This morning I was reviewing Tuesday’s price action in APOL and found a long setup that I liked. On Tuesday while trading APOL I became somewhat enamored with the 35 level as it worked twice for me during the first 15 minutes of trading. But the truth is after 9:45 34.80 established itself as a much more important level for … Read More

You Got Me $APOL

I lost money trading APOL today. During my post trade review it became apparent to me that even with a few tweeks I still would have lost money day trading it. Sometimes stocks do not behave well. Perhaps APOL is better suited for swing and position trading? It has a history of trading erratically intraday. During the past few years … Read More

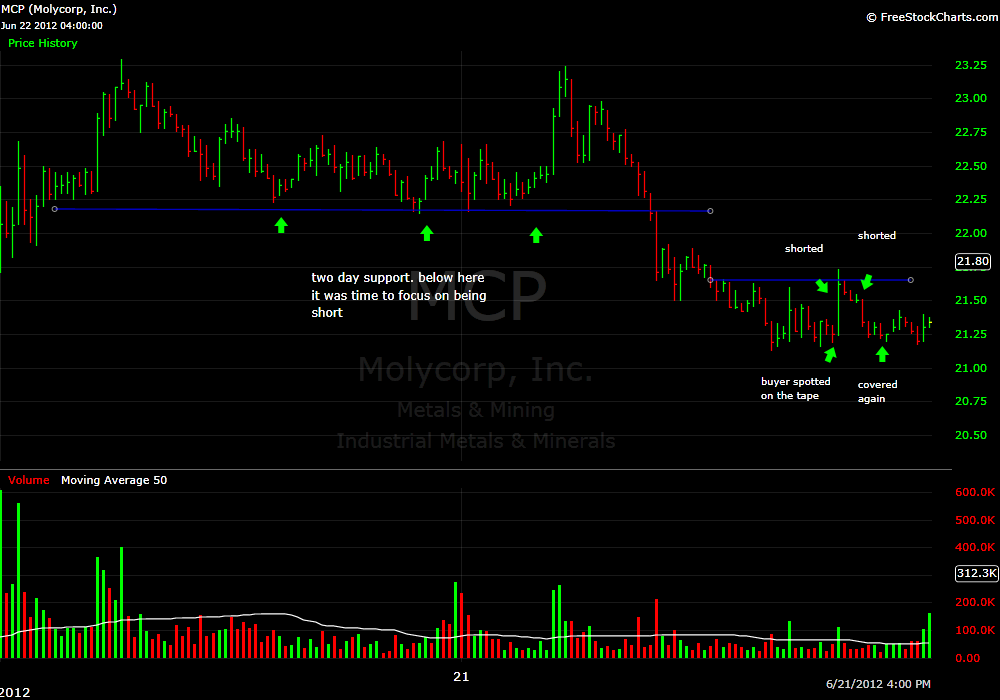

Tape Reading Was Money For This Play

On Thursday I was short MCP because it was trading below its two day support of 22.20. The market was having a trend down day and I was very comfortable holding the position until the close. But then something changed on the tape. There was a 100 share bid on ARCA at 21.20 that was being hit and continued to refresh … Read More

The Truth About Our Economy

It has been almost 4 years since the US fell into the Great Recession and we have yet to see a strong recovery. One of the after-effects of the Great Recession has been the increased attentiveness to monetary policy. Attentiveness to monetary policy existed before the Great Recession but not to the degree seen today; since the Federal Reserve took … Read More

Yesterday’s Option tribe:May and June Bearish Butterfly Strategies.

May and June Bearish Butterfly Strategies – 06.19.12 from SMB on Vimeo. SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world … Read More

Trade Execution

Hey Mike, I had a quick question with regard to order execution style and what orders you use. I know that on our keyboard, we have presets for ARCABidTier and ARCAOfferTier that are limit orders and the custom SWEEP keys that are market orders that process 3c through the bid or the offer. Although I’m working on my keyboarding skills … Read More

Traders Ask: What is a Competitive Trader?

Question: I hear a lot about the value of a competitiveness in trading success. Analogies are made with the striving for peak performance seen in athletes and entrepreneurs. One thing about this puzzles me, and I’d appreciate the thoughts of others with more experience and success. When I trade I am trying to get better: to make good trades and, inhibit … Read More

Gameplan review – June 18th, 2012

Steve reviews how these pre-market ideas played out today. DSW, BKS, UNG, FB, NFLX, NAV Game Plan Review June 18th Steven Spencer is the co-founder of SMB Capital and SMB Training and has traded professionally for over 15 years. His email is [email protected]. No relevant positions