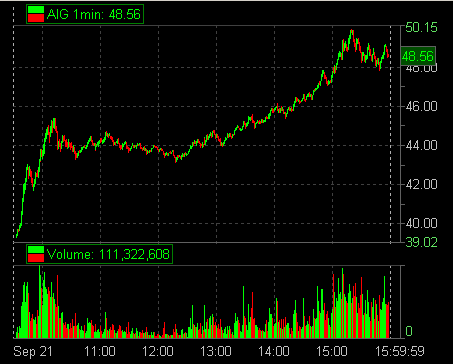

Into the Close I sit, trade, and also must watch what our traders are doing on my Admin screen. It is my job to make sure they are not violating market fundamentals. And I saw this on a few trader’s screens:

-1000 AIG

-1600 AIG

This is an example of breaking a market fundamental. We do not short strong stocks. Let’s discuss why.

1) There is more money buying into pullbacks and then selling the new highs.

2) You take yourself out of the game by shorting, watching AIG trade higher and then getting pissed at yourself for doing something so stupid (for lack of a better word).

3-10) See answer 1.

If you short a strong stock into an upmove you may make 12c on a trade. If you buy into a pullback your upside can be 80c. If you are wrong shorting a strong stock your downside can be 50c. When you buy a strong stock into a pullback your downside might be 11c. Advantage buying into pullbacks.

One of the things that intraday traders learn last is identifying the stocks capable of special moves. You need to see a bunch of stocks trade as strong as the Hulk intraday before you start believing this is possible. But here are some signals using AIG from today as an example:

a) A two point upmove in the AM

b) A break of a technical level

c) Offers cleared quickly and for size

d) AIG not trading lower after a steep upmove

e) Difficulty getting hit on the bid

f) AIG easily making new highs

I am gonna stop there, the list is long. But you must be able to identify the strongest of stocks intraday. You will identify them because of their intraday fundamentals. And you must learn not to short or fade them. Doing so is costly.

Best of luck with your trading! Don’t forget to follow us on Twitter!