This afternoon I tweeted that price was insufficient to confirm a move and that you need time as well. What does this mean? As traders we attempt to capture a new trend in the market we are trading. One of the most commonly used signals for a new trend is a powerful change in price. I have heard many traders refer to this as a change in “character” of the most recent trading pattern. This change in character is not sufficient to cause me to commit a large amount of risk.

Why not? Because a quick impulse move to new price levels are often the result of a temporary supply/demand imbalance in a market and the market will revert to its mean soon thereafter. Confirmation of a powerful impulse move comes when the new price level is sustained for a period of time. Once I see the sustaining of the new price levels I will begin to commit a more significant amount of risk for a possible new trend.

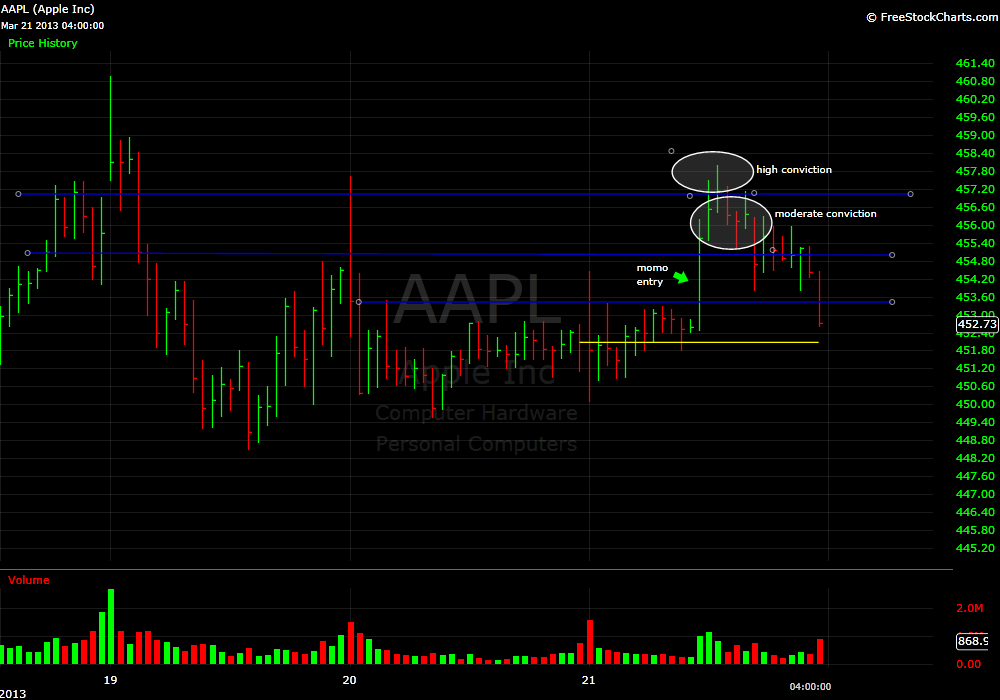

Take a look at these two examples from today. The first was in AAPL, which drove powerfully from 453 to 457. There was a quick momentum trade in this move, but the question I then needed to ask myself is this the beginning of a new trend. I used 457 as my barometer. If AAPL could sustain price above 457 for 20+ minutes I would be willing to commit more than a small amount of risk to a long position. If not either remain flat or hit out of a small feeler position as AAPL trades lower.

The second stock is CLF that showed signs of a short-term bottom yesterday. Today it traded above yesterday’s resistance area and had a powerful impulse move to the next short term resistance area at 21.50. It was a nice 80 cent momentum trade. For me to be interested in a bigger picture trend I needed to see price hold above 21.50. This did not occur so committing more than a de minimus amount of risk at prices far above the previous 20.70 resistance does not make sense from a risk/reward perspective.

If you allow stocks to show you their strength or weakness through time your win rate will increase and this in turn will allow you to take on more risk in your trades.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].

No relevant positions

One Comment on “Time & Price”

Dear Steve,

is it possible to sell short in this case (if price returns under resistance level after quick move up or rally)?

Maks