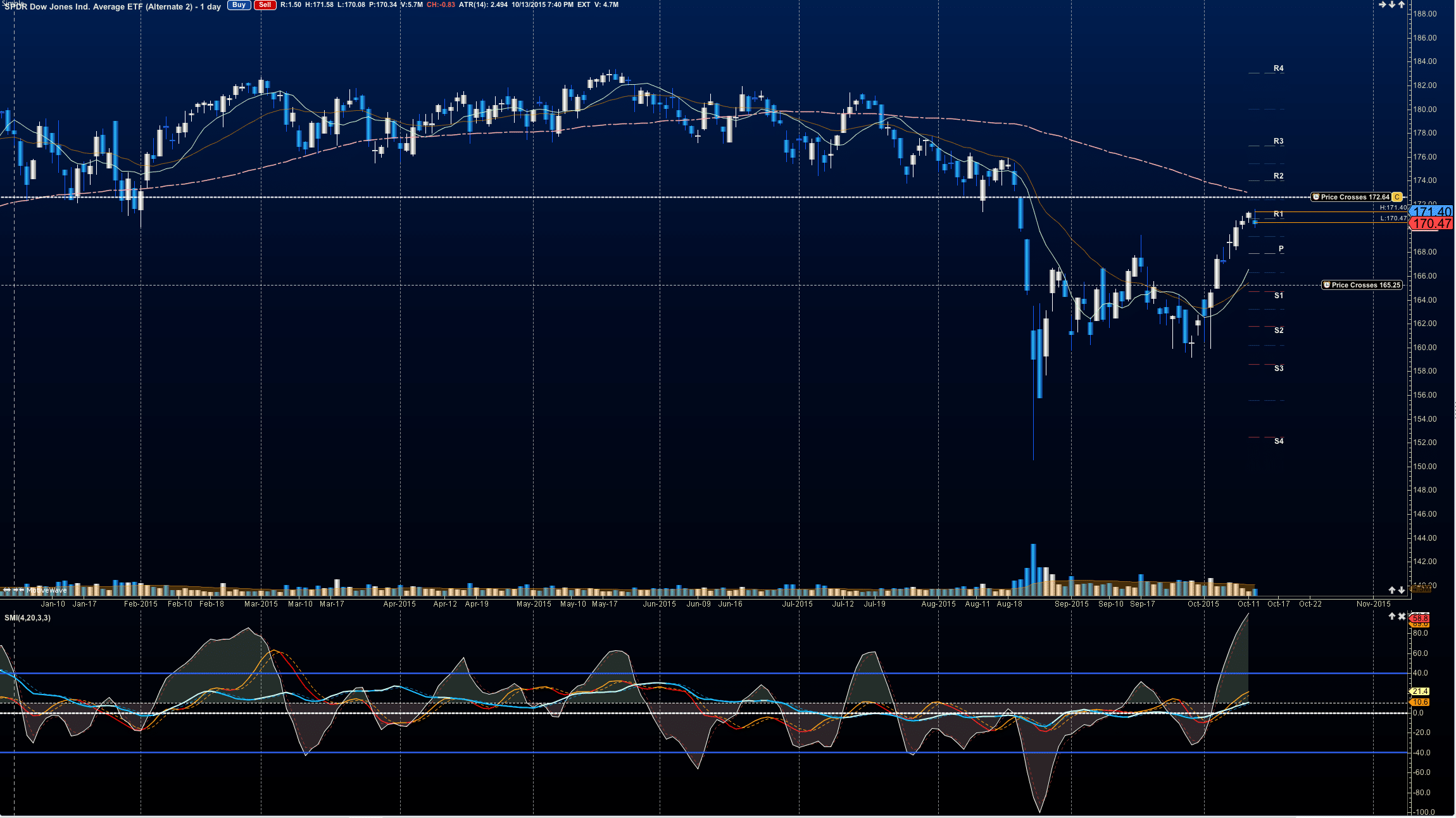

DIA

Scenario –

Trader buys the Dec 165 DIA puts on Oct 5, 2015 for somewhere near 5.35 because they felt the chart had to be rolling over…..without confirmation. A gut feeling that was overwhelming; trader used one piece of data on a very small time frame and ignored all the others suggesting the chart was going to accelerate into resistance.

