On Today’s show Steve discussed one technique for trading right on the Open. Stocks discussed were FMCN, LVS and SPY.

Traders Ask: Why did I struggle this month?

Dear Mr. Bellafiore, I am a daily reader of the SMB blog and I also really enjoyed your book. I have e-mailed you a couple of times before, and I respect your opinion greatly. I am writing because I am currently going through a difficult time with my trading. I started trading at the beginning of 2009, and have been … Read More

An idea to help improve your trading

Today we had an SMB Tradecast reviewing a play for the SMB PlayBook. A trainee records their best trade of the day in our SMB PlayBook template form and then sends me and the desk the trade. I choose the plays that I want to review for future SMB Tradecasts. An idea was shared that you might was to co-opt. … Read More

How Great Ideas Can Emerge From Trading Communities

I was on the phone over the last couple of days with two of our active Options Tribe members–Nagaraj Ramakrishna, who has developed an outstanding butterfly trade in the $RUT index and Charlie Ferguson–a remarkable weekly credit spread trader. They are each active members of our Options Tribe community, having both presented their trades recently on tribe meetings over the … Read More

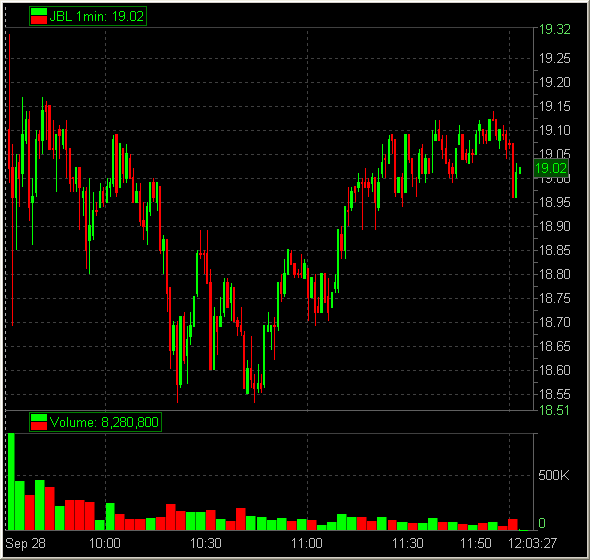

A Scalp Trade on JBL

This is a post from our traders TO about a scalp trade he made on JBL from yesterday: My trading desk neighbor SW and I were both trading JBL today, with 19 as the key level of interest. Without knowing it, I took the opposite direction of his trade at the Open for a quick momentum scalp. SW got long … Read More

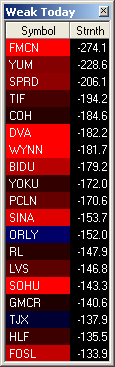

SMB Radar Update – Weak Today Snapshot

The Weak Today column ranks stocks based on the price change relative to the stock’s opening print. These stocks tend to have opening drives and continuation moves. The idea here is to find opportunity in the weakest stocks in the market with the highest probability of continuing the trend. When looking through the column, we always take note at how In … Read More

Free Options Webinar: SMB’s Options Tribe: Tuesday, October 4, 2011 at 5pm EDT: Short Term Calender Spreads

Tuesday October 4, 2011 at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

Why I covered JBL at the bottom :)

JBL was on the minds of most intraday traders around me this AM. It was mentioned in our SMB Training AM Meeting. Before the open I ask traders around me what they will be trading. Adam? Sammy? Andrew? Jeff? Peter? Tarhini? All but one did not mention JBL as one of the top three stocks on their screens. We opened … Read More