In this short video Steve discusses $BIOF, a stock from this morning’s AM Meeting. Every morning he reviews the market and analyzes the stocks that are in-play and likely to have second-day moves. Turns out $BIOF was a huge mover off the $4.00 level Steve had mentioned in this morning’s AM Meeting. You can get more calls like this on a … Read More

Let Me Help Save You 50K

Mike, I am only thru day 4 of your 10-day beginner lesson plan, so forgive me if you have covered this in the 10-day course or The PlayBook, which I will start this weekend, but do you have any advice for newbies on certain investment (trading) vehicles to stay away from until we are weaned so to speak? I am … Read More

SMB AM Meeting Recap: $PRAN

In this short video, Steve discusses a stock from this morning’s AM Meeting. Every morning he reviews the market and analyzes the stocks that are in play and likely to have second-day moves. Steve discusses the potential trading setups in $PRAN. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and … Read More

The Capital-Scaling Iron Condor

In this video presentation, Seth Freudberg, SMBU’s Director of Options Training, explains the Capital-Scaling Iron Condor Trade, an out-of-the-box approach to trading iron condors. Seth Freudberg Director, SMB Options Training Program The SMB Options Training Program is a program designed for novice and intermediate level options traders who are seeking an intensive training process to learn how to trade options … Read More

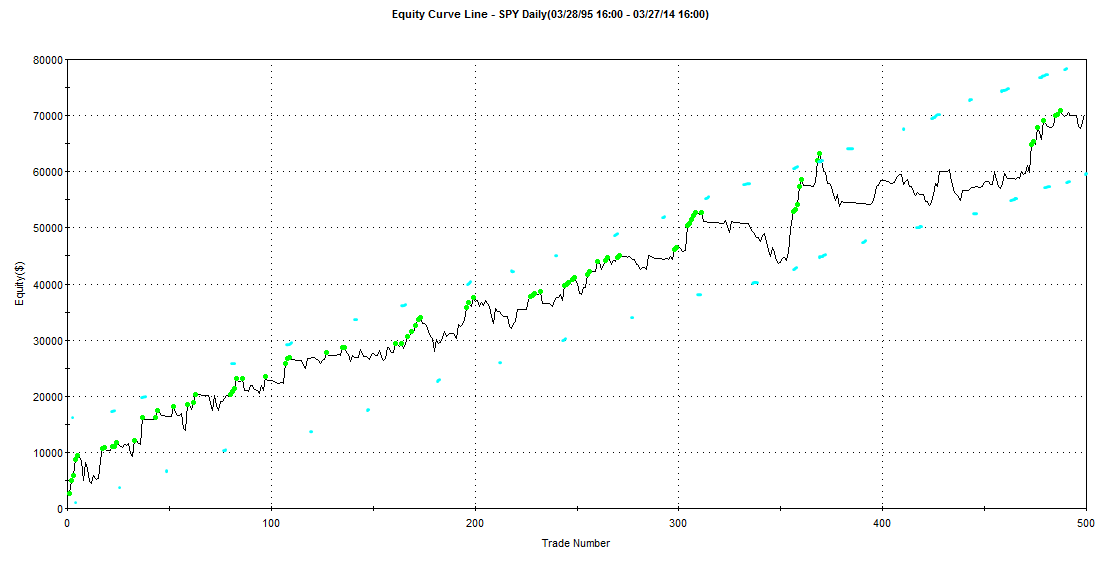

Volatility-Based Sizing

In running back tests, it’s important to understand the impact of volatility and position size. A consistent position size in number of shares or dollar amount can greatly skew historic results. If optimizing, this may lead to curve-fitting the system to periods of high volatility. Here are some examples of the impact of fixed-position sizing vs volatility-based sizing: The first … Read More

Forex Analysis: GBP/USD

Marc Principato, CMT, shares his recent analysis of the GBP/USD. This includes his long and short term perspective, potential levels of interest, and setups he is actively watching for. Subscribe: http://bit.ly/utraderyt Help me write my book: http://www.unconventionaltrader.com Training Info: http://www.bit.ly/smbhome My analysis on TradingView.com: http://bit.ly/tviewprfle Twitter: http://www.twitter.com/marcpmarkets Webinar and Trade Review Archive: http://bit.ly/archpge — Marc Principato, CMT, Risk Disclaimer *No … Read More

SMB U Trading Lesson of the Week: Position Sizing in $CCL

Mike Bellafiore, author of the “trading classic” One Good Trade and The PlayBook, talks about a SMB Trading Lesson of the Week in $CCL. Mike discusses the various trading scenarios and how your position sizing would have changed under different market circumstances. Enjoy the video! You can be better tomorrow than you are today! Mike Bellafiore One Good Trade The … Read More

SMB AM Meeting Recap: INSM

In this short video, Steve discusses a stock from this morning’s AM Meeting. Every morning he reviews the market and analyzes the stocks that are in play and likely to have second-day moves. Steve discusses the potential trading setups in INSM. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and … Read More