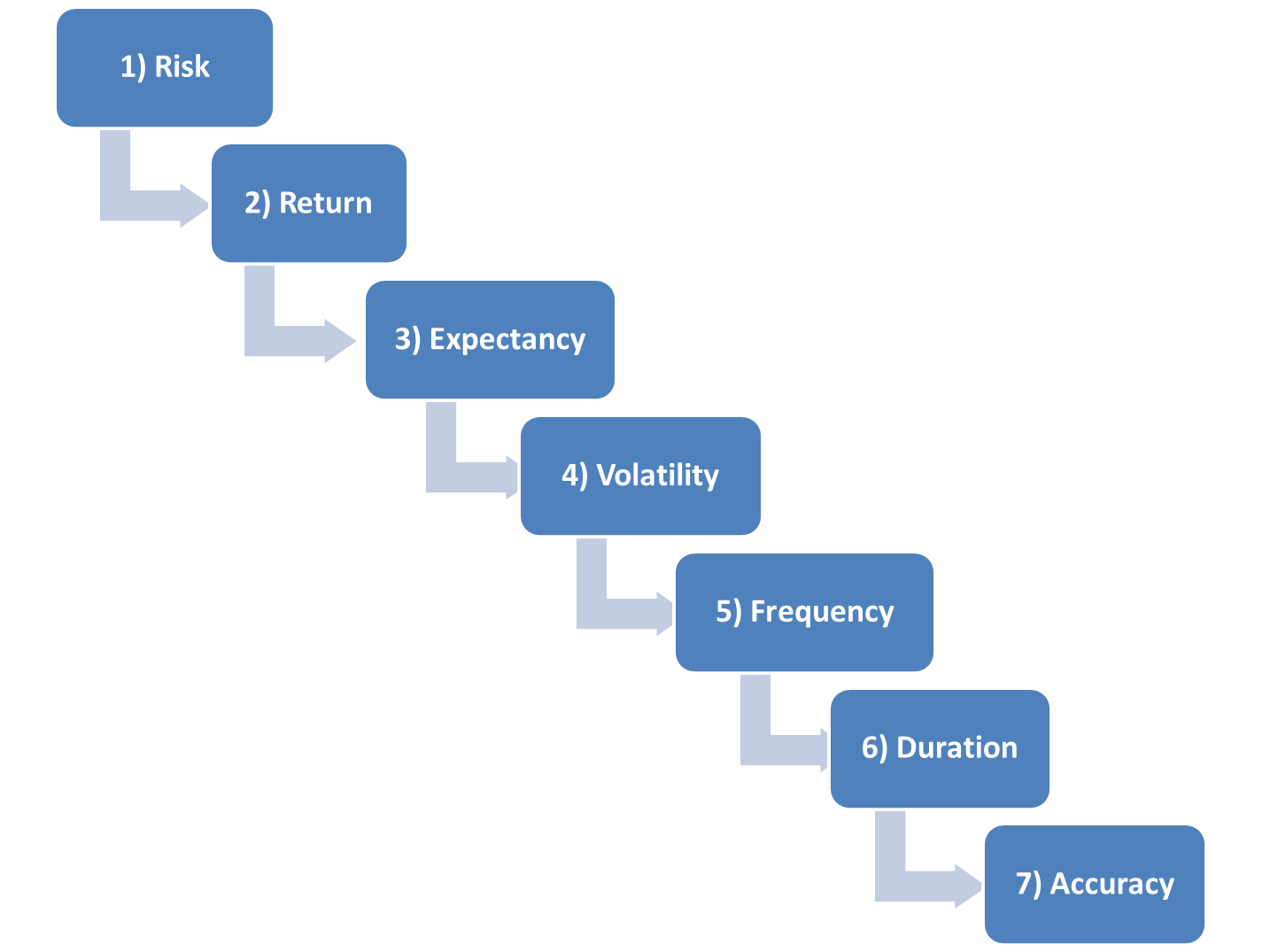

Accuracy is simply defined as the percentage of trades that end profitably. It is the final of our seven steps to systems success. To phrase it better, accuracy is the last thing we look at in building a system. Accuracy—almost without fail—is the first question asked about a system. However, it has the least impact on the success of a system. … Read More

PlayBook Checkup: Breakout Fade ($OPTT)

Below is our newest installment of the 2014 edition of The PlayBook Checkup with Bella, author of One Good Trade and The PlayBook. During these sessions a trade archived by a Junior Trader from our desk will be reviewed by Bella. Attendance is free for SMBU Tools subscribers, who can also ask questions during the event. In this video a Junior Trader talks about … Read More

Members-Only Options Webinar: Explore Earnings Plays and Options Behavior with Matt Amberson of Orats.com and Casey Platt

SMBU’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each Tuesday, SMBU hosts an options webinar—the Options Tribe—during which veteran options traders and experts in the world of options trading share live presentations. Next week, Matt Amberson of Options Research and Technology Services (ORATS), joined by … Read More

Duration: The Sixth Step to Systems Success

Number six in our seven steps is Duration. Duration represents the expected length of time in winning trades, losing trades, and all trades. Almost without exception we find that trend- and momentum-oriented signals have a shorter duration for losing signals and a longer duration for winning signals. The reverse is true for mean-reversion trades. Knowing your expected duration is important … Read More

The Blowup: Game, Set, Match!

Recently, I have been thinking a lot about the “blowup”. In trading it is the term used to describe a catastrophic loss suffered by a trader or a firm. The blowup generally lurks in a remote corner of my consciousness, ready to be pulled to the forefront at a moment’s notice in service of proper risk management. Perhaps this past … Read More

Enhancing Trader Performance… with the Ten Commandments

*****David Blair, The Crosshairs Trader, is a blogger/trader/educator who does a wonderful job of sharing research on elite performance and how it relates to trading. Below is his latest post for the SMB trading community.***** — Editor’s Note I am one who believes that in order to enhance trading performance one needs to study principles applicable both in and outside … Read More

Trading Lesson: Establishing A Trading Range—$PLUG

Often I receive questions regarding how I determine important price points for establishing trades. It is a combination of several factors each time but by far the heaviest weight is given to recent support and resistance levels. You would be surprised at how often after I make a trade I’ll receive a comment like “you shorted at the 66.3% fib … Read More

The Fifth Step to Systems Success: Frequency

Our fifth of seven steps for building, testing, and following a system is to understand the frequency of the system. Higher frequency increases profit potential, but it also reduces reliability. The two primary downsides of higher frequency are 1) transaction costs and 2) execution assumptions. In back testing you can assume buying every bid and selling every offer. But this … Read More