YRCW reported disappointing earnings on Wednesday and gapped lower. It moved very well off of the previous S/R levels 22 & 25 (see chart below). On Friday it traded below 22 as selling began to pick up again and it closed at 18 which corresponds with its pivot low from May & June. The large surge in volume as it … Read More

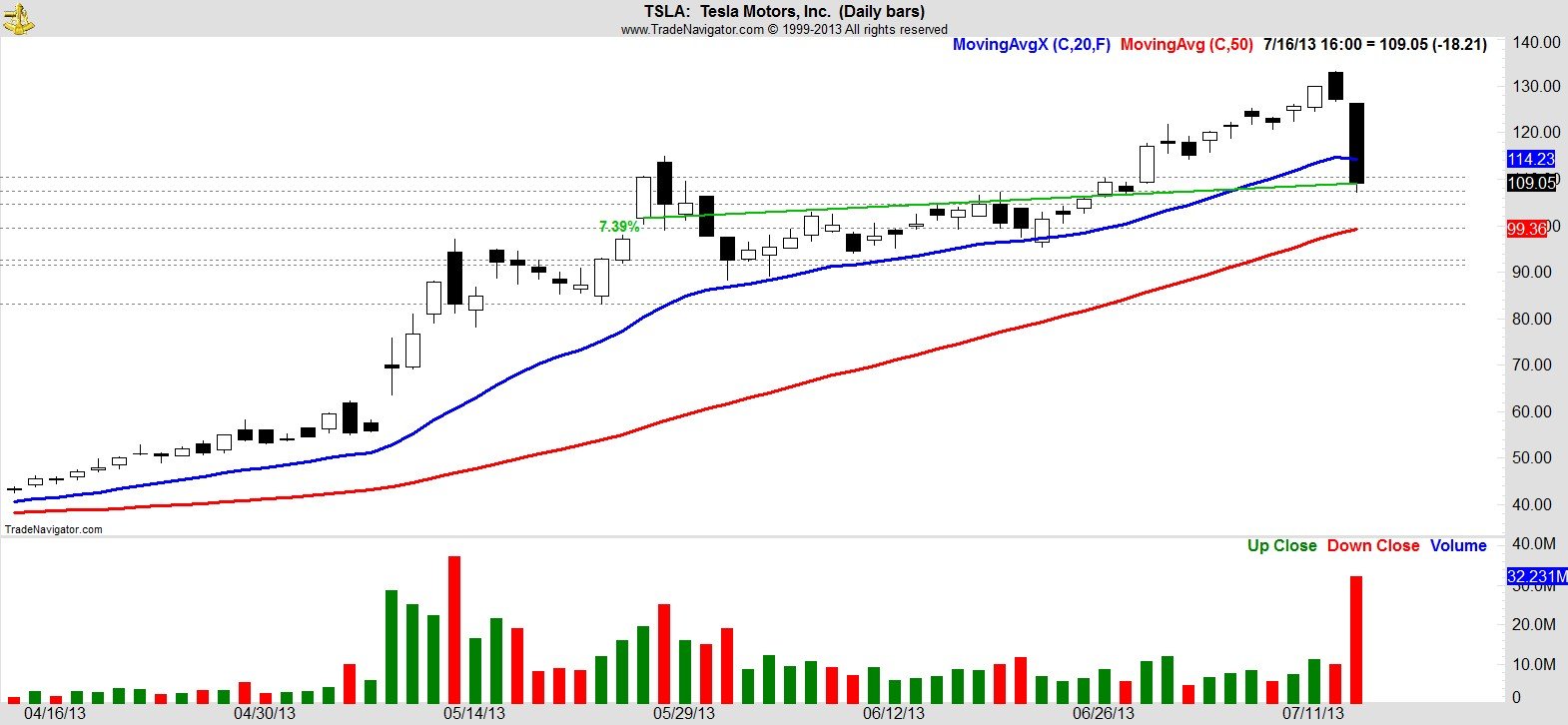

Study Trading Not Markets ($TSLA)

