This morning we were setting up for a very busy day. In addition to the market continuing its slide from last week — there were a multitude of In Play names and Second Day Plays from Friday. Our #1 ‘In Play’ idea was related to TEVA which had agreed to purchase, in a mostly cash deal, the generics business of … Read More

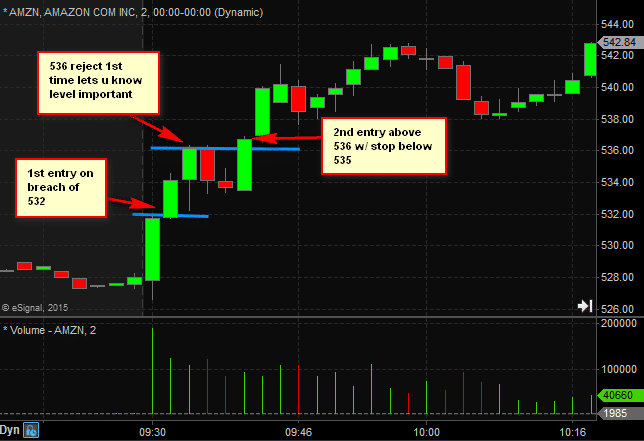

AMZN Trade Prep From December 18th

Here is a snippet from December 18th 2012 AM Meeting where Steve Spencer discusses his thought process in AMZN. SMB has never believed in the idea of a “stock picking” service. Professional traders become profitable through building a variety of skills over a long period of time. However, listening to the thought process of a seasoned professional with 17 years … Read More

Trade2Hold Exit- AMZN

Today during our AM meeting we highlighted AMZN and the 123 level as a shorting opportunity. This turned out to be a wonderful intraday trading opportunity. As intraday traders gravitate towards a longer holding period, for us Trades2Hold, set ups like AMZN must be mastered. AMZN had earnings Thursday night, gapped up on Friday, and then sold off for … Read More

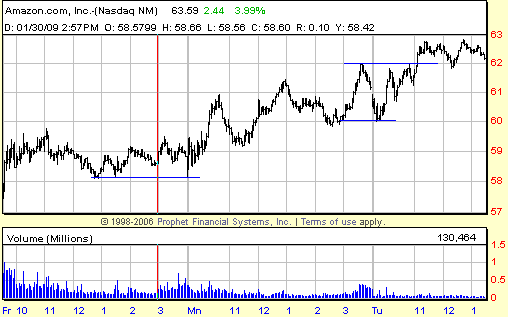

Black Friday Close

Into this Black Friday Close today we are paying special attention to some key levels in SPY: 110 is our biggest intraday level. below 109.75 I will lean short. We are watching the market leaders: AAPL (winner Best Intraday Stock for today), AMZN, GS, POT, JPM. And now we just started watching SEED as a momentum stock (above 11.31 is … Read More

HFT and AMZN

HFT (high frequency trading) has dominated the financial media of late. @zerohedge, Charlie Gasparino and CNBC, the StockTwits nation, @steenbab, GMan from @smbcapital, and many other talented bloggers have all weighed in. And then came Senator Schumer: (from Bloomberg courtesy of @zerohedge): Senator Charles Schumer asked the U.S. Securities and Exchange Commission to ban “flash orders,” saying the transactions give … Read More

Making Adjustments as the Market Changes

As traders we are constantly asked to make adjustments as the market changes. One of the questions I am asked most frequently by potential recruits for our desk is “how has the market affected the trading system that we teach?” My response is that we teach the same system we have been using for more than a decade. Our system … Read More

Advantage–SMB

About 18 months after we created SMB I remarked to Mike that one of our key advantages over other trading desks was a trading philosophy that is not broadly shared amongst our peers. The focus of our desk is to trade things that are In Play. We have a set of criteria used to find these stocks before the market … Read More

Making Money IN AMZN

So I ran out of the office after the Close to grab a couple of slices of pizza. By the time I got back AMZN was trading up 5 points. About six traders on the desk were actively trading it in the after hours. I quickly gathered some information from those who had been watching it. There was selling at … Read More