How to Use Tape Reading to determine one of the most profitable exits An Effective One Day Options Strategy Level 2 Strategies Every Day Trader MUST Know (Taught by a Prop Trader) A new trading strategy from a future star trader Scalping: An effective and highly profitable trading strategy Important disclosures

Improve your trading this weekend with these educational videos – recap of the week of September 19, 2020

Level 2 Strategies Every Day Trader MUST Know (Taught by a Prop Trader) You Can Supercharge Your Options Trades With THIS Technique A New Trading Strategy from Future Star Trader How to Trade a SPAC with Tape Reading (3 Prop Traders Reveal) How to Trade a Market Sell Off * no relevant positions Important disclosures

Improve your trading this weekend with these educational videos – recap of the week of September 12, 2020

How to Trade a Market Sell Off You are in the Driver’s Seat with this Options Strategy Tips for Successful Trading (Trading Psychology Every Trader Needs) Teaching a Prop Trader Secrets on Technical Analysis (that you will not find anywhere else) *no relevant positions Important disclosures

Improve your trading this weekend with these educational videos – recap of the week of August 29, 2020

How to effectively combine Tape Reading AND technical analysis to make a quality trade You can win so many different ways with this weekly options strategy How to use Tape Reading to make a quality trade in Target How to make a quality Breakout Trade in the hottest stock (Tesla) A Senior Trader reveals two quick and profitable scalp trades … Read More

How to Make the Leap from Consistently Profitable Trader to Star Trader Elite

In this post, I will share an idea to go from consistently profitable trader to star trader. I will share an effective daily exercise that I recommended to a consistently profitable trader on our proprietary trading desk in NYC, who wanted to to touch the next level in his trading. Let’s dive in. During my remarks at a recent virtual … Read More

Improve your trading this weekend with these educational videos – recap of the week of May 16, 2020

How This Independent Retail Trader Went From Losing Money To Trading Profitably How to Copy the Master Traders (so you become one) How to Become a Consistently Profitable Trader (like you deserve to be) Taking Trading Breaks So You Trade At Your Best Scalping: An effective and highly profitable trading strategy *no relevant positions Important disclosures

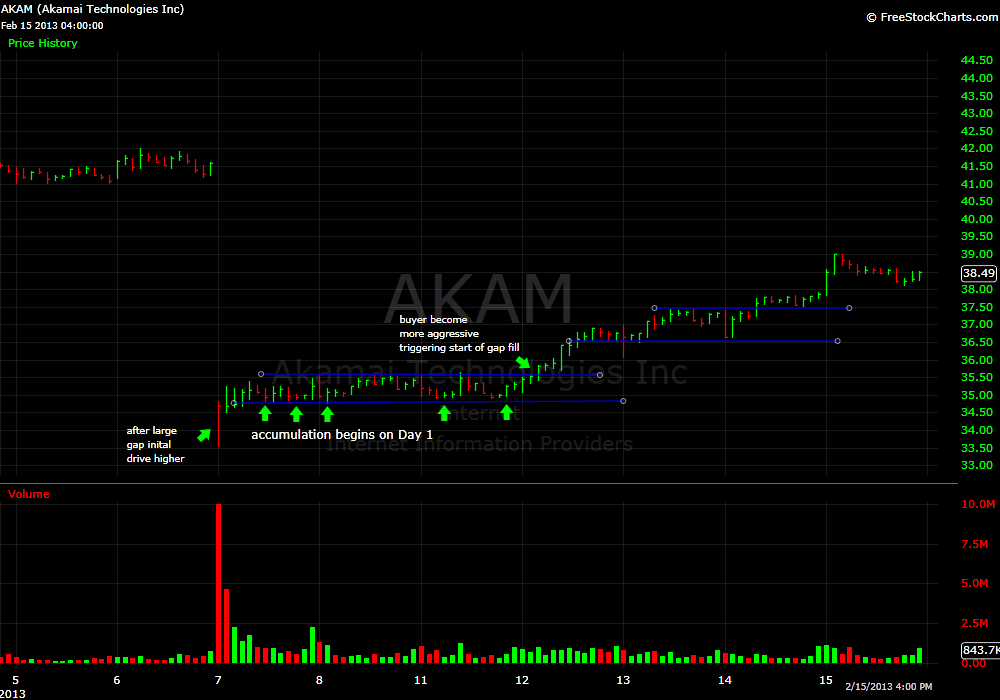

Not So Fast

One of the more common patterns seen in a strong market are longer term players buying stocks that have gapped lower after earnings. Sometimes this plays out on Day 1 with momentum buyers aggressively buying the stock leading to a gap fill. But many times a gap fill will play out in the days following the earnings release once the … Read More

Should This Trader Make a Comeback?

Below is an interesting trading anecdote I received via LinkedIn. I asked the writer if I could share his trading experience with our community. He agreed. The names and places have been changed for compliance reasons and we have no interest in saying anything negative about anyone or any firm on this blog. What I find interesting about his note … Read More