Mike Bellafiore, author of One Good Trade and The PlayBook and Co-Founder of SMB Capital will be a Speaker at Stocktoberfest in San Diego Oct 27-28. Jack Schwager author of the best-selling Market Wizard series, Howard Lindzon- Co-Founder of StockTwits, Herb Greenberg of CNBC, Josh Brown-@reformedbroker, JC Parets- @allstarcharts, Greg Harmon-@harmongreg, Phil Pearlman of Yahoo Finance, and many other notables too numerous to mention … Read More

Expanding Volatility– $SPY $VXX

I share some thoughts on trading adjustments we make in a market with expanding volatility. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 18 years. His email address is: [email protected]. no relevant positions

How to Win During Earnings Season

Every financial quarter as traders we have our Super Bowl- Earnings Season. These are exciting trading times! New traders chirp, “This is going to be the month I break out.” Developing traders announce,”I am not going to be a wuss during this earnings season and quintuple my profits!” Experienced traders unsatisfied with their results during earnings season declare, “I will … Read More

Trend-Following in Life and the Markets

Traders are always trying to improve their game. Beginners usually jump from strategy to strategy in search for some holy grail that will always win no matter what the markets do. Pro traders outguess their gut and their systems in attempts to make or save an extra buck. Such efforts are usually self-correcting by losing money. I believe we all … Read More

I Hate My Job!

Hi Mike, My name is Assaf and I would like to get your advice if it is possible. I’m 42 years old married with three kids, living in Israel and working as a software engineer. Currently I’m managing a group of engineers and making around $120K a year (in Israel this pretty good salary). I can see my career develops … Read More

SMB Trading Lessons of the Week – October 19, 2014

In the video below, Mike Bellafiore is interviewed beforeFriday’s open by Benzinga to discuss his pre-market prep. Latest Blog Posts Higher Volatility = Higher Trading Expectations I love the idea of you experimenting with a giveback rule. It has been awhile since I have written about this. From your example above, stopping yourself out for the day when you dip … Read More

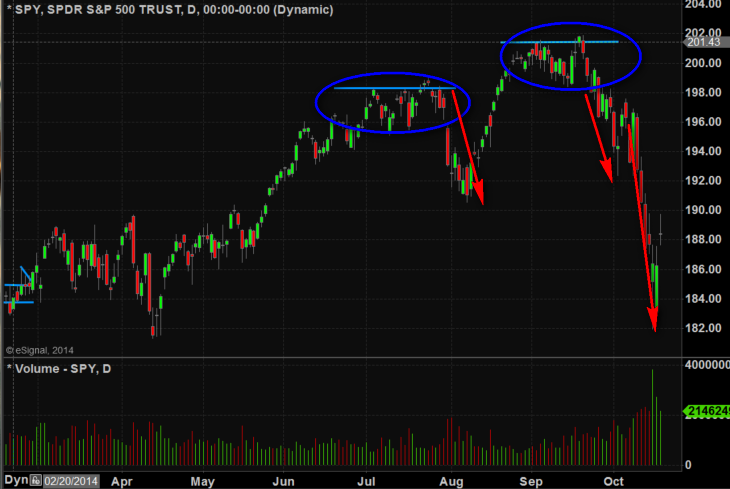

Top Calling is A Game For Losers

It is extremely difficult to identify a top in an up-trending market, however, a very useful and profitable exercise for traders is to identify conditions that may lead to a market pull back. So whereas the typical “top caller” invited to opine on CNBC has no idea whether the market is at a top professional traders focused on price action, … Read More

Options Trading for Income with John Locke for October 13, 2014

No relevant positions Risk disclaimer