I settled at my trading station wondering what to trade on this Open. RHT? BBY? AMLN? There had not yet been a price spike on the SMB Radar in health care yet but I would later ask what and where to buy for that sector. BBY showed some consistent selling at 25 so I scalped that down to 24.60 on … Read More

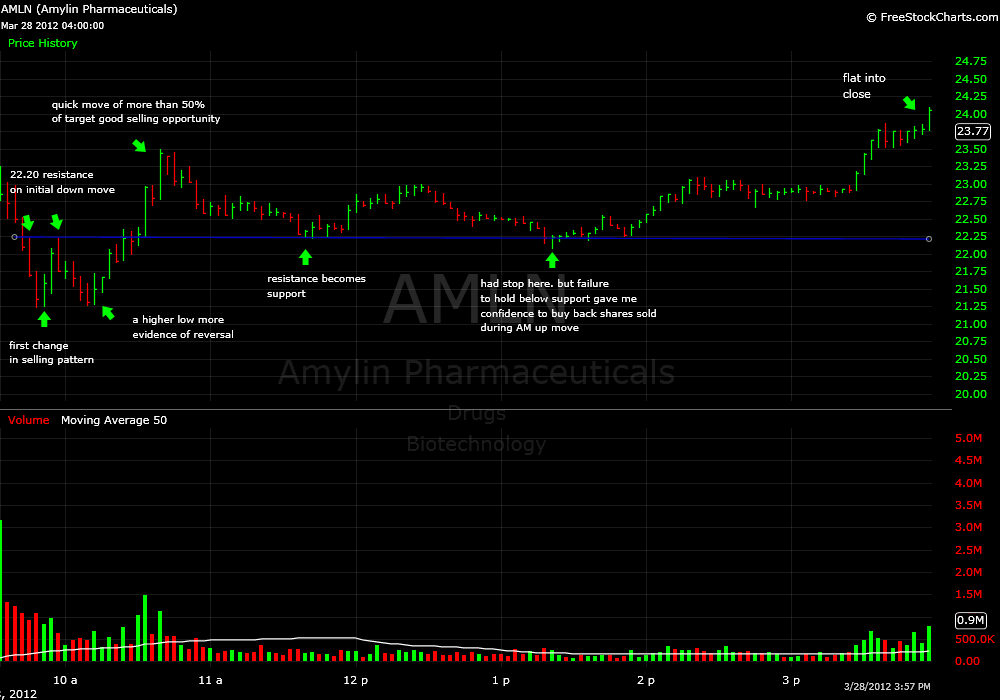

My Thought Process: AMLN

We received a few requests for a trade review of the AMLN trade I was tweeting during today’s Open. I’ve illustrated my key thoughts via the annotation of the chart below. Let me outline some of the “bigger picture” considerations that are not covered by the chart annotations: It was reported that AMLN received a $3.5 billion takeover bid which … Read More

Trading Equities versus Eminis

Eminis are futures contracts for various indexes, commodities and currencies. Eminis have their own trading personalities just as equities, and just as GOOG trades differently than WMT, each of the Emini contracts has their own trading personality profile. There is no *right* market to trade just as there is no one trading style that meets the needs of all traders … Read More

The Market Discriminates Against the Over-thinker and Ill-prepared

Hi Mike, Never wrote you, thought I would try. Had a question. In much of what I see, read, etc., there seems to be a focus there on recruitment and somewhat of a preference to younger people as new traders on your prop desk. PLEASE note that I am not looking for an age discrimination claim here, lol. It’s just … Read More

Is This Trader Complacent or Patient?

