Traders,

For anyone struggling to adapt or to navigate the market right now, Bella recently put out a fantastic post and video. If you’re in a drawdown, struggling to adapt, and/or just looking to continuously improve your game, check it out in this video. He goes over, in detail, 8 trading lessons from a painful drawdown and the cure.

Now, admittedly, this has not been the easiest market. After some hiccups, last week I found success and consistency by focusing on move2move trading/ scalping and extremely selective swing trading. I lowered expectations, focused on base hits rather than home run trades, and allowed consistency and selectivity to compound. I took what the market gave each day, without trying to force home run intraday trades or swing trades.

It’s not a tape right now to be swinging the bat hard on swing trades, and coming into the week, I don’t have any A+ intraday opportunities for Monday / Tuesday that I am stalking. So, as a trader, you have a decision to make during such a market. 1) Are you going to just sit around and complain about a slow, difficult market? Or 2) Are you going to take this challenge in your stride, focus on expanding your playbook, and collaborate with traders and reverse engineer trades that they are having success with? Doubling down on what is working well and cutting out what is no longer working? Etc., etc.,

Hopefully, it’s number 2.

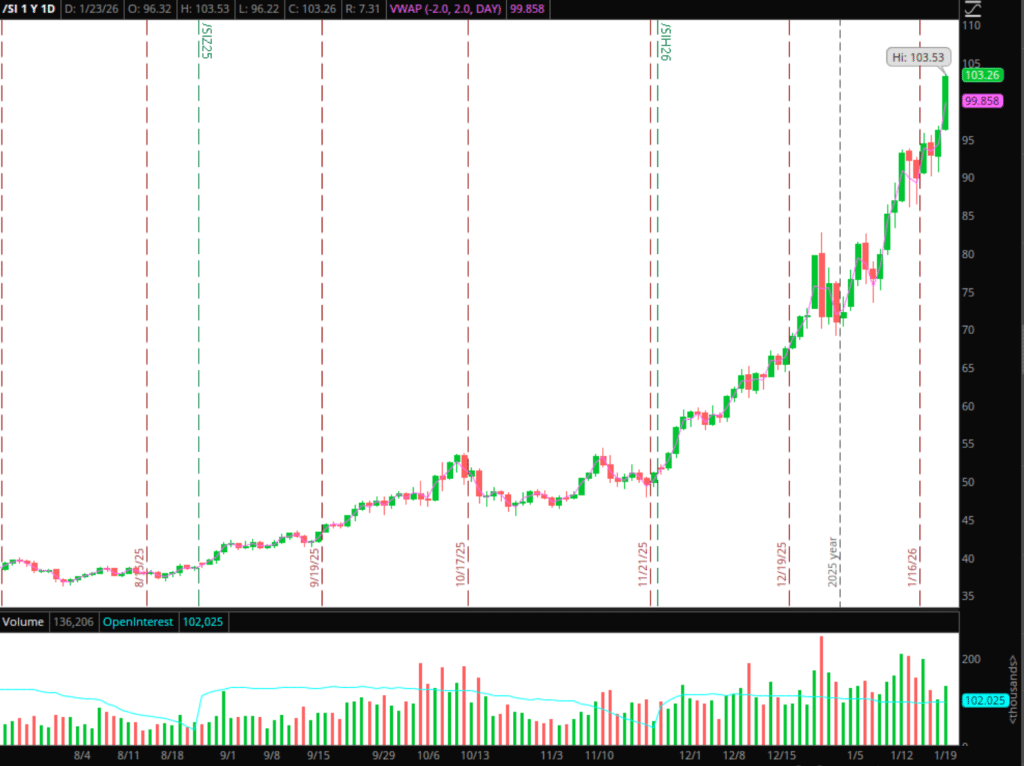

Silver: It’s only fitting to start with Silver. Ahead of the futures open this evening, it’s anyone’s guess. Now, are we overextended? Yes, of course. Does that mean we have to selloff as one would expect with an equity? Nope. My only plan for the upcoming week with silver, given the historic move and expansion above 100, is purely reactive. Either there’s a catalyst/headline, similar to last week’s headline (Greenland framework), that provided an awesome short-scalp breaking news opp in silver. Or, Silver blow-offs in spectacular fashion for an A+ intraday short against a well-defined key level of failed follow-through or lower high. Or I see silver take out a day’s low/prior key support and hold below it without reclaiming (change of character), and look to short it intraday. If nothing sets up, it won’t be on my screens.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

