The top In Play names this morning:

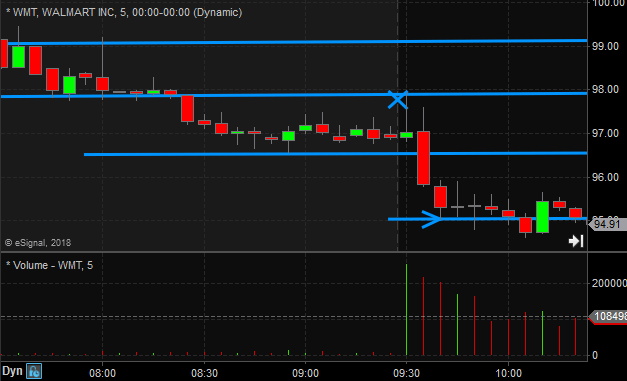

WMT was my focus as the lowering of FY19 guidance was potentially a very strong catalyst. Early indications from pre-market trading were many traders were attempting to dump the stock ahead larger selling that would come after the opening bell. You can see my discussion of WMT in the AM Meeting here.

With a short bias and such a large gap my preferred entry on the Open is after a quick pop to potential resistance areas. I offered 10% at 97.50. 40% at 97.89 and another 40% at 97.99 (this offer wasn’t executed).

As you can see from the chart WMT failed just below 98 and quickly reversed. The speed of the reversal didn’t offer the opportunity to build into a larger position. At 10AM when it flushed below 95 I bought above 94.50 with the assumption that after all the “chasers” and stops were triggered below 95 it would bounce 50 cents to $1. Flat at 95.56.

HD I didn’t have a strong bias but was prepared to trade off of the levels in the game plan. On the Open it bounced from 189 before reaching my first bid. When it failed at 191 it traded down quickly to 188 and my bid was hit. After a quick drop to 187 it popped back above 188. My trailing stop was triggered when it dropped again.

The low print was at S2 but I hadn’t entered a script to get long there and had no price alert. So I missed the $3 bounce from this level. I was trading the WMT bounce at exact time it bottomed so my attention was elsewhere.

SPY plan was to trade long against pre-market low. SPY was due for a pull back friday and the pre-market low $4 from the high was sufficient pull back in my view based on how strong the bounce from the low had been. Script entered to get long 271.12. The other trade in SPY was short into 273 which had been support on Friday. I got alert at 273 and put up an offer at 273.05 and got taken. Stop above 273.20. This trade started to work in a few minutes and I scaled out as it traded back down through 272. This idea was also discussed at the beginning of the AM Meeting.

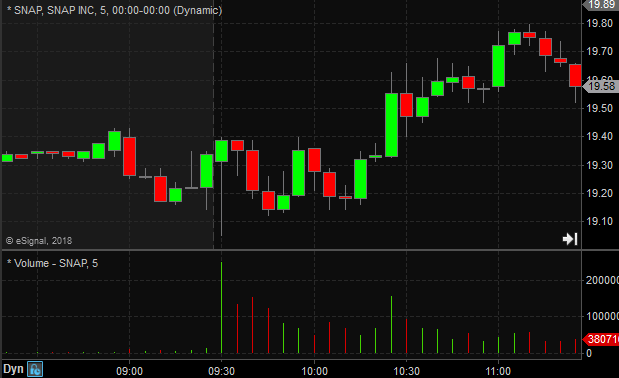

SNAP plan was to fade the downgrade. A buy into 19 seemed like a layup so I entered a script to get long at 19.05. SNAP hit 19.05 but the offer never touched that price so my script never got long. This happens quite often in “real life” trading. If you are picking good prices to get long/short often you will get in close to the bottom/top of short term moves and occasionally you will miss entries by pennies.

The other two In Play names discussed were MGM and UBNT. MGM was mainly for novice traders on the desk because of the higher liquidity and tighter spreads. UBNT was a high risk high volatility setup because of the SEC Supboena. It actually dropped another $8 in the pre-market during the AM Meeting. I entered no trades in it on the Open but discuss the possibility of a flush below 50 before a bounce and eventual roll over down to the 40s.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 21 years. His email address is: [email protected].

No relevant positions