“Meaningful work and meaningful relationships aren’t just nice things we chose for ourselves- they are genetically programmed into us. Working effectively with others is critical to getting what you want out of life.” -Ray Dalio, founder Bridgewater. These days, anyone can connect to a trading chat room, a chat where trading ideas are shared. But do they really help? What … Read More

Elite Traders Kryptonite (Shocking!)

What if I told you some of the best prop traders experienced periods of awful trading? I might go so far as to say their results were awful during specific periods. They lost money. They made unforced errors. They lost confidence. You might have periods in your trading where you conclude you are terrible. You wallow in despair that you … Read More

You Are Meant To Do Something Great (A Note to Traders)

Dear Traders, You are meant to do something great. At SMB Capital, a proprietary trading desk in NYC/Miami, we are proud to have developed numerous 7-figure-a-year and even 8-figure-a-year traders. Yes! Become your best trader with impressive PnL. But there are many other ways to be great as a trader at a proprietary trading firm or elsewhere. Being great at … Read More

The Super Consistent Trader

We noticed one developing trader show a real ability to make money but also a lack of consistency and volatility in his trading. This was holding him back as a trader. We challenged him to focus on being more consistent, a Super Consistent Trader. How to Become a Consistently Profitable Trader (like you deserve to be) I wrote the promising … Read More

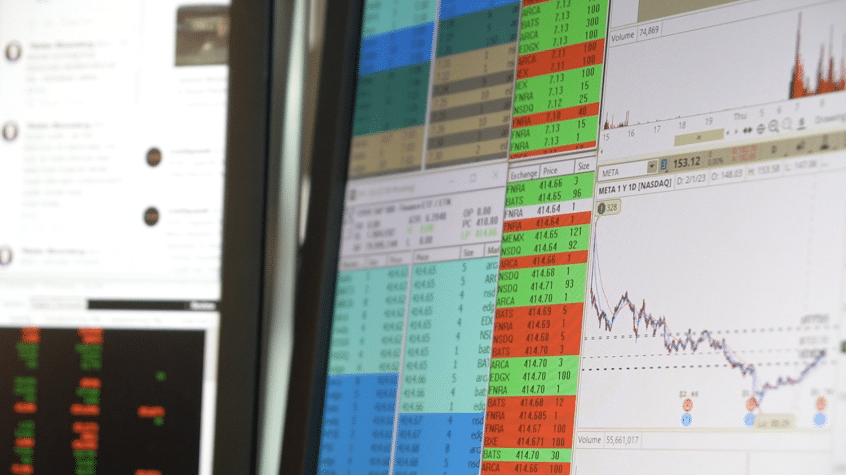

6 Ideas to Avoid Harmful Bias in Your Scalping

Here is an impressive observation made by a developing trader on the desk that can help your trading, specifically your scalping. The trader observed: I have sometimes gotten in situations where I have an overall directional bias on the name I’m currently trading, and it ends up bleeding into the actual scalps I’m taking. Scalping Rules (The secrets to scalp … Read More

An age-old trading problem to solve

There is a trading problem traders sought to solve when I started trading. (We don’t have to mention when that was if that is okay with you). There is a trading problem new traders needed to solve when we started our firm in 2005. There is a trading problem some new traders on our desk need to solve today. In … Read More

Timeless Advice for New Traders…Scalp!

My timeless trading advice for new traders is….scalp. Okay, let me explain why. What I heard too often During a recent team monthly trader meeting, I heard too often something that I wasn’t crazy about. I was particularly not so thrilled hearing it from the younger traders. While I wasn’t so thrilled, this did offer an opportunity to set expectations … Read More

5 Keys to Make More Money in Your Profitable Trades

Have you ever made a good trade and regretted you did not make more? And after giving this more thought you concluded that if you could just make more in your best trades you could do SO much better as a trader. And I mean a lot better. In fact, this one issue, might be the thing holding you back … Read More