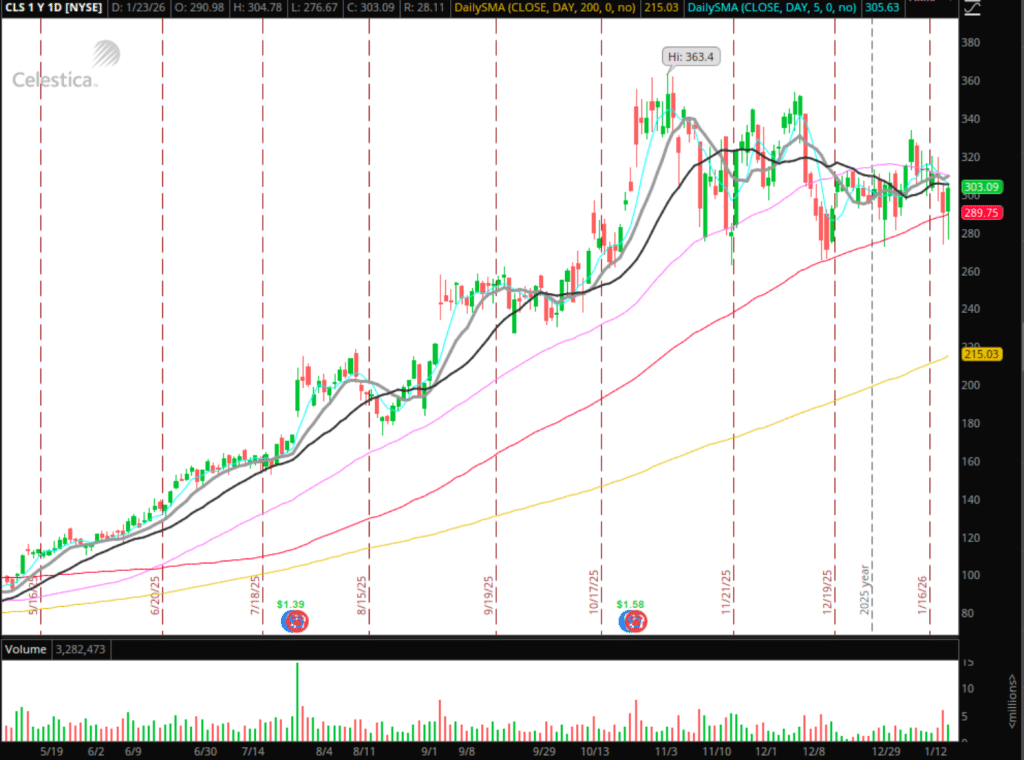

Stalking the Electronic Components / Fiber Optics Players: From memory to aerospace and defense, many of the A+ swing long trades largely played out already. If you weren’t exposed early in the year, you likely missed the move. One space that is holding up, though, is the electronic components players. I’m seeing a lot of good bases that have been built. As earnings approach, in the back of my mind, I’m wondering whether blowout earnings from the first major player to report could catalyze a sector/industry push. If that were to happen, I want to be prepared. Here are some of the names that I am stalking:

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Others include: COHR, VIAV, LITE, CIEN, LUMN, FN, TTMI, AAOI.

