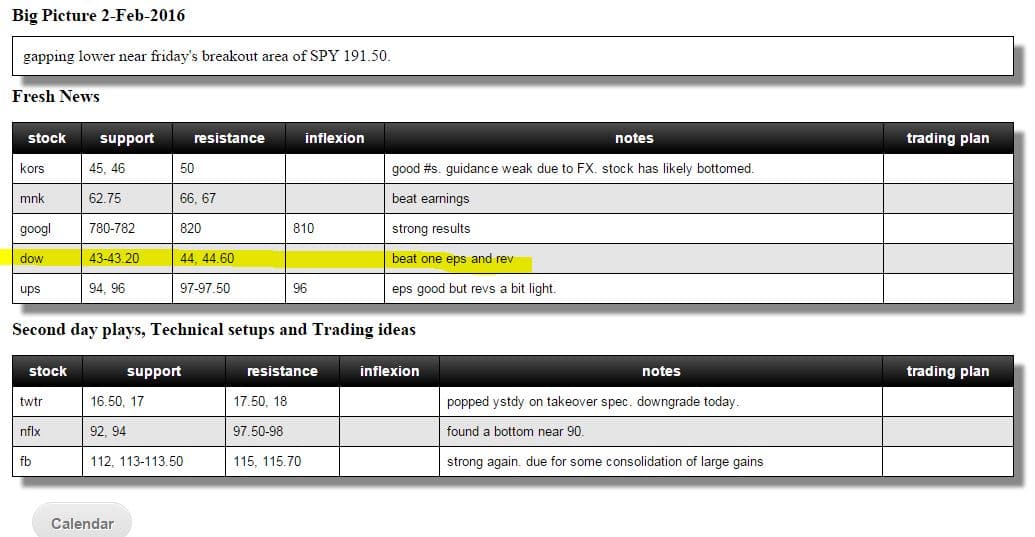

Yesterday, the Dow Jones Industrial Average declined over 250 points while DOW chemical rose over 5%. This was a textbook “stock in-play”. It was gapping higher, the desk identified clear levels to buy from (as mentioned in Trader90 AM meeting and Big Picture Game Plan), and the potential trade back to resistance was greater than the potential risk below support. … Read More

Trade2Grow

Hey Mike, Loved your podcast on chat with traders, huge fan of yours for many years. I was listening to another podcast, and they said “turn off you pNL when trading”. When writing electrical proposals and performing work I am 100% emotionless, never think of money, and never get greedy with customers. Flip to trading, and it’s a different guy. … Read More

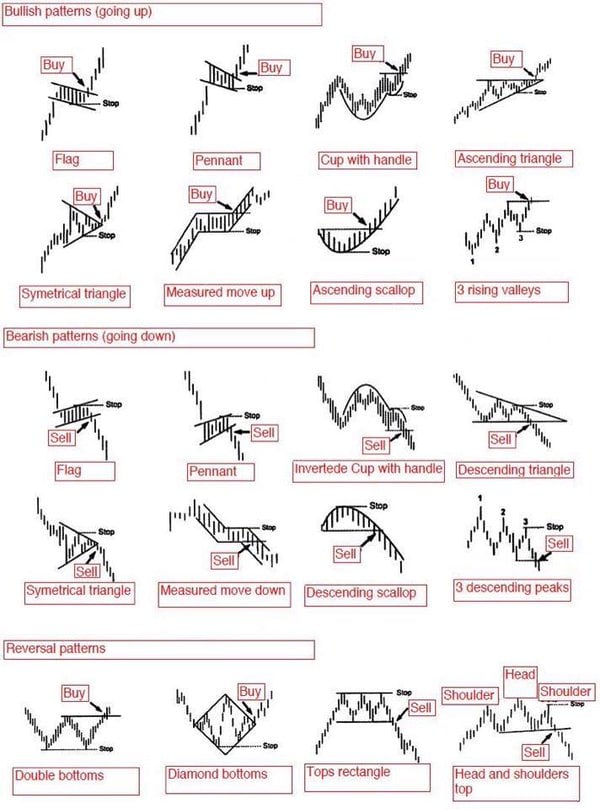

What basic trading setups should I learn?

Hi Mike, This is Ember from the Philippines. I read your book One Good Trade and was really inspired. Presently, I am a remote Proprietary Equity Trader from (deleted by compliance). I trade from home in the Philippines. I started to trade at October 2015 and I am willing to pay my dues even for more than 10 years just … Read More

