On Sundays some SMB Traders send me their weekly results. Here is an example from one trader, who I like a lot and am rooting for, that p***** me off. This week could have big a big week for me and one that has really set in on me bc I lost $1,000 and I wanted to know what happened … Read More

Each of These Opening Drive Trades Are Different

Hi Mike- Hope you’re well. I am a part of your Foundation course and have been enjoying the education thoroughly. One of the skills I’m learning to develop is trade the open in stocks that are In Play. I perused the BBY blog from today and observed the move in INFY on the open. My question for you is are … Read More

How Many Screens Do You Use to Trade?

Hi Bella, I know this question may seem sort of insignificant to others, but I know a trader who uses 10 monitors at his trading desk. Me personally, I just use 2 right now & considering adding a third here soon. I know there may be a bit of a personal preference, but I just thought I’d try and see … Read More

Danger Will Robinson

One of the final lectures in The SMB Foundation is on risk. Risk as it relates to intra-day trading is not simply evaluating the order book for possible exits if a stock moves against you. It involves understanding the current market environment, the type of catalyst that is the primary driver for a stock on a given day, the price … Read More

Eliminating Myself From The Market

Whenever I write a piece like this a fear enters my mind that I will eventually “arb” myself out of the market. Today INFY had Very Large gap higher. Recently, I did a webinar that addressed this trading scenario from a day and swing trading perspective. I also posted this video on how to trade “Very Large Gaps”. My view … Read More

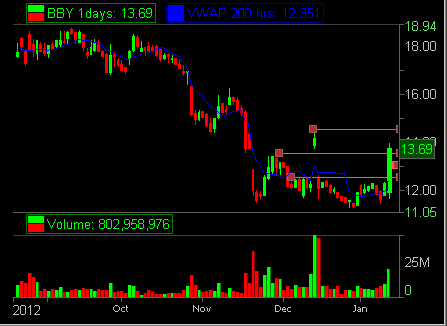

Revealed: How SMB Trader, The King of Men, Navigated BBY Premarket

On Twitter I received this tweet: @rodlivar asked @mikebellafiore is neccesary to stop in the shakeout today in BBY at 13.25 at 09:40 or you could wait for the real level 13.10 or 13 I noticed SMB Trader, The King of Men, did a nice job choosing BBY to trade and traded it well on the open. I asked him … Read More

Tips to Trade Bigger

MIKE- Good evening! I really enjoyed the webinar this evening, that was some good stuff. Lots of good nuggets in there that are practical and applicable. I’ve really been thinking a lot lately about getting bigger responsibly in those key spots where you just HAVE to get bigger and take size. Trying to be harder on myself for not extracting … Read More

I’m Out In The Boonies. What Should I Do?

I received this email yesterday. I am considering signing up for the remote SMB Foundations program. But I am concerned about the technology I would need to get full advantage from the program. I live in rural Texas, and my tools are caveman-primitive compared to those of your traders in NYC. I have a Windows desktop, a 3 mb/sec DSL … Read More