Bella, How do you distinguish between patience and complacency? Patience is what I call it when I’m riding a trend. Complacency is what I call it when price initially goes my way, but then retraces and eventually stops me out. This happens to me most in two cases. In these cases I feel as though more aggressively taking profits would … Read More

Introducing a new blogger: Greg Loehr

SMB is proud to announce the addition of an experienced options trader and educator to our blog, Greg Loehr, of Optionsbuzz.com. Greg has served both as a market maker on the floor of the CBOE as well as a proprietary trader for various firms prior to his founding Optionsbuzz.com. Greg has also been a repeat guest on SMB’s Options … Read More

Playing the Quarterly’s on the SPX

This post is the first in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. With the end of the quarter fast approaching there are two thoughts in my mind: quarterly window-dressing and a potential slowdown in China. For the next week, … Read More

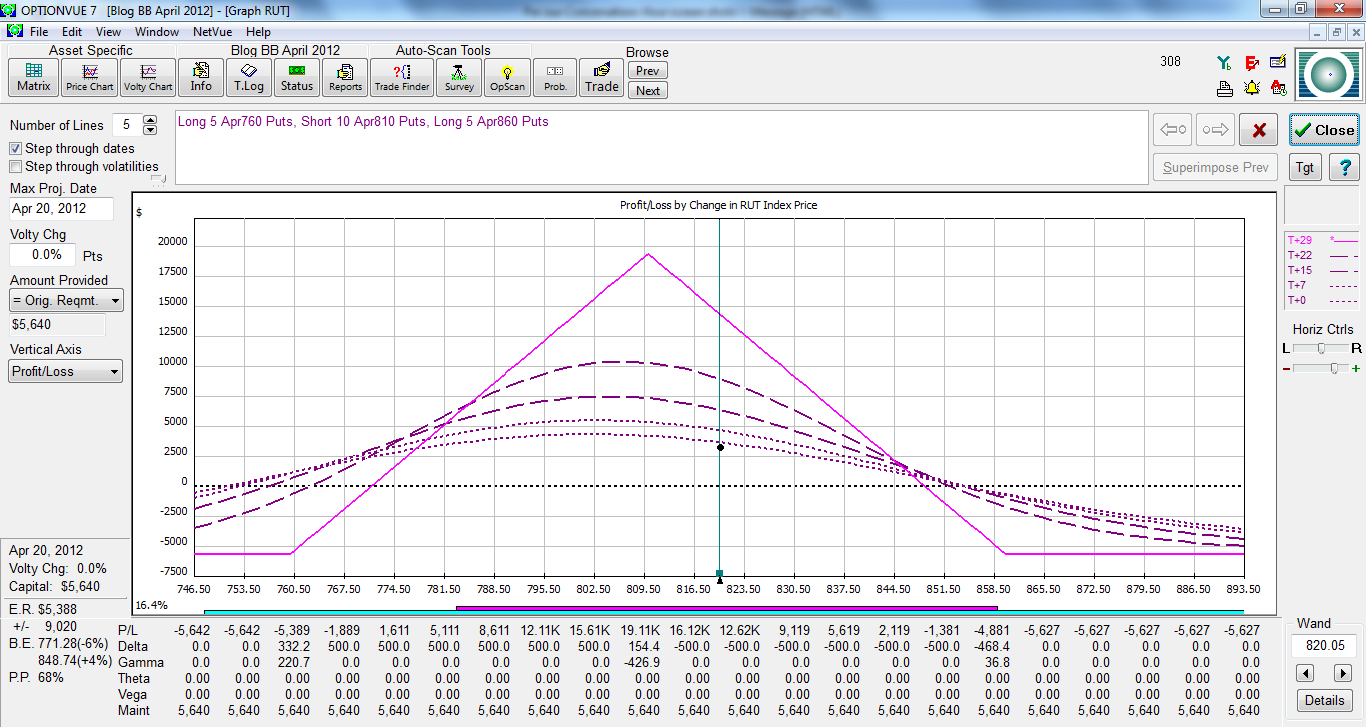

The April Bearish Butterfly Trade

This post is the first in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the April, 2012 expiration of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. On Friday, February 24, we initiated the April bearish butterfly trade … Read More