Laurel or Yanny? There are a few viral videos going around in which different people perceive different words despite listening to the same audio clip. This one is particularly impressive to me: You can hear EITHER one, simply by telling yourself that is what you’re about to hear. Kind of bizarre given the cadence and different syllables of the two … Read More

Are you overly negative, or ignorantly positive?

It’s the end of the trading session. You’re a good boy- so you’ve definitely journaled and now you’re ready to begin your post-market review. This is where things get interesting for me as a mentor. Let’s consider two traders: Overly Negative Nick, and Ignorantly Positive Pablo. They both made the exact same trade decisions that session, but let’s see how … Read More

[Recording] 5 Ideas to Improve Your Trading This Summer

Mike Bellafiore, author of The Playbook and One Good Trade, discussed why traders at the firm are so focused on building trading models right now and how to be more selective with your ideas.

A Trader’s Definition of Hell

What would a trader’s definition of hell be? I say it’s the following: On your last day on earth, the trader you became will meet the trader you could have become. Scary to think about isn’t it? I have two ways of avoiding “trader hell” that I’ll share with you. Focus on process. I can guarantee you that if you … Read More

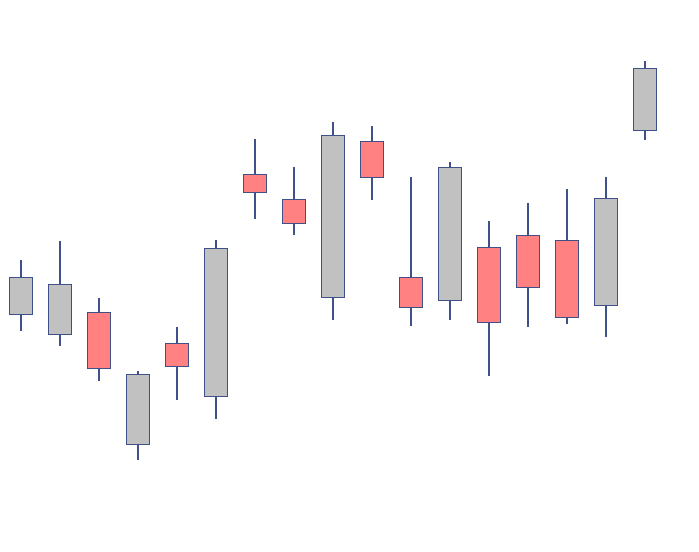

Close The Gap!

I work with a lot of traders trying to “make the turn” – that is the turn to consistently profitable. Among the plethora of issues preventing the average trader from being consistent, one has come up rather often recently. The gap. The gap between what you see as great opportunity at the end of … Read More

Underperformance and Your Beliefs

We covered several interesting topics during our weekly Trading Conversations webinar last Friday. As usual, we covered a wide range of things such as using context, randomness, risk/reward, knowing your market with statistics, and more! Not a bad way to wrap up your trading week with some open trading conversation. One topic we covered in particular stood out to me, … Read More

Amplify Your Investing and Trading Success: New Visualization Therapy Exercises

Visualization and mental practice are tools that can take you to the next level of performance in your trading and investing. These tools can have a transformational impact on your mental game, helping you to execute better in every facet of your investing and trading. In fact, they are so important that I have compiled a resource page on … Read More

