Sent to me from an SMB Trader after the close. Hi Bella, A truly significant day for me, in terms of personal achievements. 1) I was never as big as I played today Last night I was very pissed off about myself. I saw so many occasions where I should have been much bigger but I didn’t. I was being a wuss. … Read More

What Do You Do When You Hit Your Loss Limit?

Over the past 10 days, there have been two occasions where I hit my daily loss limit. Sounds like a tough stretch, but on a net basis it’s actually been positive thanks to some other good days. Mind you, I’m generally a disciplined trader, and in a dozen years of full-time trading I have broken my discipline countless times but … Read More

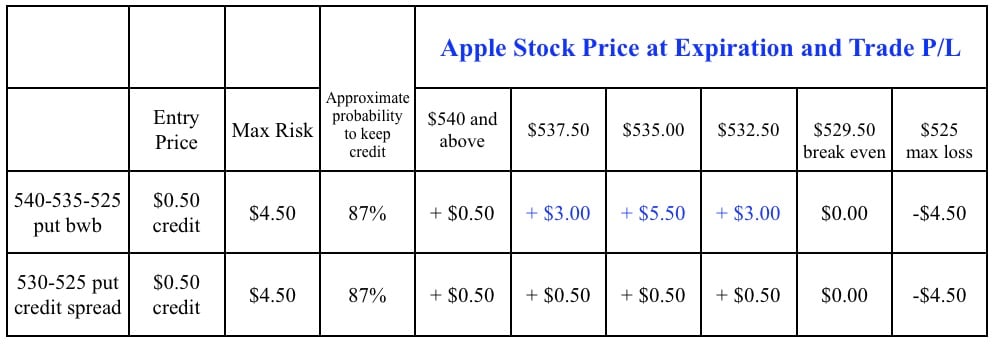

Follow Up to the AAPL Credit Spread

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. Last week I introduced the idea of using a broken wing butterfly for AAPL, entered into for a 50-cent, as an alternative strategy to a regular put credit … Read More

Comparing Ron Artest & Your Trading

It’s time for Episode 4 of When The Bell Rings. In this edition, we’re talking about something that’s paramount to your success as a trader. It’s a mindset – something that requires intentional planning and not a fly by the seat of your pants mentality. A weekend sporting event prompted this particular lesson, although the topic always applies to trading. … Read More

What behavior should a prop firm reward?

After the close one day this week I encouraged our traders to CALL OUT awesome potential trading opportunities. Shark called out SXCI into one close and the firm and individual traders caught a very profitable trade. I got our Floor Manager into ILMN for an opening drive play at the start of the week. He sent me an email of … Read More

Chill!

Here are two comments made from two SMB traders in their daily review sent to me after the close. Both harm their results by trying too hard. Do you do this? I am slowly becoming less and less content with just making $$$$ (note: SMB cannot talk our PnL because of compliance reasons) and calling it a decent day. I … Read More

A Different Look at AAPL Credit Spreads

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. A week doesn’t go by when I’m not asked a question about selling a put spread (credit spread) on a particular stock, especially before earnings when the implied … Read More

The SPX fly makes it 5 for 5.

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. Over the past several weeks I’ve been selecting broken wing butterfly trades on AAPL and the SPX using weekly options and then tracking the hypothetical P/L of those … Read More