At SMB we get a lot of emails from traders of all levels. Much of the time they are from aspiring traders who are very passionate about the markets and their work. And all of us here make every effort to respond and provide some insight into the world of professional trading. So in this article, I am going to … Read More

How Do I Take the Next Step as a Trader?

Mike, I know you’ve heard it many times. It’s like telling a model that they’re attractive. 🙂 But, you guys put out some very informational items. Every other day, I listen to “How badly do you want to be successful?” Very inspirational! The one thing I suggest is writing something on the level of knowing when to increase your size. … Read More

Principles for Turning Options Trading Ideas into Profits

Is there a method to determine the probability of an options trade? One of the terrific characteristics of trading options versus trading stocks is that there are methods of calculating probability of profit before you initiate the trade. The features of time decay, strike price and option volatility are unique to options trading strategies and apply whether you are buying … Read More

Options Trading Basics: Calculating Return on Investment

One of the questions often asked about investing in options is “How much can I earn”? Questions like this show how easy it is to fool someone if they really don’t understand how to measure trade results from one trade to the next. To put it bluntly most options trading books don’t tell the whole story. One marketing approach actually … Read More

What is the Best Market to Start With?

As a beginning trader, is there a market that is best to start with? @mikebellafiore I was asked this question during a recent Webinar “Trading Fundamentals: Things Great Traders Do and Never Do”. In a perfect world I like the idea of new traders trying all products and multiple time frames before choosing one. I am not sure this is realistic … Read More

Is This Trader Overtrading?

Q: Mike – so since scalping is dead, can you explain how Shark has hundreds of trades a day? (What I saw in the Playbook from his results on SMB ChopTracker)? Is it basically he takes a low risk entry and then is just adding and subtracting to his position with the ebbs and flows of the tape? Just curious so I … Read More

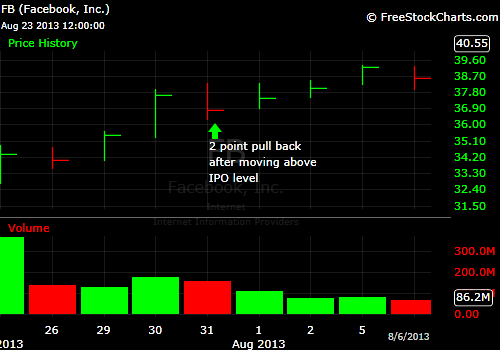

My Thought Process: $FB

Before I start to break down each StockTweet I want to share some background information for this trade. FB reported a huge fundamental shift in their most recent earnings report on July 24th. FB’s mobile revenue as a percentage of its total revenue doubled. This was a game changing piece of information as the largest impediment to FB’s stock performance … Read More

Can You Overthink While Trading?

The cycles of trading. Do we get worse sometimes if we overthink and get too caught up in things? @mikebellafiore I was asked this question during a recent Webinar “Trading Fundamentals: Things Great Traders Do and Never Do”. Gr8 question! Yes, traders can over-think. I sat in our conference room yesterday with one of our brightest traders who has been … Read More