Visualization and mental practice are tools that can take you to the next level of performance in your trading and investing. These tools can have a transformational impact on your mental game, helping you to execute better in every facet of your investing and trading. In fact, they are so important that I have compiled a resource page on … Read More

What I learned from visiting SMB Capital

Here’s a guest blog post from Austin Mitchum, an active writer on his blog A Technician Plays that Market………. I have just returned from a very special holiday in New York. Whilst there, I was fortunate to meet with Mike Bellafiore (Bella), co-founder of SMB Capital and author of “One Good Trade” and “The Playbook”. SMB is a proprietary trading firm … Read More

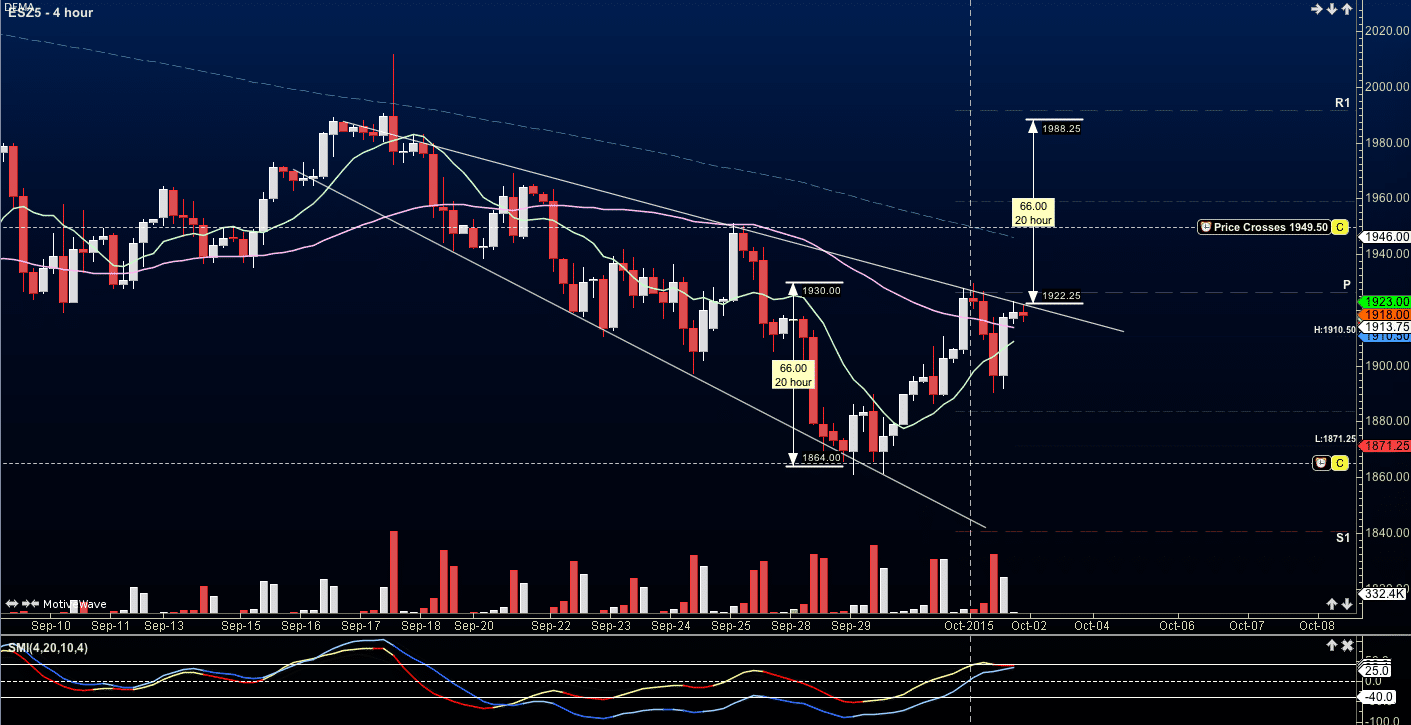

Inside The Trading Vault – Futures Market Assessment – $ES_F

SMB will be hosting a free webinar on October 6th where I will outline several trades based on techniques taught in the Vault. The formation above is that of a falling broadening wedge- this is a bullish formation. The current measured range is 66 points. We sit above the moving averages and momentum suggests at this time that pullbacks should be bought and … Read More

Inside The Trading Vault – The Power of Mechanical Process

If you value consistency, and find it lacking in your trading, The Trading Vault is certainly something you should investigate. SMB will be hosting a free webinar on October 6th where I will outline several trades based on techniques taught in the Vault. Many traders learn the concepts of trading with a bit of a salad bar approach – a … Read More

Making Your Visualizations Better

Making Your Visualzations Better

Enhancing Trader Performance: Process Vs. Outcome

What is more important? The OUTCOME of a decision regardless of the PROCESS that generated it? Or the PROCESS applied to generate the OUTCOME regardless of the results? The answer can reveal the strengths and possible weaknesses of how we manage the information used to define our trading edge and the significance we place on the results of that trading edge. For … Read More

The Fourth Week of More Mindful Trading

In this post, I will continue my eight week experiment with cultivating mindfulness and trading. The earlier posts in the series can be found here: Eight Weeks to More Mindful Trading The Second Week of More Mindful Trading The Third Week of More Mindful Trading To bring new readers up to speed, here is a brief refresher on … Read More

Mindset Hacks: Adopt the Mindset of a Champion

This is the final blog post in a 3 part series from Bruce Bower on Peak Performance. Part 1 was on consistency and Part 2 was on making better decisions. When we did a survey of the top three topics that people wanted covered, I was surprised by the third place winner: “Mindset Hacks: Adopt the Mindset of a Champion”’. On the other … Read More