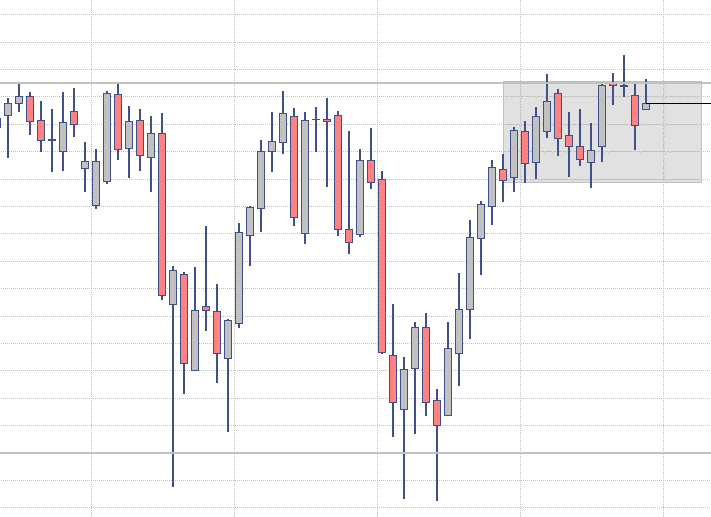

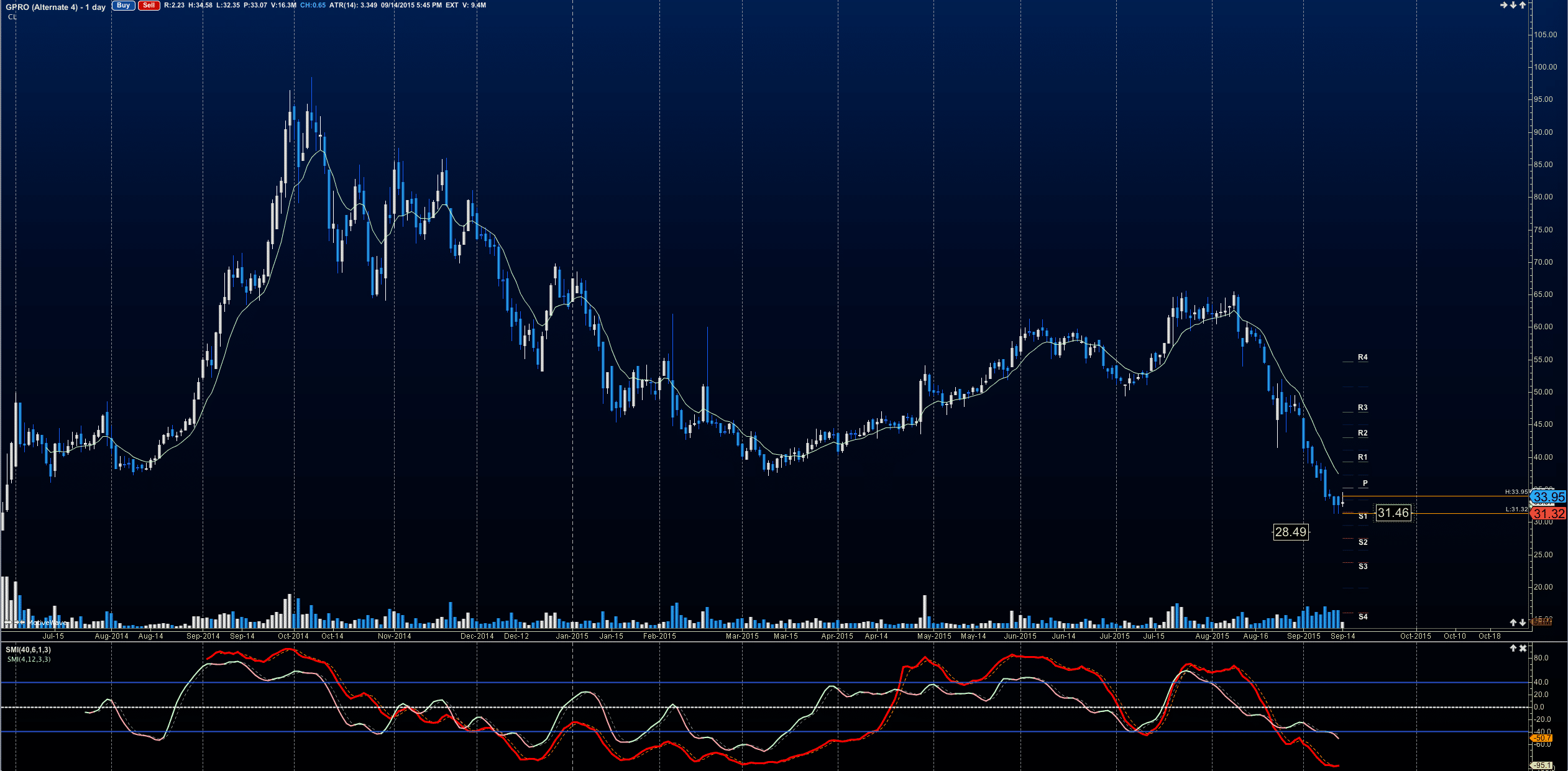

Inside The Trading Vault – a look at GPRO and KO

Trading Vault Concept – “When evaluating a chart, continually ask yourself why buyers or sellers behave in a specific way – and what it means to them when support and resistance levels are made and broken” Many of us are up and coming traders who have consistent issues with the ‘WHY’ to enter a trade. Meaning, we don’t have a hard … Read More