Facebook had been an great swing short since Tuesday morning when it made a new post IPO low. It continued to make lower highs and lower lows. The definition of a “downtrend”. You were hard pressed to spot two consecutive green bars on the 15 minute chart and the few times that did occur there was very little volume and … Read More

New AAPL weekly ‘fly and SPXPM update

This post is another in a series tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. The hypothetical butterfly on the SPXPM is progressing nicely. You’ll recall that this was instituted as a “longer-term” trade compared to the weekly broken wing butterflies that I had been tracking on AAPL and SPX. So for now … Read More

Midday Review – May 25th 2012

On this review, Steve reviews PAY and explains why we focus on trading stocks with this pattern. Also references GMCR, NTAP and FB. * No relevant positions

The Trading Show Chicago

Mike Bellafiore, author of the “trading classic” One Good Trade will be speaking on The Trading Show Chicago 2012 on June 25-27, 2012. The Trading Show Chicago brings together the leaders in North America’s trading community, to explore new advances in trading strategy, quant models and technology. Mike will be presenting a seminar session in one of the on-floor theatres … Read More

A sad anecdote of a failed trader

I received this email from a trader this week: Hey Mike, We talked awhile ago, about how your book “One Good Trade” has helped me and my 5 friends on the trading desk at our prop trading firm($$$$ Capital). I have been trading for about 12 months total and about 6 months live. I have found that your website blogs … Read More

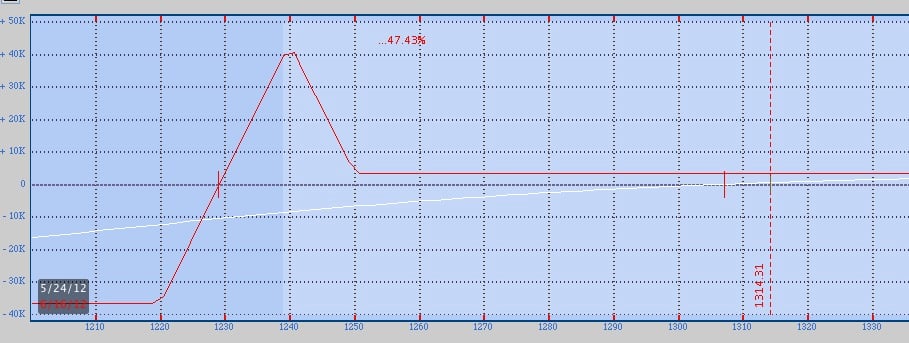

Longer-Term Broken Wing on SPXPM

This post is another in a series tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. Over the past several weeks I’ve been selecting and tracking hypothetical broken wing butterfly trades, in real time, using the weekly options. I was using AAPL, SPX and most recently SPXPM, and all six trades produced simulated profits … Read More

“Et Tu, Bruno?”: Lessons for Traders from JP Morgan’s Recent Loss

London’s “Whale” got harpooned. After being in the press for taking outsized positions in the credit derivatives market, it finally ended for Bruno Iksil, aka the Whale—and badly. JP Morgan’s recent multi-billion dollar trading loss caused a huge amount of angst in the financial press over its prop trading activities and risk controls. As traders, we should pay attention – … Read More

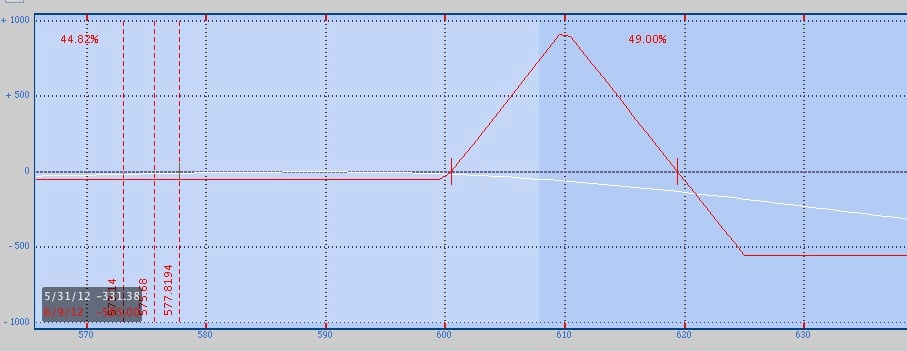

Facebook Friday And Rocket Science

Despite the fact that the fast majority of those hired by hedge funds and banks these days are literally rocket scientists (PHD’s in Physics, AstroPhysics, Mathematics etc.) trading is NOT rocket science. Of course being good at math and being able to write algorithms doesn’t prevent someone from successful market speculation it just isn’t a prerequisite. On Friday I outlined … Read More