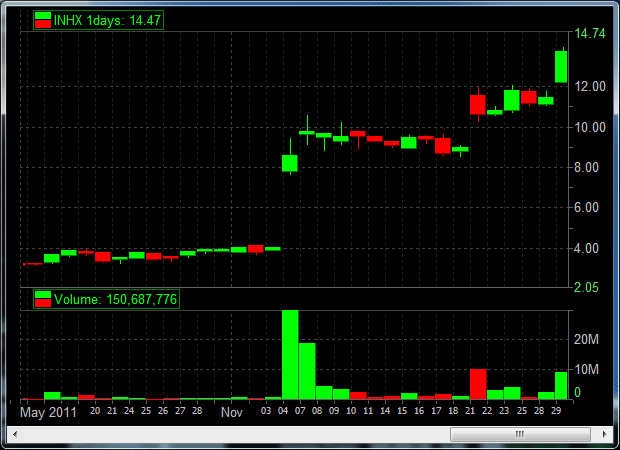

New blog format: Short trading lessons with charts for illustration. Trading Lesson #1: Second Day Play–Buying A Strong Stock After It Pulls Back To Prior Afternoon’s Support Area INHX was on our radar yesterday after another fresh news drug catalyst. As you can see from the two charts below INHX is trending higher on multiple time frames. Here is the … Read More

A Few Spins Of The Wheel

Last week we talked about the casino’s edge which in the trading world is called expectancy, but all that expectancy tells us is whether or not our trading strategy is likely to be profitable or not—but not how much money we might make. How profitable depends on how often we have a chance to trade our system—will it be a … Read More

Free Options Webinar: SMB’s Options Tribe: Today at 5pm EST: Options Trading and Trader Psychology

Today at 5:00 pm Eastern Standard Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options trading. This … Read More

So You Say You Want to Be a Pro Trader

I’m the guy you pitch as to why you should be hired for your “dream job” as a trader. This whole trader recruiting thing is inverted. You should not be pitching me. My desk should be pitching you. But you need to do some work before this can happen. Like start developing a track record now! During a recent interview … Read More

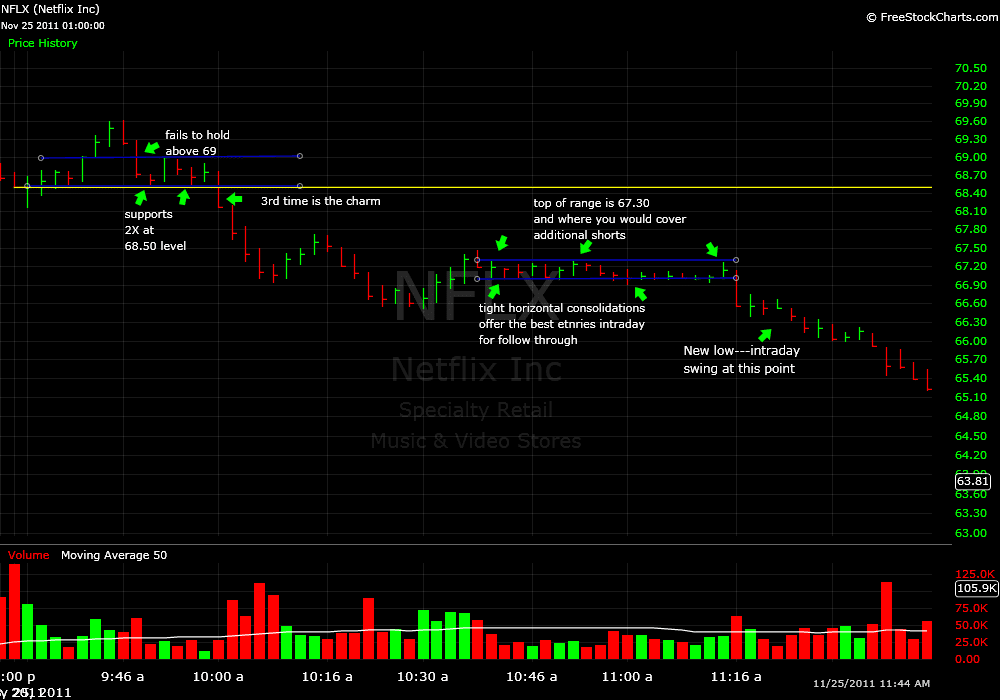

Using Prior Days’ Price Action–NFLX

Prior to the Open of Friday’s shortened trading session there was not much in the way of fresh news catalysts. So my first trading choices were second and third day plays. For those of you who are new to the SMB Blog you can use the “search” feature on the blog to review posts explaining how and why we trade … Read More

December 55 day $RUT bearish butterfly options trade: The finale

On Wednesday, the market gapped down and continued it’s downward trek of the previous 5 trading days. According to the guidelines of the bearish butterfly strategy, the reduced profit target of $1000 comes into effect 21 days to expiration on this lot size. As 21 days to expiration was yesterday, and the position was up $1800, I previously stated that … Read More

Free Options Webinar: SMB’s Options Tribe: Tuesday, November 29, 2011 at 5pm EST: Options Trading and Trader Psychology

Tuesday November 29, 2011 at 5:00 pm Eastern Standard Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

Traders Ask: Is it Better to Trade Stocks in Play or a Basket?

Question: Greetings From The Great White North Bella, Just re-read One Good Trade again (it just keeps getting better) and I found myself asking the same question. Are we better to trade Stocks in Play that may be news to us but have momentum and/or should we be playing a basket of names which we have become familiar with. By … Read More