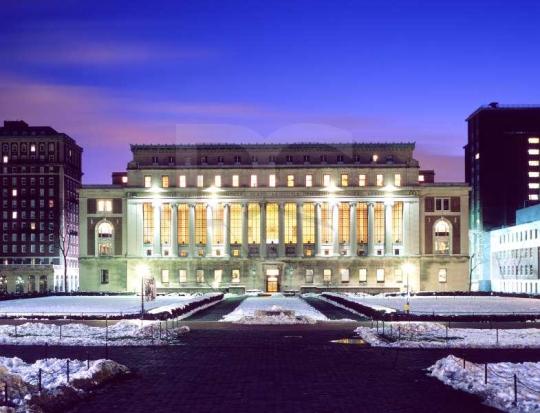

I was invited to lecture at Columbia University this week to talk with their students most interested in the markets. I have been guest lecturing at colleges since the start of our proprietary trading firm, ten years ago. While walking home to my apartment a few blocks south after this lecture, it struck me that so much has changed with these college traders.

1) The macro knowledge of students was more advanced than prior visits.

2) Before my lecture, students organized presentations on global news catalysts. They were well-organized, with short bursts of knowledge shared. In this social and information age, students have adapted so their peers were not bored and the special interests of different students were leveraged.

3. The number one question asked after my presentation? How do I get started in trading. I was surprised by this, as I would assume they had already found this answer. But if students like them haven’t, surely many at home haven’t either.

Paper trade.

Read about trading.

Find traders who teach on the internet.

Find an internship where you can learn about and shadow successful traders.

Trade and determine if you like it.

Try different trading styles.

Backtest trade ideas.

4. Many students, more than I remember in the past, had financial internships lined up for the summer after their Junior year. I was cleaning pools and painting houses during my summers in college.

5. There were still very few females in attendance. The ones that I chatted with after were super-smart and talented. How do we get more females interested in trading?

6. Interest in automated trading and custom indicators was SIGNIFICANTLY a larger topic. When I talked about our firm’s proprietary software, gr8py, to backtest-forward test-run live all from your desktop, students were most engaged.

7. There was a disproportionate interest in macro theses compared to trading ideas with edge. Their interest in macro ideas was impressive. As traders we must be careful to care mostly about news catalysts that helps us make money. There were a few ideas where this veteran trader wondered: How the heck is that idea gonna make you money.

8. The coding skillset of younger college traders is more advanced. One student cornered me with his options strategy, running through it on his laptop. Cool stuff!

9. Everyone loves stories. They want to hear about the firm trader in Austin who made 15.5m on August 24th. They want to hear about the trader in Year3 who held a 10m market trade last Friday into the close. They love the story about SWang being so fast a Tier 1 firm complained about his manual trading. The path of today’s successful traders inspire the next generation of great traders.

If this is the quality of young future traders coming, our markets will be super-competitive.

*no relevant position

Related Posts

What this college trader can teach you