This is one blog post that I hope you never have to read. Why? Because it’s all about failure. The word “failure” has tons of connotations. Shame. Guilt. Disappointment. Anger. These are things that we try to avoid at all costs. If the world were perfect, you would never run into failure in your trading career. I hope that you … Read More

Extraordinary Situation; Ordinary Trade.

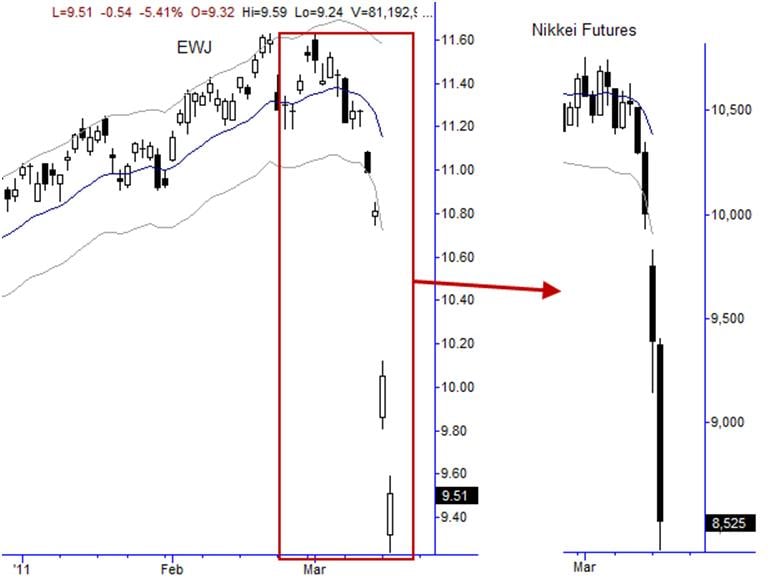

In yesterday’s post, I made a case for a bounce play in the Japanese stock market. Last night’s extreme move makes this call look kind of silly in retrospect, but I want to highlight some important points and lessons here. First of all, this really highlights the difference between “armchair quarterbacking” or “time machine trading” (as we like to call … Read More

Market reactions to “Acts of God”

In my daily report for Waverly Advisors I issued a short-term buy on the Nikkei 225 futures. Obviously, this is a controversial trade fraught with difficulty, but I thought it might be interesting to think about this type of situation from a technical perspective. First of all, please read the link above. Before reducing the situation to a set of … Read More

Market Leaders Bounce Off Key Levels

This morning we saw some pretty heavy selling pressure for the third consecutive day. We then saw some of the leaders bounce from very important prices.

US Open Flu?

I have missed the past two trading days because of the flu. I know what some of your are thinking. Hmmm. Bella loves watching golf. And he is always blogging about how much he loves that Phil Mickelson. And Phil made a run at the Open today. The US Open was just in Bethpage. Was this the US Open Flu? … Read More