This week, Gareth Ryan from IUR Capital presents options income strategies that could be used by investors this upcoming summer. He will discuss several key areas of both the equity and options markets including, strike positioning and time horizon with credit spreads. He will also discuss both near-term and longer term strategies with a focus on risk.

A+ Options Trades

In our SMBU Daily Video, learn about A+ options trades. In this video from Seth Freudberg, you will learn: Not all conditions are optimal for all options income trades It makes sense to increase capital on trades when optimal conditions exist for that strategy We hope this video helps you improve your trading skills. – SMBU Team Hi I’m Seth Freudberg, I’m … Read More

Options Trading Modes (SMBU Daily Video)

In our SMBU Daily Video, learn more about the two modes of options income trading. In this video from Seth Freudberg, you will learn: Greek based trading mode Statistically based trading mode How our option traders develop option income strategies pertaining to these modes We hope this video helps you improve your trading. – SMBU Team * no relevant positions … Read More

Free Option Tribe Today: CBOE’s Russell Rhoads on $VIX vs. $VXN trading

Tuesday, January 22, 2013 at 5pm EST SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options trading. Today, … Read More

Introducing a new blogger: Greg Loehr

SMB is proud to announce the addition of an experienced options trader and educator to our blog, Greg Loehr, of Optionsbuzz.com. Greg has served both as a market maker on the floor of the CBOE as well as a proprietary trader for various firms prior to his founding Optionsbuzz.com. Greg has also been a repeat guest on SMB’s Options … Read More

Playing the Quarterly’s on the SPX

This post is the first in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. With the end of the quarter fast approaching there are two thoughts in my mind: quarterly window-dressing and a potential slowdown in China. For the next week, … Read More

