Traders,

I hope you’re all enjoying your holiday season!

If you’re like me, the holiday festivities have been cut short somewhat due to the unprecedented action in Silver. It’s history in the making. While I have taken some time off, I was back at my desk on Friday and plan to be present throughout next week to the action.

So, with that being said, let’s get right into this week’s watchlist, which, for me, is entirely dominated by Silver.

Silver’s Gone Parabolic…

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

$SLV, the iShares Silver Trust, was up 20% last week, 53% on the month, and 170% YTD. The RSI is now nearing historical levels near $86, as both range and volume have expanded. From the prior day’s close, SLV traded almost 3x ATR on Friday, and over 3x average volume. Not bad for a Friday following Christmas.

Before I get into my plan, here are some interesting points on the recent action. China recently announced a government-issued export license on silver, beginning on January 1 – a move that could further tighten the supply of the already-strained commodity globally.

CME has just raised margin requirements on precious metals, including Silver, beginning December 29 (Monday). That especially matters for leveraged futures traders, as they could be forced to liquidate if undercapitalized.

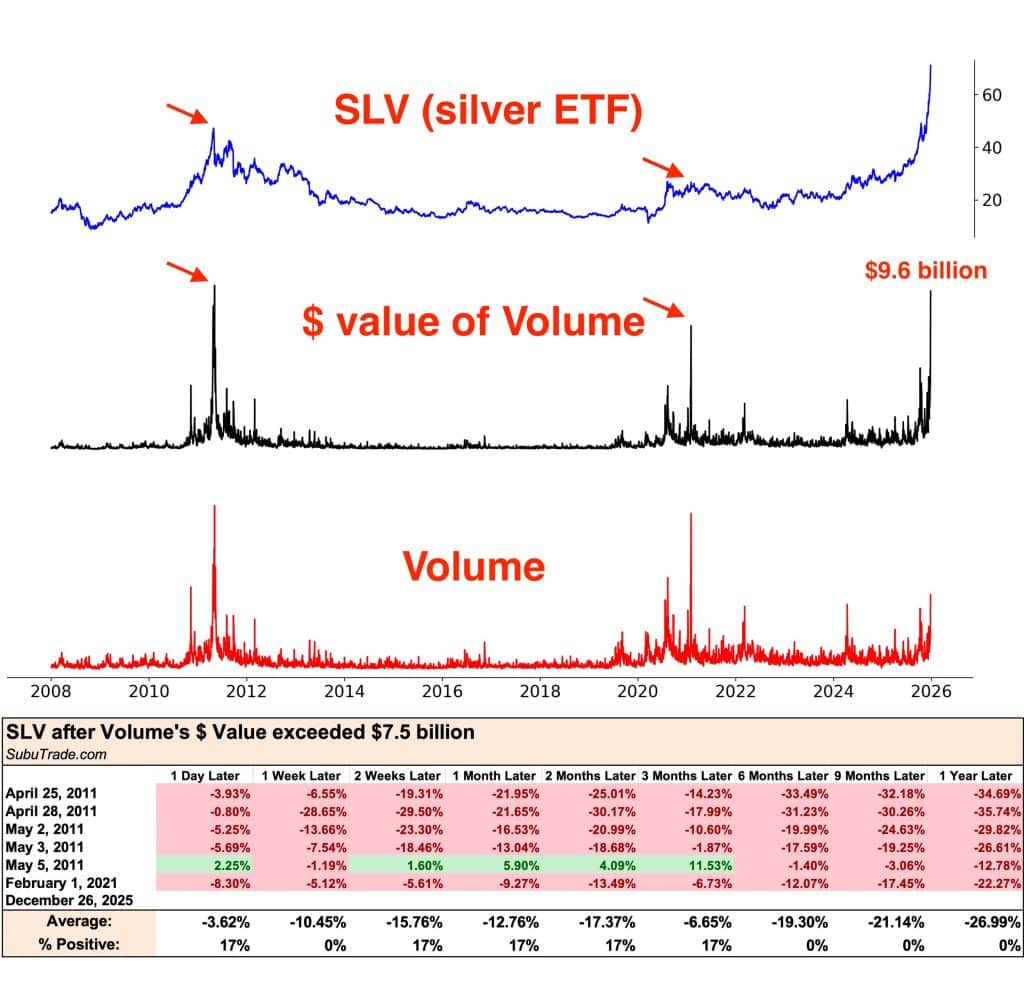

$SLV ETF volume surged on Friday to levels only seen twice before. Last time that happened, with volume $ greater than $7.5 billion on average, SLV was negative 3.6% the following day, and almost 10.5% a week later.

(Below graphic from subutrade on X)

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

But could this time be different? Could it also be that the action on Friday was dominated by market makers delta-hedging? And could the blow-off top be on Sunday evening/Monday morning, with weekend euphoria and FOMO, leading retail to chase the excitement before reality sets in?

A+ Mean Reversion in Silver

I believe the short-term top is close, in terms of timing. And I’m prepared to be short this week and will be stalking SLV for a character change Monday – Tuesday. That said, it might only materialize and confirm up 5% + from Friday’s close. I believe it’s near, but it’s a fool’s errand to size short ahead of time. I have the idea; now I need the setup and price-action confirmation.

So, what will my vehicles of choice be for playing a mean reversion? I will focus on $SLV and $ZSL.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The ideal A+ setup would be a gap-up Sunday futes into Monday am, followed by a blow-off / failed follow-through. In that scenario, where SLV re-tests resistance / or lower highs and fails, I’ll look to initiate a starter short against the pivot high. The change in character and risk-on for me would be a hold below the intraday VWAP and lower lows, or a consolidation breakdown to size in. Of course, if this reclaims VWAP or holds firmly above, I will not be short with any meaningful risk. The key is to wait for a shift in momentum – lower highs / hold sub LOD or VWAP / trendline break/blow-off top, etc. I plan to short once I notice a shift in momentum, with A+ size, closing over 50% into intraday targets, and holding a core as a multi-day swing trade.

Alternatively, we get a FRD setup in Silver, and I’ll trade it accordingly…as outlined many times for the FRD setup in previous watchlists.

And lastly, what would my lofty targets be for the core position that I plan on holding short as a swing trade be? Mid to low $60s would be ideal. I’ll look to maintain a core position from day 1, targeting a reversion toward the 5-day and 10-day SMAs. Of course, any basing action and higher low confirmation on the daily will result in closing the trade ahead of targets.

Remember, having an idea is one thing; executing efficiently is another.