For the most part as expected the market has been quiet this holiday week. This is clearly demonstrated by this screenshot of theSMB Radar. We use color coding throughout each list to quickly assess how In Play any given name is. Red indicates “hot” and blue indicates “cold”. I know–we are so clever. Overall, when you see 90% of the … Read More

Morning thoughts 12/29

Good morning traders, I am traveling and away from the computer all day. (Driving 9 hours back to New York, a big Thank You to Continental Airlines for that one, but don’t get me started…). I don’t see a lot in terms of setups today. Everything I had said from past days applies here: focus on specific in play stocks … Read More

End of the Year Review

I know I’ve been slacking a bit with my blog schedule. Let’s just say that I am more of a social butterfly, this writing thing is not my favorite :). But as a New Year resolution I have it to be a lot more active with my writing. Yay!! I have received a few emails from fellow traders and mentees … Read More

Randomness revisited: random levels?

Another look at randomness in markets… this time looking at random S/R levels drawn on real price charts.

Happy Holidays!!

Bella, Steve, Gman, Roy, Charles and the rest of the SMB team would like to wish you an abundance of friends, happiness, and fun this holiday season. May 2011 be another prosperous year full of joy and happiness. Thank you for your continued readership, we look forward to another fun year.

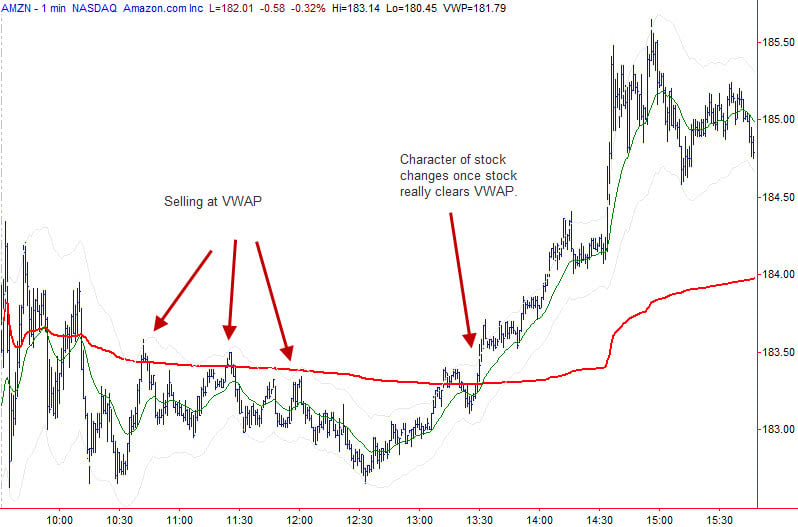

Traders ask: VWAP?

A brief look at VWAP: what it is, how to calculate it, and some ideas for how you might use it in your trading.

Morning Thoughts 12/28

Good morning traders, The bullet point format is a lot easier for me to write. Since you guys don’t seem to mind (or maybe even prefer?) it, I’ll continue with that format again. Also, I am once again writing this the night before, so I will update and note on Twitter if anything changes. I am not trading these last … Read More

Morning Thoughts 12/27/10

Good morning traders, I am still on semi-vacation (and not in the city for the big blizzard!) but wanted to share a few thoughts with you this morning. I’m writing this again at 2AM… if something changes before the open I’ll update. Key thing to remember is that we are still in post holiday mode. Don’t expect much followthrough… in … Read More