I was grateful to be asked by my friend, JC Parets (@allstarcharts), to present at Chart Summitt 2017. My mandate? Share 5 lessons from the prop desk. As always, I love to include anecdotes from traders succeeding on our desk to teach. And I did so again here in this online presentation. My 5 lessons from the prop desk were: … Read More

Get Your Exclusive Inside Look of “The Winning Trader” Program

The Winning Trader is a very intensive 10-week training experience. This Wednesday we are inviting the entire SMB community to attend the orientation webinar. During this webinar, you will learn about the tools, mentoring meetings, and training modules that are included in The Winning Trader. This is the last open meeting before we buckle down and get to work with … Read More

Fail, Win, and Then Fail Some More: The Path to Becoming a Winning Trader

Part II of our training program on our prop desk in NYC is Trader Development. There is a lot of necessary and wonderful failing that goes on during Trader Development. During this process traders experiment with different setups that we highlight. There are trading strategies worth exploration that active traders use to win. We continually point them out daily during … Read More

The Trading Setup That Turned One Trader into a 7-Figure Trader

Thursday we held an online class for our trading community: The trading setup that turned one trader into a 7-figure trader. The replay of this class can be found below in HD video. Here is what you will learn from this class: The trading setup that catapulted a floundering developing trader into a 7-figure trader The path this trader traversed … Read More

SMBU’s Options Tribe Webinar: Ron Bertino: The Space Trip Trade

This week , Ron Bertino makes his debut presentation of his signature Space Trip Trade which Ron designed as a downside hedge to a trader’s at-the-money market neutral options strategies. Ron will show you how this strategy takes advantage of portfolio margin or SPAN margin, while maintaining a comparatively conservative T+0 line. Ron will demonstrate how the trade later morphs into a downside hedge with very little downside risk at that point in the trade

Misery–Nothing Worked Today $CREE $STX $EAT

(1/25/17) Things didn’t work out so well today. Technically, EAT trade idea worked perfectly but I forgot to enter my “trading script” pre-market so I missed the short at 46, which worked perfectly trading down $2 to our first support area. It’s actually my second favorite setup for a stock reporting earnings: poor EPS & guidance that pops to well … Read More

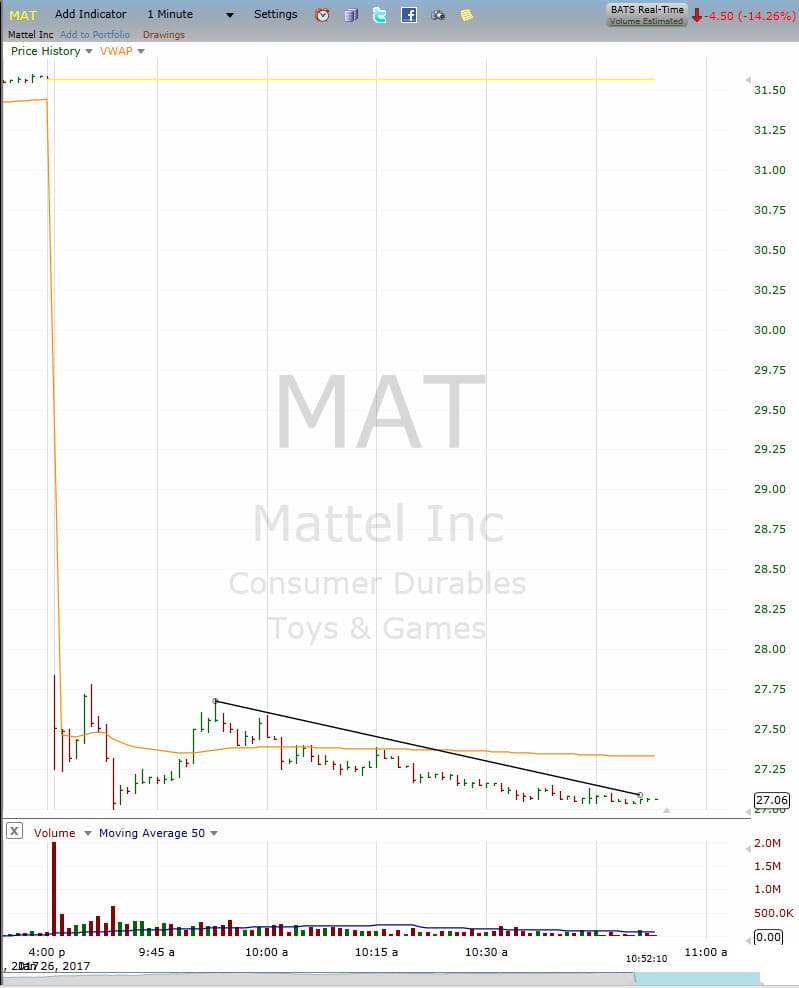

I like this trading pattern in Mattel ($MAT)

I like this trading pattern in $MAT: a) stock gapping down b) stock with a negative news catalyst c) fight on the tape where the seller wins d) holding below VWAP e) no longer term technical support in sight f) staircase stepping down visually on our charts g) hold short for a real move We have this pattern today in … Read More

Exploring a Newly Stressed Trading Strategy on the Prop Desk

A tight wedge pattern for Stocks In Play is favorite trading strategy newly stressed on our proprietary trading desk. Two chart examples of this trading pattern were seen just yesterday with ATI: and CSX: I prefer when these wedge patterns appear in a Stock In Play- something with a news catalyst behind it. Breakouts from these wedge patterns work best … Read More