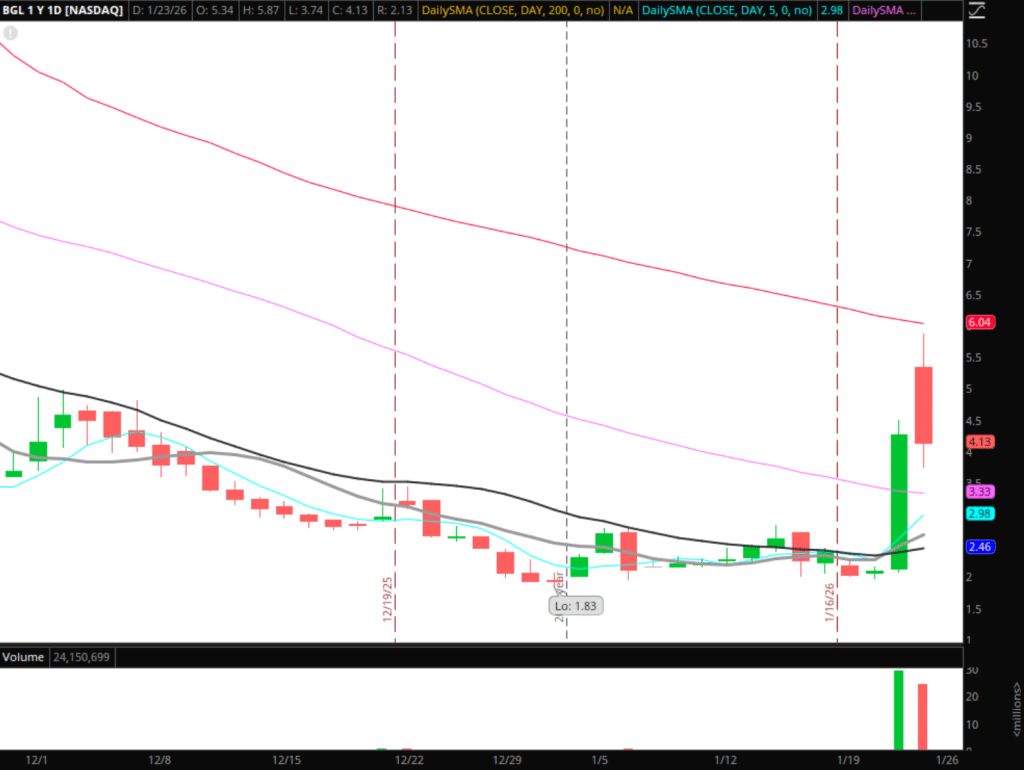

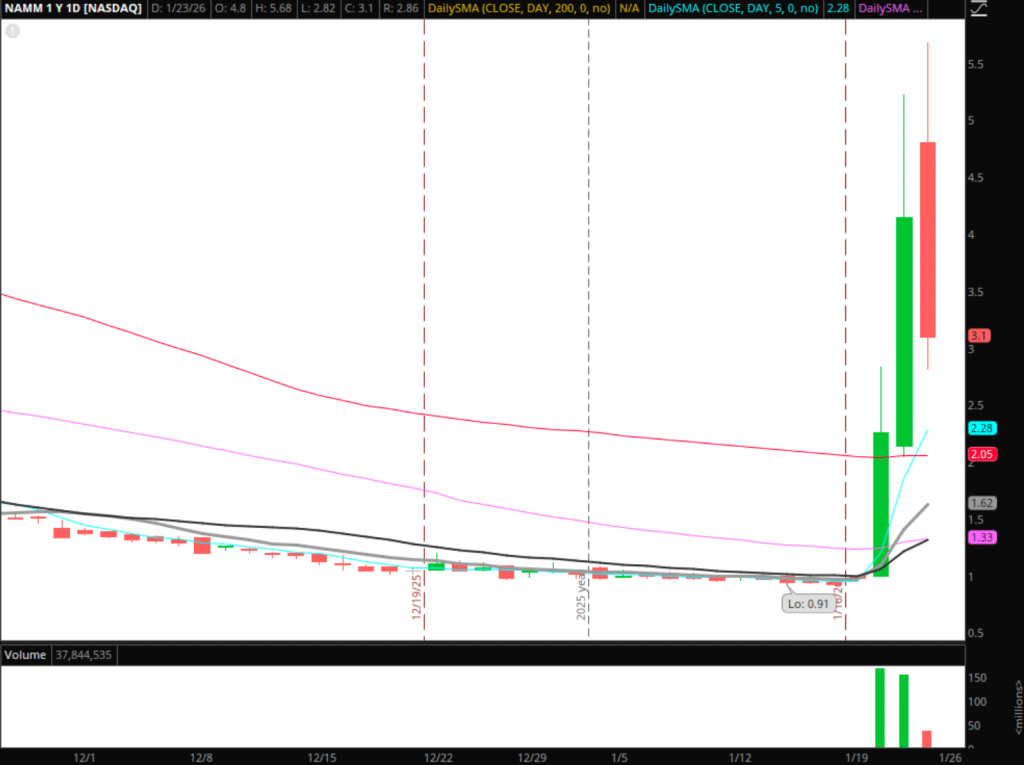

Intraday Shorts in NAMM and BGL: Both NAMM and BGL were sympathy low float runners to the basic materials sector run. After Friday’s intense sell-off in both names, whilst commodities held up extremely well, I’d be inclined to short pops. Given the market conditions, I’d react rather than scale on the front side. For example, if BGL popped back toward VWAP from Friday, I’d wait for it to stuff before shorting. The same goes for NAMM. If they push higher and fail, I’d short against the day’s high and trail on the 5-min.