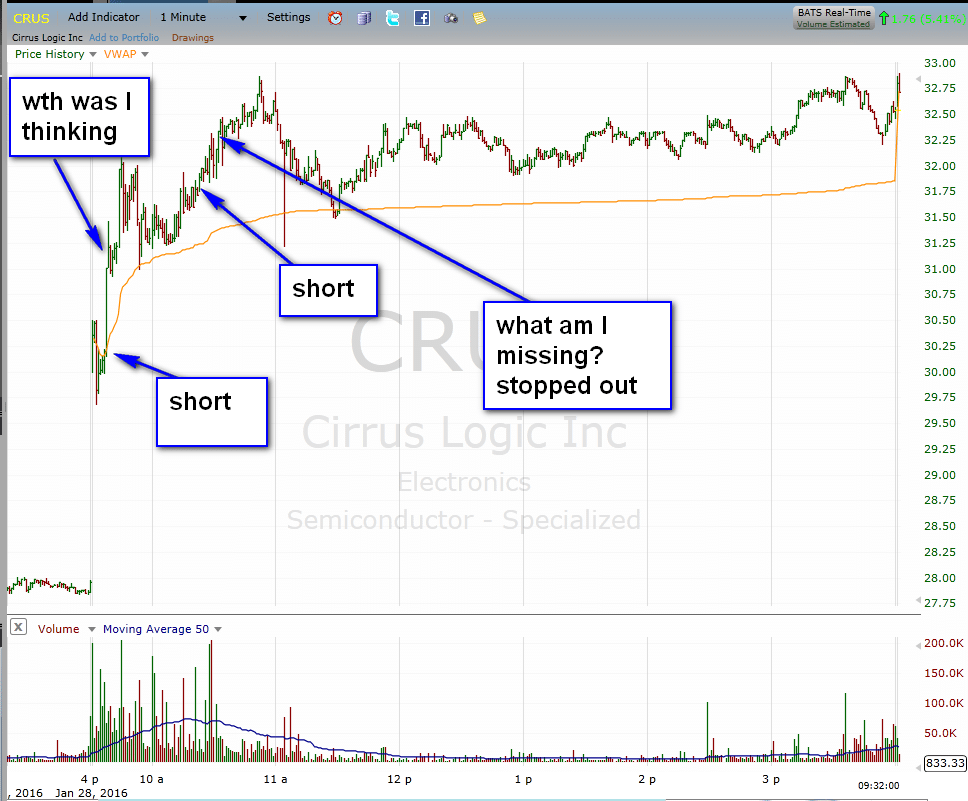

The trading mistake I made

I called out a trader yesterday (Don’t make this trading mistake in Facebook) on a trading mistake and today it’s my turn. Man I messed up in CRUS yesterday. And here’s why. I missed this very important piece of information in Oppenheimer analyst Rick Schafer’s note : As a result, Cirrus will obtain an average of about $5.50 for each … Read More

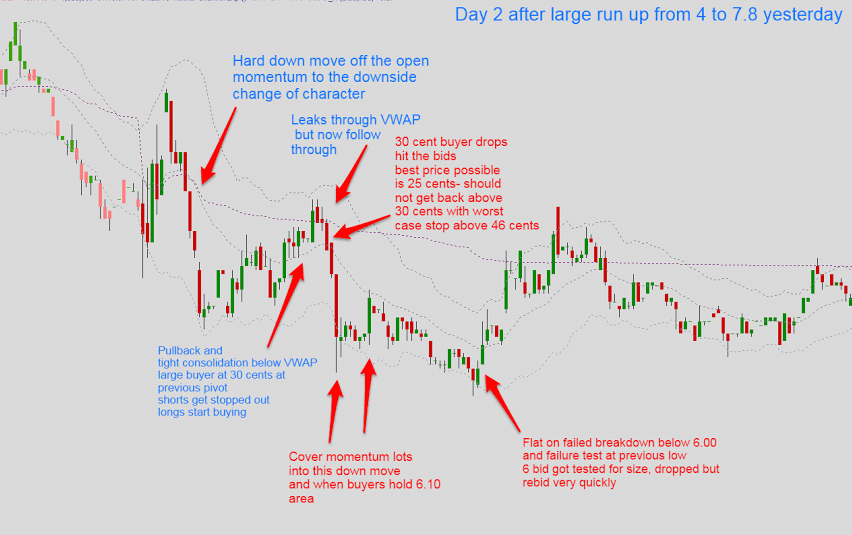

Do not make this trading mistake

Trader Frequent Flyer was having another solid day on the month. He was up near 2k, which for his level of experience and skill was strong. The trading session ended. He was up near 10k for the month, with a few days to go. He had just closed out his 5th straight profitable trading session. And then Facebook earnings hit … Read More

A Perfectly Ineffective Hedge

In our SMBU Daily Video, Seth Freudberg explains a perfectly ineffective hedge. Many options traders buy puts in a panic thinking they will control downside risk in their trades We did a study on weekly options and found that they were incredibly ineffective at controlling downside risk over the last year In fact, traders would have made much more money SELLING … Read More

SMBU’s Options Tribe Webinar: Frank Fahey, Optionvue Systems, International: Trading Volatility Events—building a recurring earnings event portfolio

This week, Frank Fahey returns to the Options Tribe to discuss his approach to trading earnings events.

The edge is not just in the chart

During mentoring sessions after the open with our newer traders, I ask each of them what they traded. First up today was a trader who shorted a failed breakout in ENOC. He likes that chart pattern. But is that simple chart pattern enough to trade this pattern with edge? No. There was more to this trade than a failed breakout. … Read More