Yesterday, I made the below three trades on the Open based on our morning game plan and strategies we teach on the prop desk. It is important to spend time reviewing your trades each day to determine if you followed your trading plan and identify possible improvements on execution. BABA (win)—good #s. With large recent runup no great setup but expect … Read More

Did A Short SetupTrigger in JPM?

Following JPM’s earnings report it gapped higher then faded the rest of the day. Steve Spencer discusses a possible short setup. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 20 years. His email address is: [email protected]. No relevant positions

Understanding Market Turning Points

Short term traders make thousands of trades each year. But not every trade is of equal importance to our bottom line. We develop a trading plan for every trade regardless of how large or small the opportunity, but with experience we begin to identify the trades that offer the greatest upside and the best risk/reward. I have found in my 20+ years … Read More

When A Stock Is Crushed

When a negative catalyst causes a stock to gap lower 20% or more it attracts a lot of attention. Should we look for a bounce? Should we stay short and look for more downside? Here are some things to consider Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and … Read More

Decoding Price Action Analysis: Understanding the Key Differences from Technical Analysis

Technical Analysis is what you already know. Price action analysis is what you should know. Technical analysis is the study of charts. Looking at patterns with the hope that it will appear again and offer an opportunity to make money. That’s not how you make money trading. Profitable trading is about skill development. Price action analysis is truly understanding the underlying factors … Read More

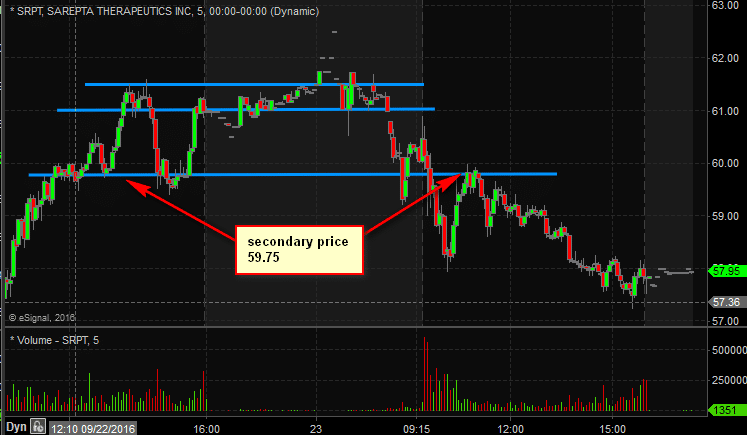

Decoding Short Opportunities: How Goldman Sachs & JPM Morgan Created Profitable Moves in $SRPT

Our #1 trading idea for Friday was SRPT. It sold $300 million of shares in a secondary offering via Goldman Sachs and JP Morgan. Normally, biotech secondaries are excellent long set ups. The prior week I had been long AERI following its secondary offering and it traded 30%+ higher in a few days. But this time was different. I discussed why SRPT was likely a good short … Read More

Trade Review–Shorting A Stock After Earnings $RHT

In this video I walk you through my thought process in developing a plan to short Red Hat following its earnings report. Each morning we develop trading plans for Stocks In Play. For more info sign up for a free trial which includes all of our trading tools and live position updates. Steven Spencer is the co-founder of SMB Capital … Read More

How To Identify A Long Term Bottom–Twitter

In this video I discuss the process by which Twitter formed a long term bottom in 2016. This lesson has broad applicability for traders/investors attempting to catch larger moves (30%+) in the stock market. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 20 … Read More