This is the setup that has offered the highest win rate intraday since the beginning of October and the greatest risk/reward ratio. It is the setup that I chose to write about in a very cool trading book that will be released in 2011 and I discussed it last week in Vegas during our tape reading/intraday swing lecture.

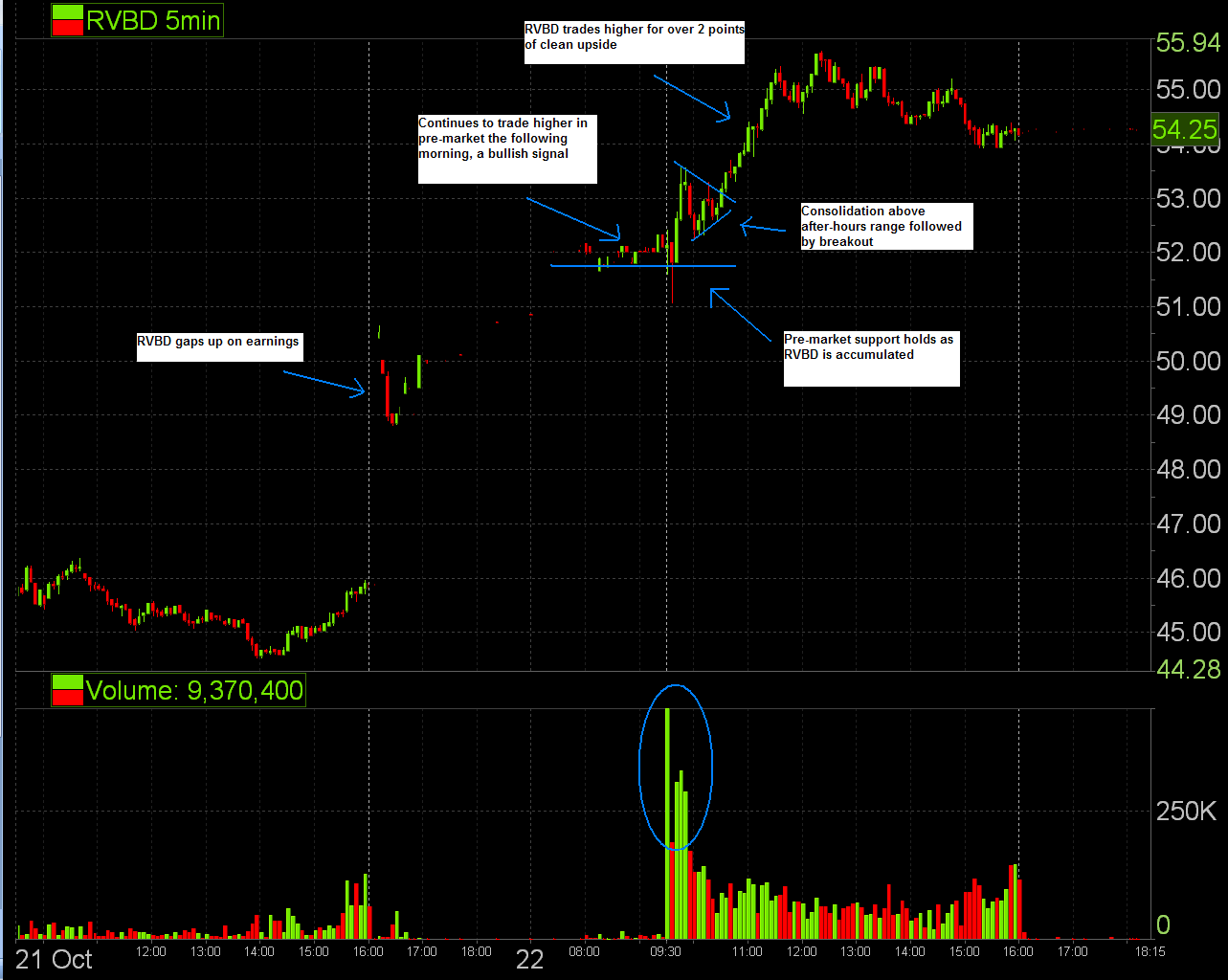

- growth stock reports better than expected earnings and raises guidance

- the intial after hours reaction to the announcement is a move to the upside with heavy volume

- the next mornings premarket volume is at the top of the prior day’s after hours range or at a higher level

The Execution

- Buy first lot at the bottom of the premarket consolidation range. If no consolidation then wait for market to open before trading

- Buy second lot above pre-market resistance. Place stop immediately below pre-market high.

- Hold 50% of position until the market closes

This setup will work in any type of broader market conditions. It tends to work the best during a longer term uptrend in the market where the momo funds who seek this setup are particularly aggressive. If you are an experienced trader you can truly crush this trade. Your eyes should literally light up if you come across this setup during the next earnings season.

Take a look at these charts from the most recent earnings season. And by the way, also notice that the intraday moves are just as large as the gaps, so no more complaining that the overnight gap took away your opportunity to get long 🙂

6 Comments on “The Money Trade”

FFIV also presented an identical setup to the ones described above. BIDU also to some extent, with the exception that the stock initially sold off on e’s, only to trend up for almost 9 points. Will you ever buy 1 lot the day before if it closes on highs in A/H? Looking forward to your book Steve, Bella has set the bar high.

GMCR as well!

sweet mr spencer, youre coming out with a trading book?

Thanks for the tip Steve. It seems to me that after hours charts are just as important as intraday. Not just for this setup but for others aswell.

Whats really cool is, the more people that pile in this ‘pay up circus’ the better it will be for EVERYONE. One day, stock will go from 100 to 1000, and we’ll all be rich. Thanks!!!!

Looking forward for your book mr. Spencer and I really appreciate the tips that you offered in this post 🙂