SMB is proud to announce the addition of an experienced options trader and educator to our blog, Greg Loehr, of Optionsbuzz.com. Greg has served both as a market maker on the floor of the CBOE as well as a proprietary trader for various firms prior to his founding Optionsbuzz.com. Greg has also been a repeat guest on SMB’s Options … Read More

Playing the Quarterly’s on the SPX

This post is the first in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. With the end of the quarter fast approaching there are two thoughts in my mind: quarterly window-dressing and a potential slowdown in China. For the next week, … Read More

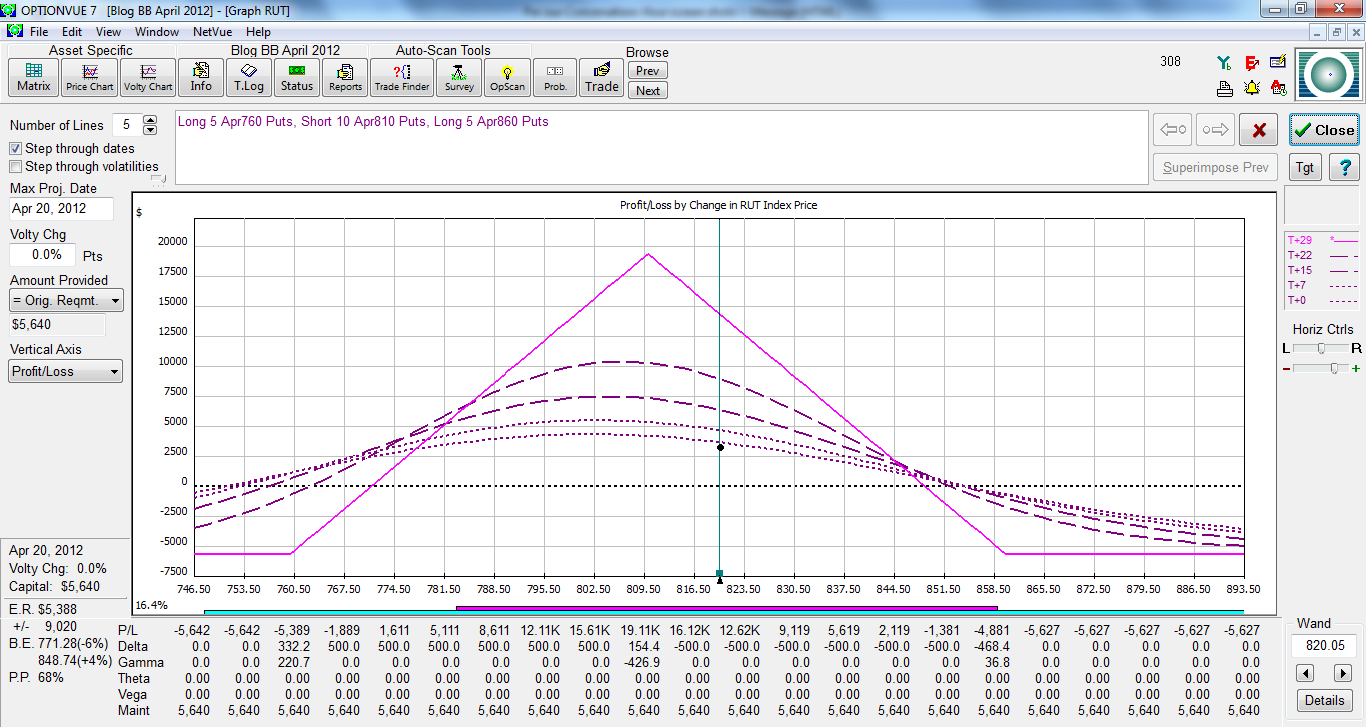

The April Bearish Butterfly Trade

This post is the first in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the April, 2012 expiration of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. On Friday, February 24, we initiated the April bearish butterfly trade … Read More

How to identify a swing trade

When trading, we identify different levels from different time frames. When the market makes new lows or highs, we can go back in time and make decisions based on the swing price market. In this trade taken in the USD/CAD, the price market made new lows but just enough to be in areas in possible rebounds based on bigger time … Read More

A Quick Conversation

One of our newest trainees (5 days live) had been trying to get a hold of me for a few days to answer some trading questions. I had been especially busy lately but finally was able to squeeze in a quick conversation with him before heading to the airport to visit some trading friends in Texas. His first comment/question related … Read More

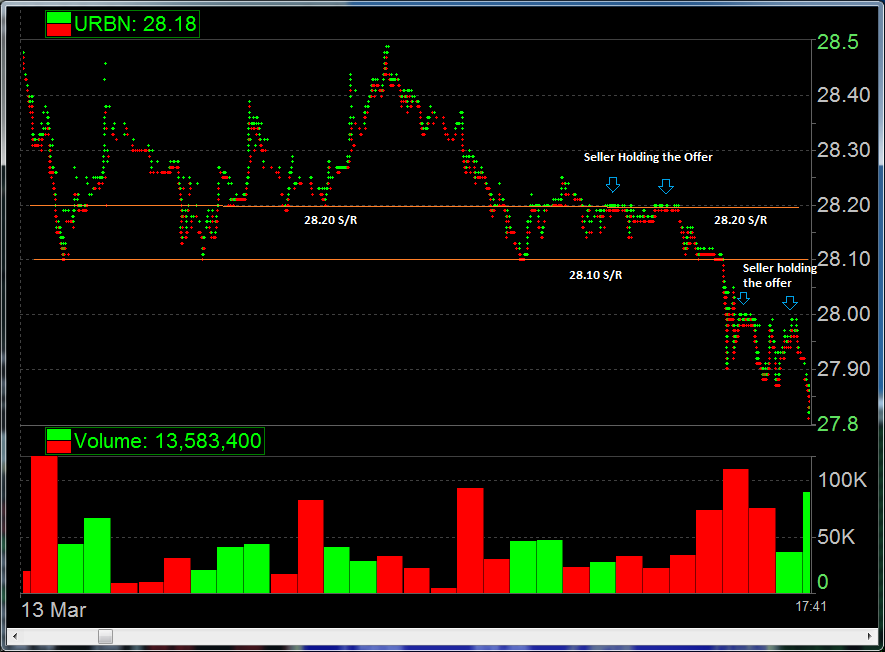

A Tape Trade–URBN

I make trading decisions based on 3 factors: Tape (order flow), Technicals (trend, support, resistance) and Catalysts (News). The least understood of the three is the Tape. It is a skill that takes thousands of screen hours to develop. But once developed it is a skill that enhances the risk/reward of your trades and often enables you trade with larger … Read More

March 12th Gameplan Review

SMB Capital Stocks In Play Call Review. Each morning before the market opens we discuss the stocks that we believe will offer the best risk/reward trading opportunities intraday. Today’s review featured YOKU, ORCL, SODA, MCP,GMCR, FCX and AAPL PDF Summary Gameplan March 12th Steven Spencer is the co-founder of SMB Capital and SMB Training and has traded professionally for over … Read More

I Love Being Wrong–SODA

One of three In Play names discussed in today’s AM Meeting was SODA. It was gapping up to 36 which is a longer term resistance level. My initial thought was the news didn’t seem like a big deal and it would be a nice short on the Open against this level. As the market opened it traded a few cents … Read More