On my latest StockTwits TV show, SMB University, I was asked about trading right on the Open. Often new traders struggle with this time period for two reasons: a) they miscalculate their downside risk before entering the trade b) they do not have a playbook with trades that work for the open. Well let’s try and correct some of (b) … Read More

SMB Morning Rundown – June 1, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Ten Mistakes by BP a Trader Should Never Make

1. No Exit Plan. There was no exit plan for if the rig (RIG?) exploded. Before every trade we must decide where and how we will exit BEFORE entering the trade. 2. Live to Play Another Day. It is not definitive that BP is a viable company going forward even with 6.08 Billion in quarterly profits. 1) When will the … Read More

Intraday Reversals Indicate What?

In the final 3.5 hours of trading Friday we touched 109 three times on the SPY and 110.30 twice. Generally, this type of up down action does not instill much confidence in market participants, and many believe it is a sign of lower prices to come. I’m not in that camp. Someone definitely was dumping a couple of billion dollars … Read More

Traders Ask: What is the Proper Exit on a Swing Trade?

Reader Alex asked: My name is Alex and I’ve been swing trading for two years. I’ve been reading SMB’s blog for a while, and really enjoy the posts on trader development. I have recently journaled a question that emerged during two of my recent short trades. I believe that this question relates to intraday trading as well. Depending on conditions … Read More

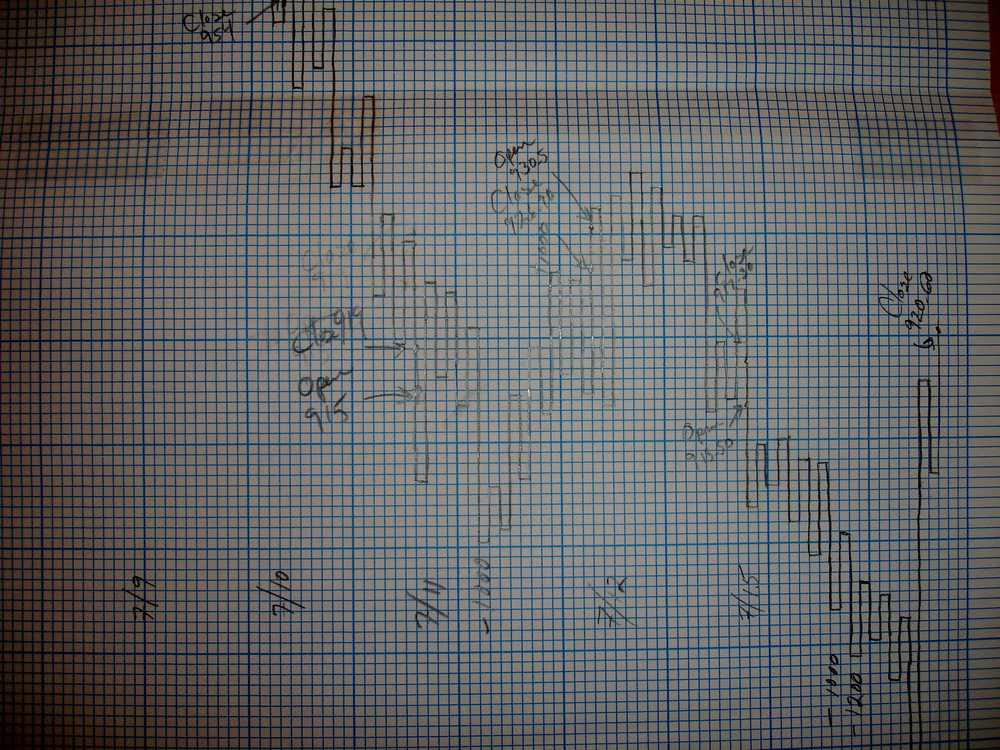

Embracing the Value of Keeping Charts by Hand

Keeping price charts by hand can shorten your learning curve.

SMB Trade of the Week: Visa

Watch SMB Trade of the Week, a Resistance Trade in V from Mike Bellafiore.

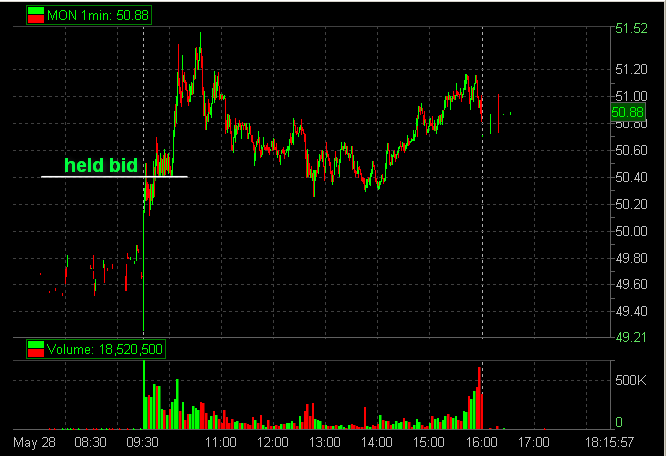

SMB Morning Rundown – May 28, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.