Recently, I exchanged emails with a successful prop trader at a Tier 1 firm. I have known him since he was deciding whether to pursue trading, while still in college. We have kept in touch during his trading career. He has become a *very* successful trader. I asked him to share his thoughts on why he became successful. Here is … Read More

Trading A Momentum Reversal–TSLA

This past week many traders sought to profit from a short trade in TSLA. Eventually it reversed dropping almost 10% in two days. But it wasn’t an easy or simple trade by any stretch. My thoughts on one way to make this trade easier… Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in … Read More

This Trader Wanted to Quit

Mike Bellafiore, noted author and founding partner of SMB Capital tells a story of an ambitious young trader that he met while giving a presentation at a university. This trader entered the professional trading world a few years later at just the wrong time. He was ready to throw in the towel — but he stuck it out for a … Read More

Preserving Profits When You Can’t Be At Your Screen

It can be troublesome when a trade is profitable and close to its target profit, yet a big move, unattended, could severely draw down that profit. Occasionally, an options income trader simply can not be at his or her screen. Seth Freudberg discusses a solution to that. Enjoy the video. * no relevant positions

SMBU’s Options Tribe Webinar: Options Tribe Member Dave Freitag: The Ten-Delta Move Trade

This week, Options Tribe member Dave Freitag presents his Ten-Delta Move Trade for the first time on our weekly webinar.

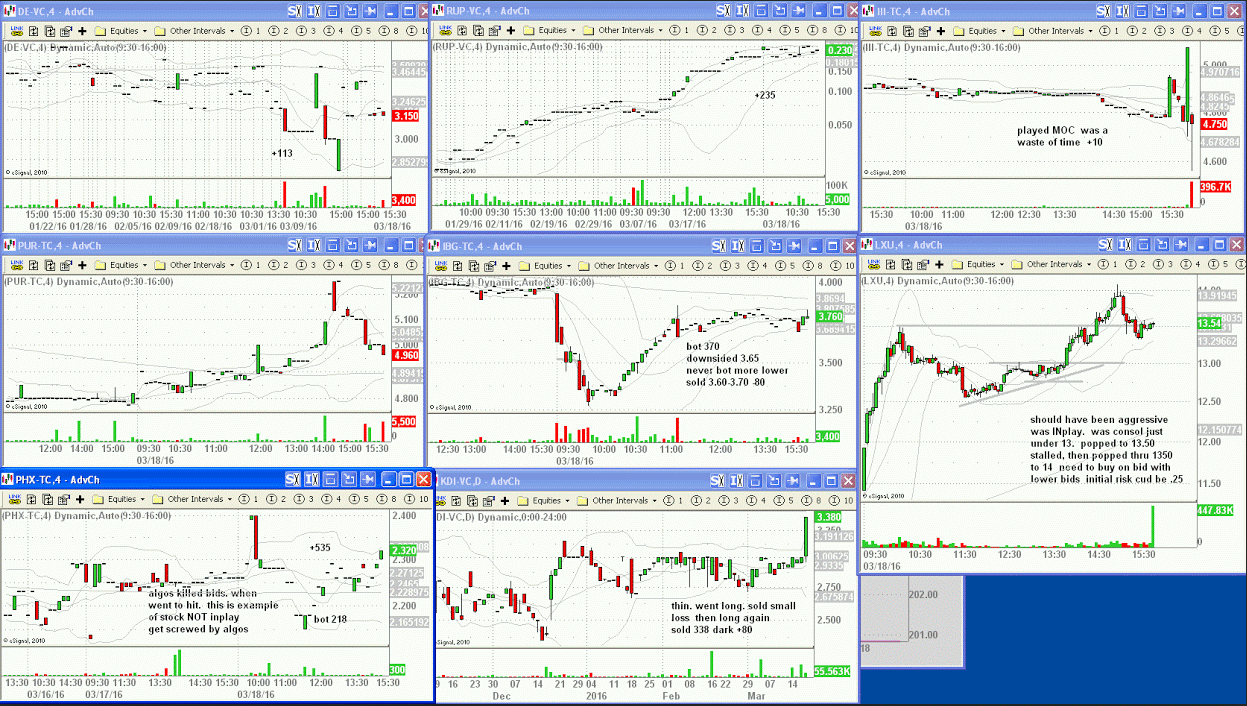

My trading is “garbage”

Hey Mike Couple of things….I’m reading my way through The PlayBook and felt I should send this GIF along…. Don’t know if I should laugh or cry at the garbage I trade. Again, my background over the years was to make $ trading the crap. its where I had an edge….. Obviously I no longer want to trade this way, … Read More

SMBU’s Options Tribe Webinar: Options Tribe Member Nagaraj Ramakrishna: The Smart Options Income Trade

This week Options Tribe Member Nagaraj Ramakrishna returns to the Options Tribe to present his “Smart Options Income Trade” to our community

How Short Term Traders Use Catalysts

In this video I discuss how price action following a significant piece of news helps to determine a trading bias. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 19 years. His email address is: [email protected]. No relevant positions