Mr. Michael, I am Alexei, from Paraguay, South America, I’ve been following SMB Capital for a year and now reading your blog posts is a must every day. Recently I have finish reading One Good Trade. I have read so many books about technical analysis and trading and I now you heard this a lot but it was by far the best … Read More

Notice, Explore, Execute

This morning we noticed that shortly after the open CF hit my new low of the day ticker. Hmmm…a market leader getting sold right away into a gap up in the SPY and continued strength in the SPY. I took “Notice”. A little later we see it again, this time joined by MOS, AGU and some others from the sector. … Read More

Trader’s Ask: How should I decide when to increase my tier size?

Hi Bella, If you don’t mind, I have a question for you. How long should a trader trade at a given tier size before they move it up? I don’t want to jump in larger too fast, but I don’t really know what an optimal time frame is for advancing, and I’m sure it varies from trader to trader. Is profiting … Read More

SMB Radar – Snapshot

Here is a look at a few of the columns I use on the SMB Radar, as of today’s close. Notice a lot of blue today which means institutional activity was minimal. Also note that the In Play list has a lot of IPR’s with readings below 3.00. Regardless, I still like to sift through these after the close as … Read More

Back to the future

The future’s on it’s way, the past is gone Old and rusted, with your busted bones Break the crystal ball, you’re on your own Wipe away the fear of the unknown Now, here we go, on with the show Makin’ our way, just living for today It’s in my sight, and the time is right For takin’ a bow, into … Read More

Free Options Webinar: SMB’s Options Tribe Today at 5pm EDT: A unique approach to butterfly spreads

Tuesday August 30, 2011 at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

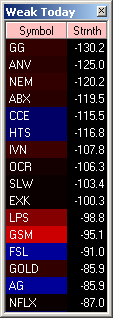

SMB Radar Update – Miners Weak Today

The Weak Today column ranks stocks based on the price change relative to the stock’s opening price. These stocks tend to have weak opening drives and continuation moves. When looking through the column, we always take note at how In Play the stock is to gauge the validity of the move (Bright Red to Dark Blue). Today there have been … Read More

Forex Trade/ Our risk reward

Before entering a trade, we should know what is our return based of our risk. Taking risk is the price of achieving returns; therefore you cannot cut out all risk. It is not completely true about the fact of an investor who takes on more Risk expects higher Returns. In the picture below, you can see the risk involved with … Read More