There are two truths that I’ve observed about trading over my trading career. 1. Trading edges come and go 2. Great traders last For these two truths to exist simultaneously, it means that great traders cannot depend on a few edges that currently work. Mike Bellafiore has said many times before that the most important aspect of success in … Read More

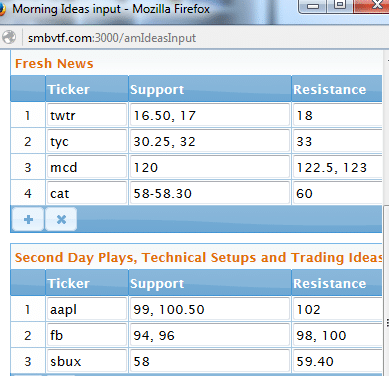

Pre-Market Trade Prep–TWTR TYC SBUX

Each morning before the market opens we outline a series of trading ideas. There is a written “game plan” to make it easier to follow along. We identify the best stocks to trade before the opening bell as this puts us in a better position to execute in the heat of the moment. Here is a screen cap of the … Read More

Selling the dream- I will pass

I got asked to do a podcast to discuss one of the books I wrote. I like doing podcasts. I did one with my friend ChicagoSean for StockTwits here. I did one with Chatwithtraders here. I like listening to podcasts. Soundcloud is an app on my phone, which I frequently use on my walk from the west side to the … Read More

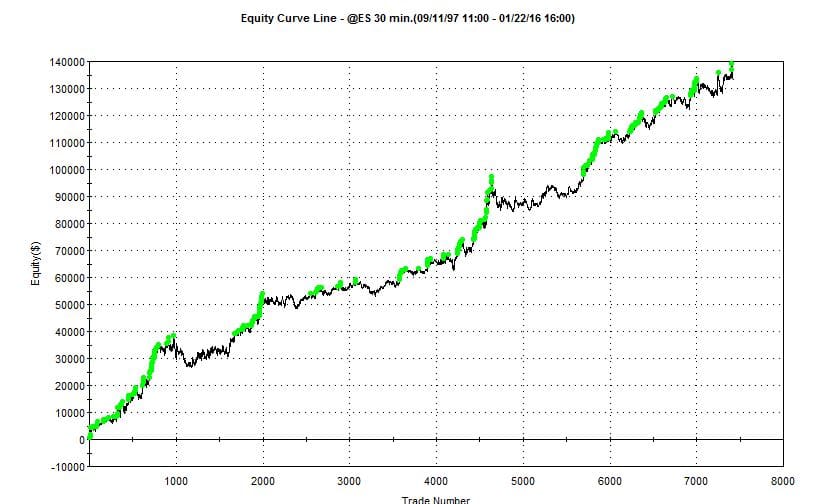

One Benefit of Intraday Trading

The following is a simulated back test of a simple short term momentum system on SPY. It generally has positive performance but the draw down periods are a little deeper and wider than I would prefer. Now, I’ve taken the same system but coded it to go flat at the end of each day. Then it waits for a fresh … Read More

The sloppy, the good, the same trader

Let me share actual trading events from our prop desk this week. It’s Tuesday, the market is selling off hard and Trader A thinks the market should bounce and VXX decline. He fades the market and VXX all day for a net result of -10k. Let’s call this The Sloppy (in his trading). It’s Thursday, the oil has sold off … Read More

The Market Pays You For Volatility

In our SMBU Daily Video, Seth Freudberg discusses how market volatility can pay you. Everyone knows that the market has been selling off hard since the turn of the year. Many traders of market neutral options strategies are struggling in this environment However, initiating trades in this environment historically provides the trader with an edge. This video discusses one of … Read More

Heightened Volatility is a Double-Edged Sword

Volatility (both real and implied) has been stepping higher. While not at extreme levels, the S&P 500 Volatility Index ($VIX) is at a precarious point. Volatility is one of the more reliable market segments for a mean reversion bias. Most of the time, the VIX lives somewhere between 10 and 30. However, when it gets above 30, the index can … Read More

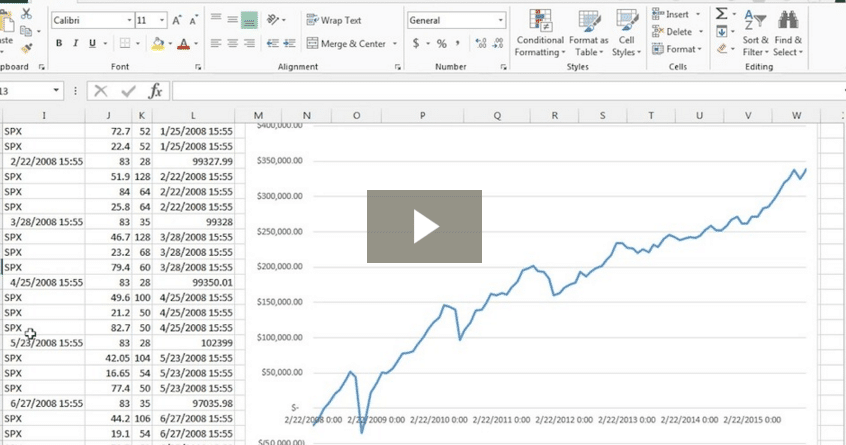

Building a Once Per Month Trade Plan

In our SMBU Daily Video, Andrew shows you how a simple, once per month, trade plan on the SPX could have generated a 43% annual return over the past 8 years (when the market averaged less than 5%) Andrew discusses the importance of finding the key (and simple) elements that provide edge. He shows you how to systematically eliminate the complexity that may … Read More