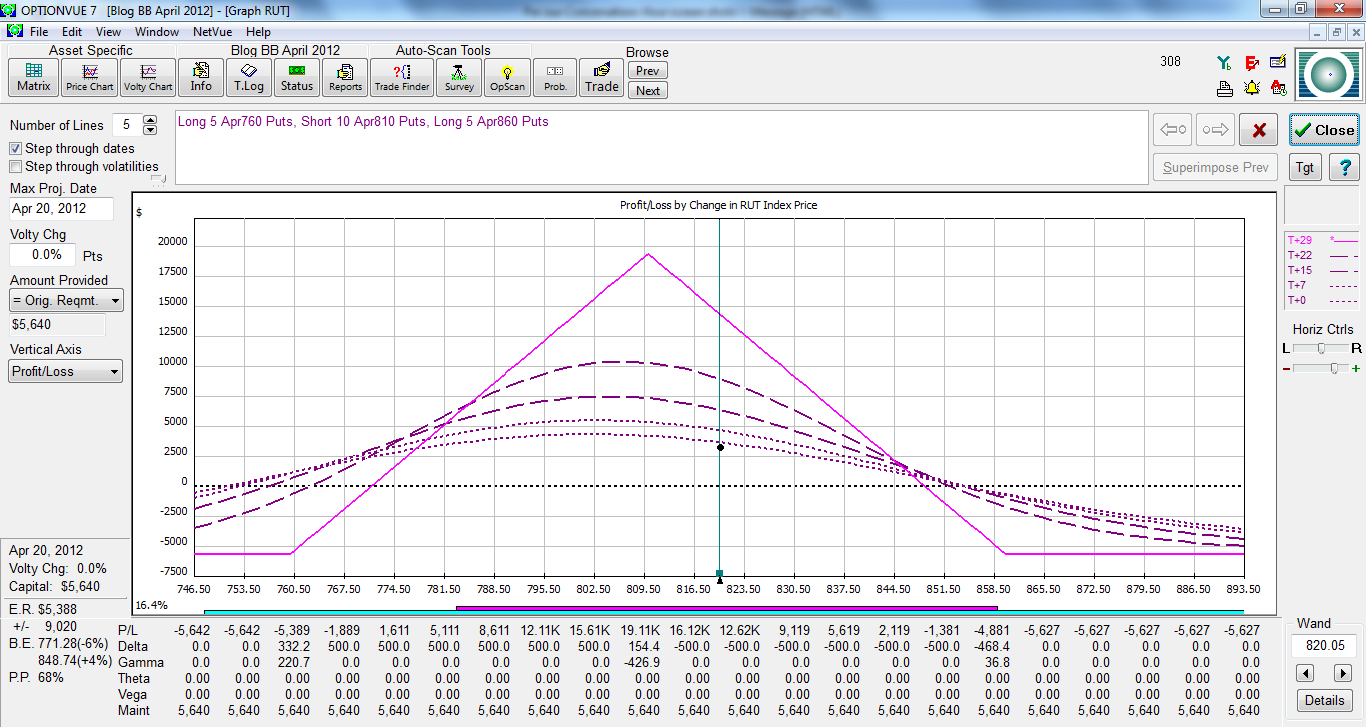

The April Bearish Butterfly Trade

This post is the first in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the April, 2012 expiration of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. On Friday, February 24, we initiated the April bearish butterfly trade … Read More

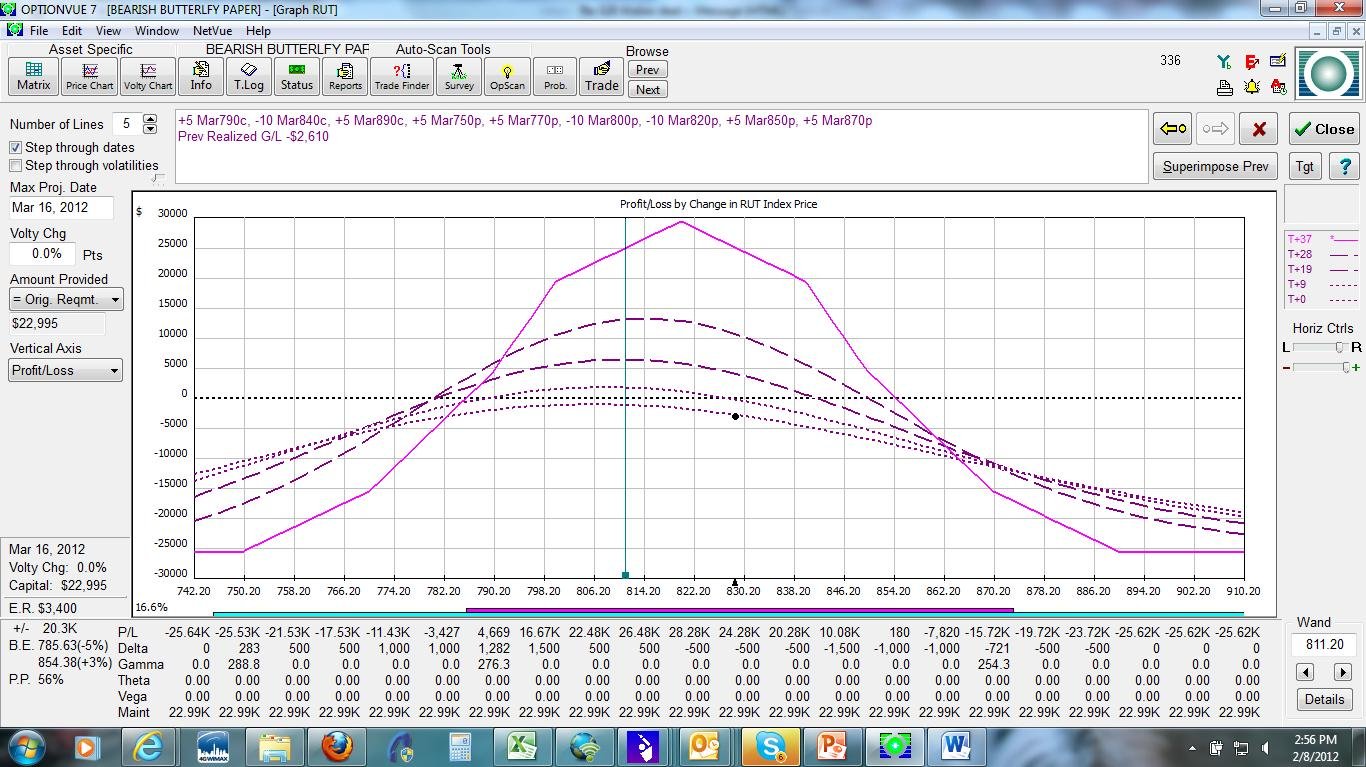

The March Bearish Butterfly–the wheels of the $RUT grinds slowly upwards

This post is the second in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. In the law there is an expression, “the wheels of justice grind slowly”. To bearish butterfly … Read More