In this video Steve offers two trading tips on how to improve your results. 1) The importance of being present throughout the trading day 2) Using tape reading to add to a position in a very low risk way Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is … Read More

Forex Trading Realities: The Ebook

I wrote a 38 page ebook titled, “Forex Trading Realities” and wanted to take a moment to let you know what it is about and why I wrote it. The retail forex business in which we are a part of is infamous for misleading information, misguided analysis and trade stimulating ideas offered by brokers, marketers and others trying to profit … Read More

AMZN Trade Prep From December 18th

Here is a snippet from December 18th 2012 AM Meeting where Steve Spencer discusses his thought process in AMZN. SMB has never believed in the idea of a “stock picking” service. Professional traders become profitable through building a variety of skills over a long period of time. However, listening to the thought process of a seasoned professional with 17 years … Read More

A Stock May Trade Higher When New Competition Enters Their Market

On December 12th CSTR announced they would be starting a streaming service in competition with NFLX. My initial reaction was a smile and a bit of a chuckle. CSTR has been doing very well for the past few years offering $1 DVDs at supermarkets. A simple business model that was leading to good cash flow. Now it was going to … Read More

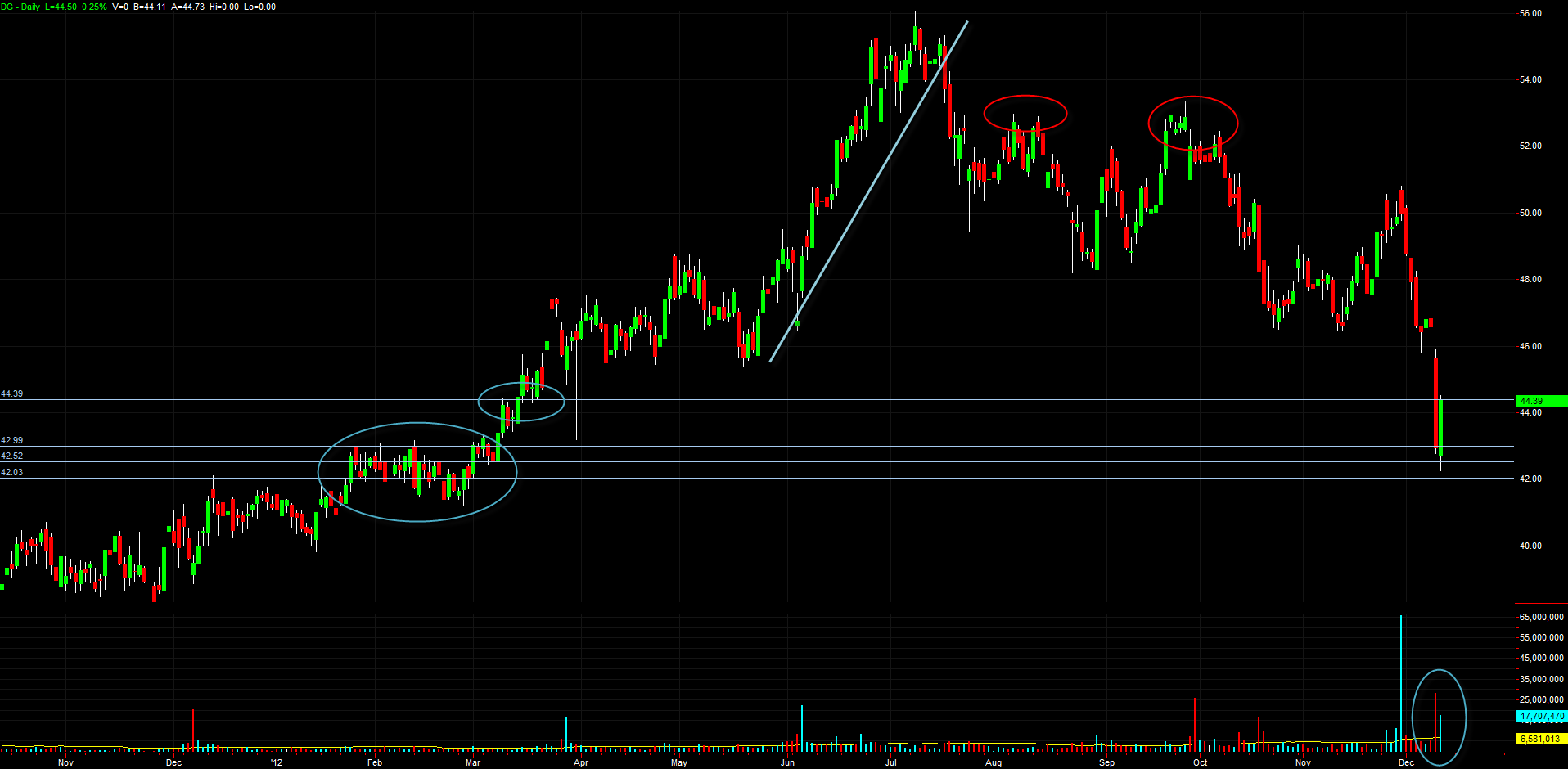

Guest Post: “Reversal Rehearsal” $DG

This guest post from experienced futures trader Bruss Bowman provides an excellent example of how to incorporate higher time frame price action into a possible lower time frame trade. It is clear from the post that Bruss in a methodical thinker who is also flexible in his thesis if price behavior fails to confirm. Reversal Rehearsal: Stock Study in DG … Read More

Forex: Are Futures better than Spot?

These days traders have so many choices in terms of what instrument they want to use to express their opinion in the markets. There are mini futures, cfds,spot, ETFs, and regular futures contracts not to mention traditional stocks and bonds. So spread capital amongst all these products and combine that with a general lack of trust from the general public … Read More

“Reversal Rehearsal” Guest Post

Thanks for all the submissions regarding the DG reversal trade that occurred on December 12th. This post was written by a college student who participated in one of the SMB College Training Programs last Summer. Although the post is short and to the point I think Tim captures some of the key elements we look for in a low risk … Read More

Forex: Where’s the “Easy” Button?

Many new traders are looking for a trustworthy resource that will hand them a strategy with a high percentage win rate, a stellar track record and a very short learning curve. This is reminiscent of the many attractive young women in New York City today who according to their online dating ads all seek the same guy: tall, handsome, full … Read More

- Page 1 of 2

- 1

- 2