How do you make more on your best trades? – Bella

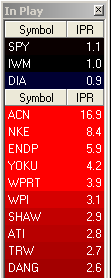

SMB Radar Update for June 28, 2011

These are today’s top stocks on the In Play column on the SMB Radar. This is the most important function of the scanner. The Radar uses a number of proprietary algorithms on a prescreened universe of stocks and processes every tick in search of finding stocks that are In Play. These stocks have unusually high order flow that indicates heavy … Read More

Trading Thought of the Day – June 28, 2011

However, when trading with 60% edge, there’s still a 40% chance of being wrong and a 6.4% chance of being wrong three times in a row. – Adam Grimes

My Take On The Market

My view on the market is encapsulated via a chart on the SPY for the past several weeks. We have been in consolidation mode for 16 days now. I am starting to wonder if we will continue to stay in this range until earnings seasons begins. Each time we have moved to the 126.60 support area buyers have stepped in. … Read More

Trading Thought of the Day – June 27, 2011

It’s more stressful for most traders to stay in a trade that is working than just get stopped out of a losing trade. – Bella

The Trend Trend Trade

I am officially naming a new trade. SMB will call it the Trend Trend Trade. Below we explain through the trade of one of our traders, Shark, reviewing a recent trade in LPS, using the SMB Playbook template. The Trend Trend Trade is a set up where the long term trend and the short term trend align. We look for spots … Read More

Trading Thought of the Day – June 24, 2011

But trading has a lot of psychology attached to it. People aren’t loved as kids and first they take it out on the markets and when that doesn’t work out they take it out on comment boards. – James Altucher

Trading Thought of the Day – June 23, 2011

Everyone who has found any kind of lasting success on Wall Street has the same thing in common – a lack of complacency. – Josh Brown of The Reformed Broker