This week I presented for 90 minutes and sat on a panel discussion for an HFT conference. I thought I would report back with some running themes. 1) What is the next Brazil? 2) What markets are most inefficient and offer trading opportunity? 3) Will most traders have access to most markets from their trading home? 4) Teaming with discretionary … Read More

Free Webinar: From Good to Great – Pre-market Trading

In his 4th and final webinar for 2011 Steven Spencer will discuss pre-market trading. This is a very important skillset for professional short term traders and has become increasingly relevant during the past few months. The webinar is intended mainly for those with an intermediate to advanced level of experience. But all are certainly welcome to attend! Time: Wednesday December … Read More

When is a good time to trade

In previous videos, we talked about levels of support and trading areas. When specific trading areas are breached, we patiently wait for the price to develop to the next trading zone. During the time of price expectation, we step away from the market in order to avoid costly errors. In SMB forex, we follow the real market’s trend and … Read More

SMB’s Options Tribe: Tuesday, December 13, 2011 at 5pm EST: A Multi-Month, Multi-Index Butterfly Strategy

Tuesday December 13, 2011 at 5:00 pm Eastern Standard Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of … Read More

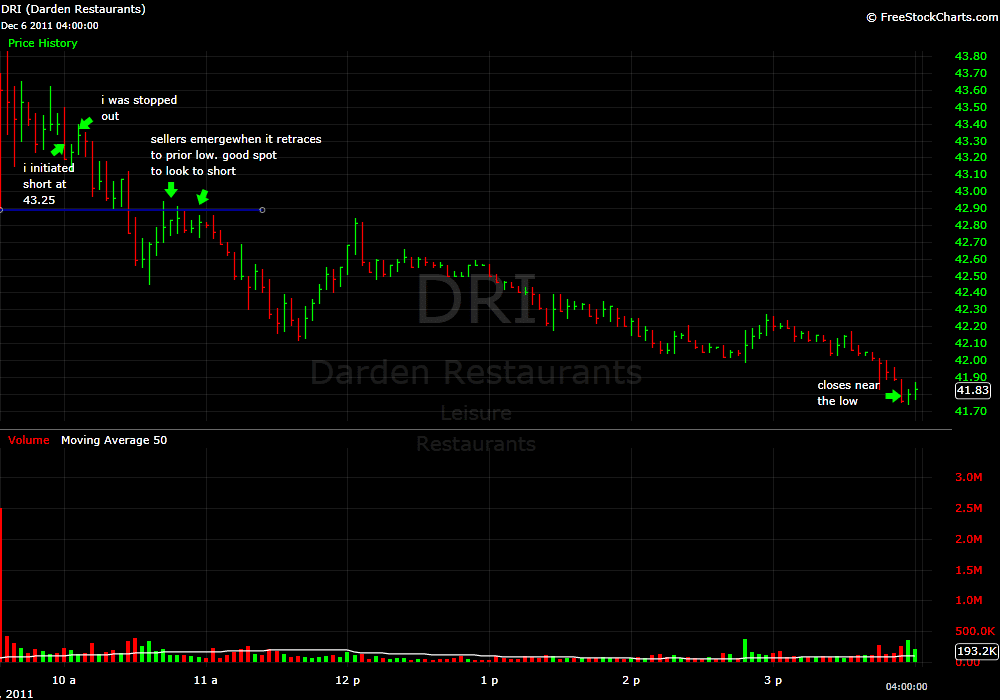

The Risk of Closing a Position That is Working For You

I was watching DRI trade on the Open today. To say that the price action was “whippy” would be an understatement. It seemed to be touching every price and there was no way I could possibly control my risk. So I waited. After 10:00AM I initiated a short position at 43.25. I saw some selling a couple of minutes earlier … Read More

Free Options Webinar: SMB’s Options Tribe: Today at 5pm EST: Weekly credit spreads using a trading system

Today at 5:00 pm Eastern Standard Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options trading. This … Read More

Traders Ask- Should I add or sell?

Happy Saturday Bella and Steve, I’m reviewing one of my old trading tapes and wanted to get your opinion on a trade I executed in TVIX back on 7.11.11. Let me setup the trade for you: Basic Sup and Res Play Prev close: 16.36 Res: 17.90-17.95 Sup: 17.70, 17.50 Gapped up to 17.30 pre-market, consolidated around 17.45-17.50, started an uptrend … Read More

Understanding the market structure of the day impacts all of your intraday trades

Understanding the market structure of the day impacts all of your intraday trades. Corey Rosenbloom has done some excellent work on this important trading concept. Dr. Steenbarger has written about its importance. At SMB we talk about the Big Picture before we start our AM meeting. Below is a self-proclaimed rant from a new trainee. We can learn from his monthly analysis … Read More