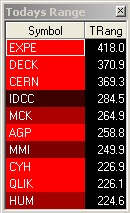

Here is a quick snap-shot of the top stocks on the Today’s Range list on the SMB Radar. This is just one of 10 categories that the algo captures. @tarhini_smb

One Bad Trade

I made one bad trade today in VPRT. After the trade I shook my head and remarked to Steve how amateur my trade was. I was not pleased with myself as a trader. The result of the trade? A complete chop. A two point winner. I couldn’t agree more with Steve as he summarized my bad decision-making: “That could have … Read More

SMB Morning Rundown for July 29, 2011

Market showing some weakness this morning after end of day selloff ystdy. No vote in House ystdy on debt vote not helping. GDP numbers not good for Q2 but info is backward looking. Short bias but most of the downside has been realized prmkt. A pop to 129.40-129.60 would be a safe short area. SPY support 128.35ish Morning Idea: STEC … Read More

No Vote, more uncertainty

Word just broke that there will be no vote on Speaker Boehner’s bill tonight. This will breed more uncertainty to the markets. This is not HardBall or Nightline so I will skip to our thoughts as a trader firstly. I will watch Asia to see how their markets react. So far they are down almost 1 percent as I write. … Read More

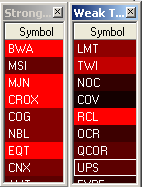

SMB Radar Update for July 28, 2011

There has been a lot of long and short opportunity in the market today. Here is a snap shot of some strong and weak stocks based on the SMB Radar going into the close. The Strong/Weak Today column ranks stocks based on the price change relative to the stock’s opening price. These stocks tend to have strong/weak opening drives and continuation … Read More

Free Options Webinar–SMB’s Options Tribe: Tuesday August 2, 2011 at 5:00 PM–Weekly Options

Tuesday August 2, 2011 at 5:00 pm Eastern Daylight time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

SMB Morning Rundown for July 28, 2011

SPY resistance around 132.50 to 132.70. below watch 132 level. key inflection point from yesterday is between 131-30 to 131.60. failure at 131 premkt and last period point. watch support levels at 131 to 130 to 130.20, 129.63, and 128 to 128.40 Morning Idea: AKAM resistance at 26, 25.50, 25 key inflection point on long term charts. holding below 25 … Read More

A market trading day

Today was a market trading day. For new and developing traders this is a very difficult trading day to master. Normally we focus on one or two stocks that are best for us and find set ups that make sense for us. On a day like today, a market trading day, you want to apply a different technique. Let’s discuss. … Read More