Certainly, from a raw trading mechanic, this is not an appropriate entry for a short whatsoever – but what is done is done, and now we are in a process of damage control and potential triage.

First -the bad news –

The trade was considered on a very small time frame – instead of a longer one.

The trade was based on gut and not on technical market structure or current market conditions.

The trade was entered into when the instrument was headed for breakout.

The instrument has continued the breakout, still making higher lows and higher highs (definition of an up trend, in case we forgot there =)

The option is now worth 3.05 from 5.35 – a 43% haircut.

The student is worried, as their position size was based on an optimistic move in the right direction.

The only good news?

This trader has time on their hands – they paid good money for it.

=========

So, let’s consider two options – that the student is correct about direction but missed the timing of it dreadfully, or that the student is incorrect, and the chart is headed back to new highs – or at least well out of the option strike region.

Solution One –

Cut and run – this is a common choice – trader just gets frantic about losses and leaves the trade without the assessment of the chart, and what could happen. Essentially, it is the compounding of two mistakes – poor trade entry AND poor trade exit.

-If the trader is wrong about the direction, this could be a fair choice but due to market ebb and flow, it is not usually the most prudent approach.

-If the trader is right about the direction, and just has poor timing, this cut and run becomes fodder for self abasement and more poor decision making.

Solution Two –

Wait it out and do nothing; just let it get into expiration week -second most common choice- trader falls into the” it’ll start doing what it is supposed to, it just has to. I’ve lost too much for it not to turn around; I’m not getting out now”. Trader will stop chart analysis and look hopelessly at the candlesticks as they move against them, just cross their fingers, or cry (I used to do this) or scream at the screen powerlessly (ok, I used to do this, too).

-If the trader is wrong about the direction, this is the worst of all choices incurring 100% losses. Amazing how often some of us do this.

-If the trader is right about the direction, and just has poor timing, the reward is slapping oneself on the back, and expounding on their great trading prowess and guts (failing to remember the entry was abysmal).

Solution Three –

Use the power of options to potentially give power to the trader, mitigate risk of further losses, and whether right or wrong on the choice, leave virtually unscathed. So just how does someone do this properly?

The most simple solution is to turn those puts into calendar spreads – selling against the Dec 165 puts to hedge against further loss if the chart continues to move to the north. This solution will also work if the trader is correct, with minor adjustments made to the strike price as time moves forward.

If DIA continues to run or stays where it is now (we would use trading mechanics to assess the probability of this) the trader might begin selling the weekly 165 puts expiring next week, and allowing it to expire, selling new puts each week following the expiration of the prior week, and doing this each week until the Dec 165 put held is in its expiration week – then selling some strike lower. There are 9 weeks that this can be done – if DIA sharply accelerates, we can turn the calendars into diagonals as we move closer to expiration. Theoretically, if we are collecting between .50 and .75 each week for our sold puts, we can clearly recover our outlay by expiration of the original puts.

Another risk mitigation suggestion for the incorrect trade direction is employing a ratio spread, selling more puts than the trader holds to increase returns, versus just trying to minimize loss. This becomes risky as it requires margin and if the chart starts moving in the proposed direction, there is double trouble to contend with there.

There are a series of choices that are available to the option trader who understands market structures and trading mechanics when they are holding a position in what appears to be the wrong direction. The number one thing NOT to do is panic. People simply do not think clearly if they panic. It takes a trained and aggressive mind to get out of trouble.

I’ll leave you with my favorite analogy –

What makes a great golfer?

They shank, they slice, they send it into the sand, they send it flying into the woods, and more – it happens to the best of them. But they don’t panic. They train their minds up in preparation for the bad shot, and when it happens, they use the tools they have honed to get out of trouble.

Aggressively think through your trades – it will create much greater opportunities for getting out of trouble. Think, don’t panic. If you are the type to panic, get yourself a trading buddy/coach who can peel you off the ceiling.

Strive for grace under pressure.