Dear Bella, My name is (name deleted) and I am a twenty year old student at University of Florida. I have been following smbcapital on twitter ever since I saw you guys on Wall Street Warriors. I am more of a currency trader but recently I have been reading your morning rundowns and trying to trade the stock like how … Read More

Learning From a Reader Who Learned From SMB Blog

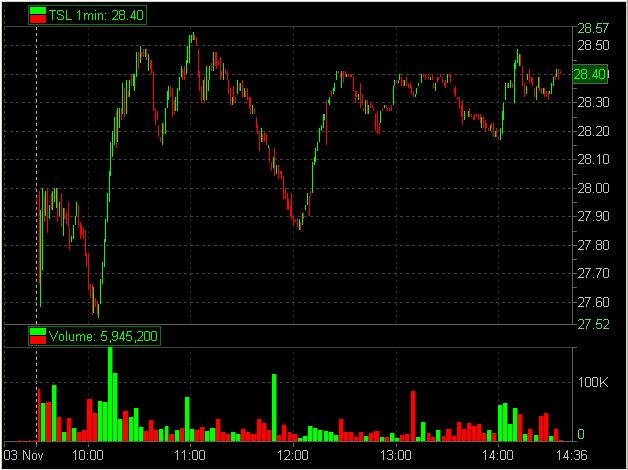

Today I received this email from a trader who learned from SMB Blog. Perhaps now we can all learn from him. Here are his trades: Attached is a word document with screenshots of a trade I made this morning. I used 2 of your recent blog entries to find a stock and implement your strategy. Probably one of the best … Read More

Paying Attention+Communication=$$

We have written many times about the importance of reviewing charts each night for a variety of reasons. One such reason is to spot patterns that seem to be most prevalent during a particular market period. Since earnings season began a few weeks ago I was noticing that quite a few stocks that were trending down in the morning were … Read More

SFO Webinar with Bella on November 4, 2010

Mike Bellafiore to present a free webinar with SFO Magazine.

No More Mr. Nice Guy!

Attention all short term traders! Stop with the stupid short trades in LVS! If a stock is in an uptrend in every conceivable time frame you need to spend your energy thinking about how to get long. It is asinine to think that every time you see some weakness on the tape or it has one negative day that this is the … Read More

You Should Know Which Sectors Are Driving

Tracking strength and weakness in individual sectors can give us an edge for broad market direction.

Time To Pay For That Expensive Handbag

COH was one of the best trading opportunities last week. It is set up very nicely for another leg higher. The trigger buy is above 50.25. Add to the position if holding above 50.80. If this trade works you should be able to afford that dopey handbag your significant other has been bugging you to buy for her.

The 800-Pound Gorilla in the Room: Exits

Managing your exits is at least as important as where you’re getting into the market, and a quirk of human nature makes this a little bit more complicated