Some traders/investors make the mistake of studying markets instead of trading. This can negatively affect your trading performance. More specifically, this certainly was the case with the recent down move in battleground stock TSLA, the growth stock. For those of us who have traded professionally for 15plus years it is hard to watch and read the nonsense about TSLA’s valuation. … Read More

Andrew Keene visits SMB

Andrew Keene stopped by our trading office in NYC last week to talk with those in the SMB College Training Program. He was visiting before sitting as a guest on Bloomberg TV. Andrew has been a presenter with Seth Freudberg for the SMB Options Tribe in the past (see the video below). One of our trainees put together his thoughts … Read More

Do Not Fear the Bots

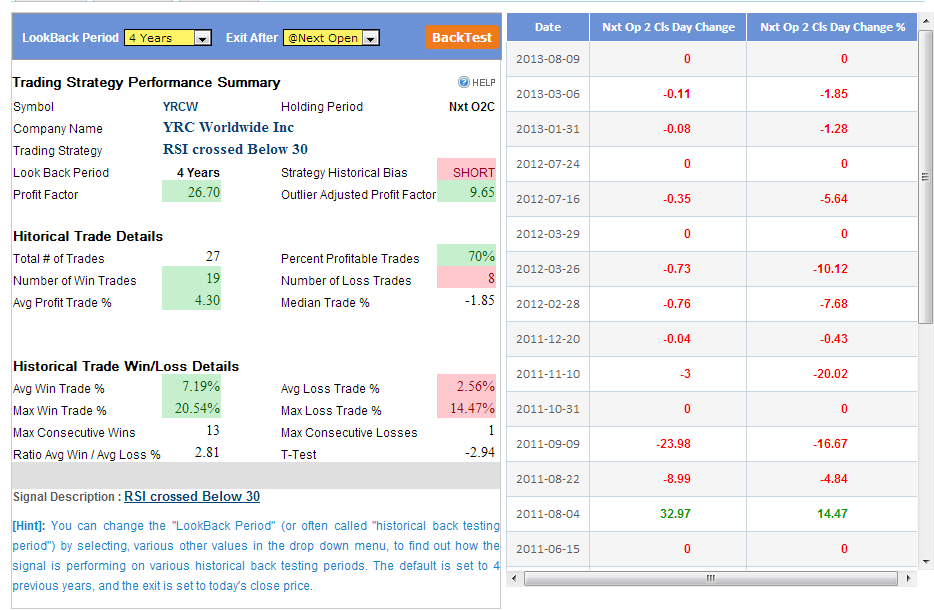

Computer trading has become the largest part of our market’s volume threatening the profitability of many discretionary traders. Many traders/investors fear the bots. We shouldn’t. We should embrace their underlying technology and use it to help us find more of our favorite trading patterns. And even turn quant. Adding support to my thesis above was a recent blog post at … Read More

John Locke Weekly Market and Position Update for August 5, 2013

Be sure to visit our trading blog! www.lockeinyoursuccess.com

Proper Preparation Disguised As Luck– $WLT

I was long WLT two weeks ago as it was trending higher from 11 to 14. Then they made an announcement after the close about a new financing deal and it gapped lower the next morning causing me to give back a decent chunk of my profits. After trading down to 12 in the morning where it did huge volume … Read More

New Fatherhood and Trading

They say that fatherhood changes everything and I can confirm that it does. At 42 my life changed completely when Luke entered the world. How you ask? My downtime is gone. After work I used to enjoy some downtime with Hardball, PTI and the Yankees. Now as soon as I walk in the door, I get the immediate hand-off from … Read More

The Round Tripper

It is not every day that you are able to catch a trend in both directions in a stock. FB has been a short term trader’s delight for the past five trading days. Media coverage hit a fever pitch today with FB tagging its otherwise meaningless “IPO price” of $38. The fact that it has been moving higher since last … Read More