SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options trading. On August 23rd, Seth Freudberg, the Director of … Read More

Free Options Webinar Today at 5pm EDT. SMB’s Options Tribe : $NDX Calender Spreads

Tuesday September 13, 2011 at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

Free Options Webinar: SMB’s Options Tribe September 13, 2011 at 5pm EDT: $NDX Calender Spreads

Tuesday September 13, 2011 at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

Traders Ask: Is it better to buy options for swing trading profits, or sell options for time decay?

Trader Sam asks: “Dear Sir: Allow me to ask a question about options, as I am a new trader: I have heard that delta neutral strategies are the best approach to trading options but I have less than $6,000. in my trading account and my broker’s margin requirements make it impossible for me to trade iron condors, butterflies and other … Read More

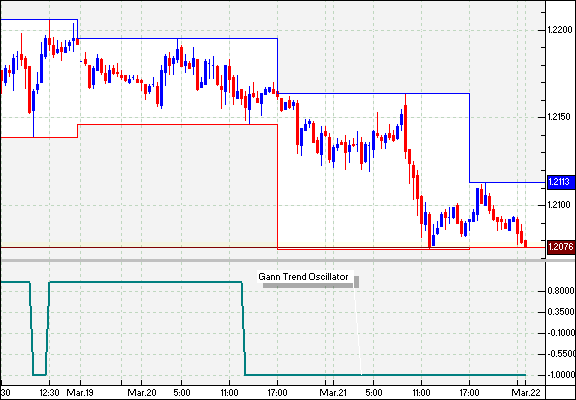

Directional Indicators That are Not TOO Wrong

One of the great things about options trading is that you can make a directional bet, be wrong, and still make excellent money on a trade. As many of my closest relatives are fond to point out how wrong I am on so many life issues, it is a comfort to know that there is a way to trade options … Read More

Maximizing Profits: Legging Out of a Winning Options Spread

Nothing is more frustrating to an options spread trader than working a trade for 30-60 days, using all of your skills and knowledge to initiate, adjust and improvise to position the trade for a nice win and then, on the day you have decided to exit and pocket that profit, you run into execution problems. There is nothing quite like … Read More

Sittin’ on the front porch sippin’ iced tea

It’s funny how non-directional options trading differs from many other kinds of trading. For example, most forms of trading require price change to be taken advantage of by the trader. Day traders salivate when they look at charts that are vertical, in either direction. Directional options traders are the same way. But, non-directional options traders normally do best when … Read More

Can I Trade Options While Holding Down a Busy Full-Time Job? How About While I’m Asleep?

While there are common themes to every kind of trading discipline, there are of courses differences as well. Options spread trading, for example is a very different world in many respects from day trading. At SMB, our intraday equity traders tend to focus on the opening hour and the closing hour of trading, with sometimes very high speed activity and decision-making … Read More