I was chatting with a veteran trading coach about a trader in drawdown. Is this drawdown part of her strategy or is she making it worse? Are you making things worse for your trading with your worst trades? Veteran Trading Coach: I actually love how she fights so much. She never wants to admit defeat in a trade until she … Read More

A Formula for Evaluating and Selecting a Set of Trading Systems

Here are the two main ideas to focus on while you watch this video: – A Small Positive Drift + Diversification = Smooth Returns – Smoothness is not the only goal. We want Smoother AND Steeper returns. Furthermore, I hope these concepts demonstrate that smoother and steeper results can be achieved without taking on excessive leverage. Share your thoughts with … Read More

Adapting to Changing Market Conditions

In our SMBU Daily Video, Steven Spencer discusses the range expansions occurring in today’s market. We take a close look at the ranges that have developed in the $SPY over the past months. We hope this video helps you improve your trading skills. Subscribe to SMB’s YouTube to keep updated on new videos! * no relevant positions

A conversation on an insufficient stop loss in Valeant

During a group meeting with our newest traders we discussed a Double Bottom in Valeant (stock symbol VRX), that triggered a buy from a new trader on our desk. Newb: I saw VRX holding near 62, so I got long. Me: Where was your stop? Newb: 61.90 Me: So you got stopped out? Newb: No Ok so now we have … Read More

What troubles me about this trader

I had a conversation with a new trader today and shared my observations of his trading career. Here is what I liked: He has the ability. He possesses the ability to process information quickly. He has the ability to make fast decisions. This was clear during his firm interview and persists after his start. He has an outsized interest in … Read More

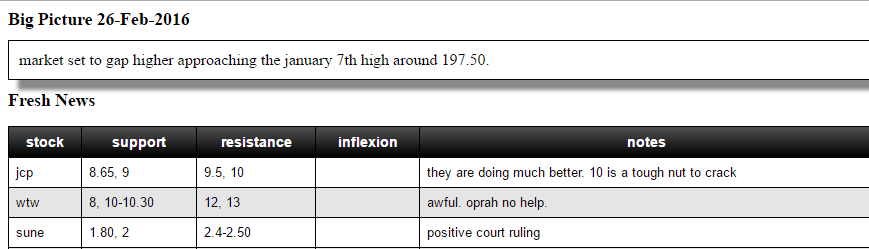

Trade Review–JCP WTW SUNE SPLK BBY

Every day we hold a pre-market meeting where we discuss the best risk to reward trading setups for the day. The trades fall into 3 categories: Stocks with a fresh news catalyst, “Second Day Plays” that had a catalyst the prior day, and finally “technical setups”. I’ve marked up some charts for five trades I made. 4/5 had a fresh … Read More

Unlocking Trading Success: The Formula for Profitable Trades

Yesterday I presented at the TradersExpo in NYC: A study of 5 successful traders from our desk. (Above is a picture of me, chatting with traders after my talk.) It’s important to study traders who have succeeded and learn from them as a trader and firm. The successful traders provide inspiration for those striving and best practices to copy. We … Read More

Andrew’s Strategy Set Theory

In this video Andrew Falde looks at combining diversified strategies in different asset classes to create a portfolio equity curve that is reliable and smooth. This strategy set will be an on-going update. * no relevant positions