In Part I of this series I discussed whether understanding the news could help short term traders limit their risk on overnight positions. Today’s post discusses whether understanding the news gives a short term trader a possible edge in determining profit targets and when to exit an intraday position.

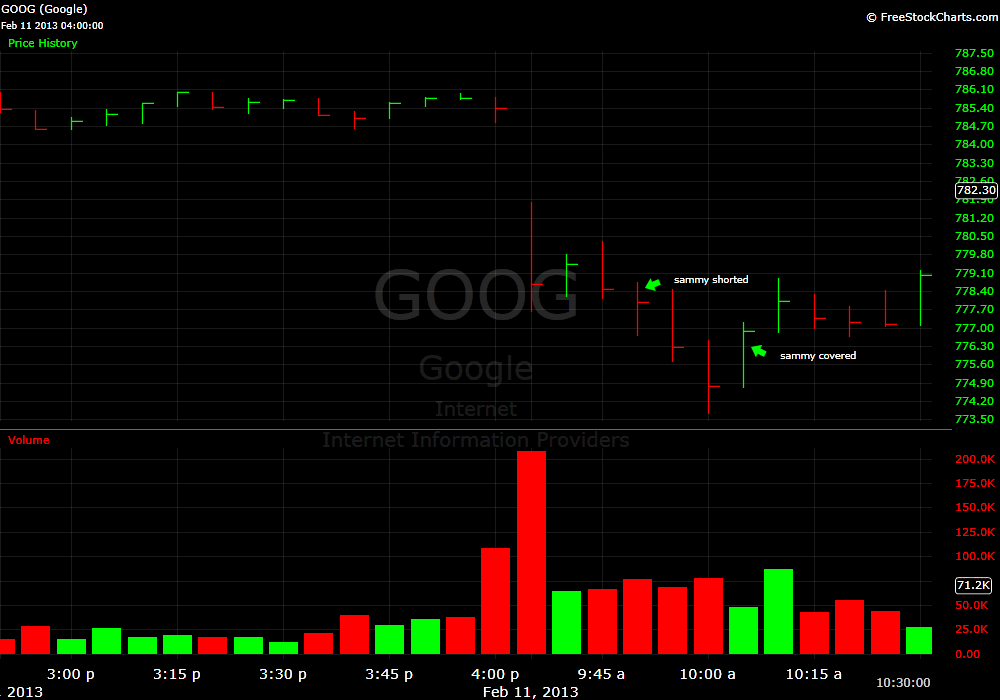

As examples I will use two trades that Sammy, an SMB trader, executed today. The first involved a short right on the Open in GOOG. It was gapping lower on news that the former CEO Eric Schmidt was selling 50% of his position in the company. My analysis of this news from our AM Meeting was that it was a non event from a long term perspective but might create a short term trading opportunity. Schmidt selling his shares could give some the impression (wrongly I believe) that he thinks GOOG is possibly overvalued or that its best days are behind it. That impression or the anticipation of the market of a possible reaction created some selling pressure on the Open.

As a short term trader Sammy saw the selling pressure as an opportunity to jump on board for a quick momentum short. If in fact there had been real negative news in GOOG Sammy probably would have been looking for a bigger picture trade to the downside but in this case he was looking to take advantage of some short term momentum to capture 3-5 points. Sammy asked me for my thoughts on possible targets for his momo trade. I said that I would look to cover quickly if it came into 775 as it has been very strong recently and could reverse as many would look at any type of weakness as a buying opportunity.

I think in this case knowing the “news” which was in no way a fundamental shift in the stock was helpful in the process of being more aggressive covering if the trade began to work. If the news had actually been something truly negative it would have not made sense to look to cover into further weakness.

The second example was a trade in REGN. The stock was halted in relation to a filing from Sanofi that stated it intended to buy some more shares in REGN. But it became clear very quickly that this would not lead to an acquisition for legal and other reasons. For an experienced trader this is very tradeable information. If in fact REGN was a possible target of Sanofi the filing could lead to a large gap higher and then after some type of retracement another leg higher.

The question becomes is there any edge in understanding this news versus simply playing the price action? I think so. When Sammy first asked my for a possible price target to cover his his short from 175.50 he suggested 172. After seeing the news I said this unlike the GOOG trades was a Trade2Hold and REGN could give back all of its gains.

He changed his price target to 168 and eventually covered when it looked to be bottoming and traded back above 169. Without understanding that news he would have looked to cover on a much smaller retracement.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].

No relevant positions

One Comment on “Should Short Term Traders Consider Fundamentals–Part II”

thank you spencer for a great post!!!