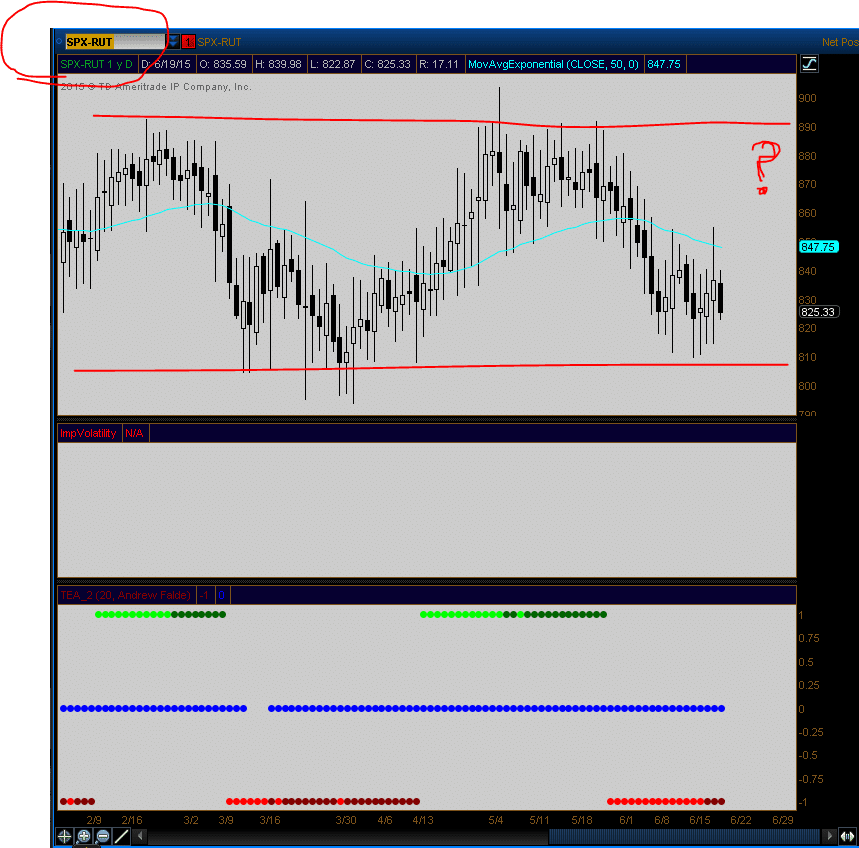

With RUT accelerating to new highs and the SPX lagging — is there an opportunity for a mean reversion pairs trade?

I believe so.

The probabilities are high for mean reversion. But, the danger of a mean reversion trade is the possibility of being too early.

That is where options can give us additional edges.

With options we can “lean” one way or the other and not need the directional bias to work out.

A bearishly positioned spread in RUT (like the bearish butterfly) coupled with a more bullish spread in the SPX (like a medium probability credit spread) could allow for the mean reversion bias to be profitable — even if there is no mean reversion.

With August expiration 59 days out, that gives plenty of time and plenty of premium to work with for these two trades.

Chart: SPX-RUT (Subtracts RUT from SPX)

Andrew Falde

[email protected]

SMBU

No relevant positions. Options Risk Disclaimer