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Names on Watch:

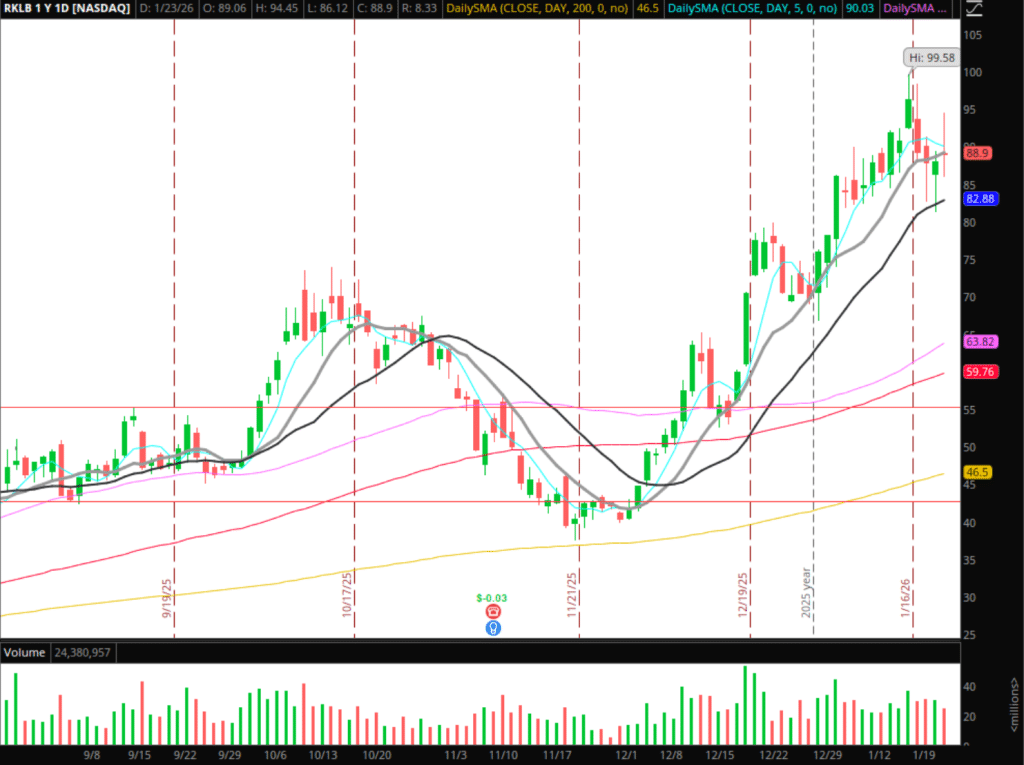

RKLB: Eyeing the higher-low and a base to build above Thursday’s low for another leg higher.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

PL: Eyeing the base currently being built for a potential momentum breakout intraday.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

VRT: Beautiful base and bull-flag developing on the daily and weekly.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.