Traders,

I hope you’ve all had a wonderful weekend.

Several of the ideas shared today will be similar to those from last week. And that follows on from general thoughts shared in my recent IA meeting. On a swing trading front, it’s all about being patient right now and allowing charts to reset and base. After the momentous run we’ve just had in the market and many leading sectors, it’s only normal for prior leading names to take a breather and digest recent gains before setting up for potential follow-through.

Alright, let’s get right into it.

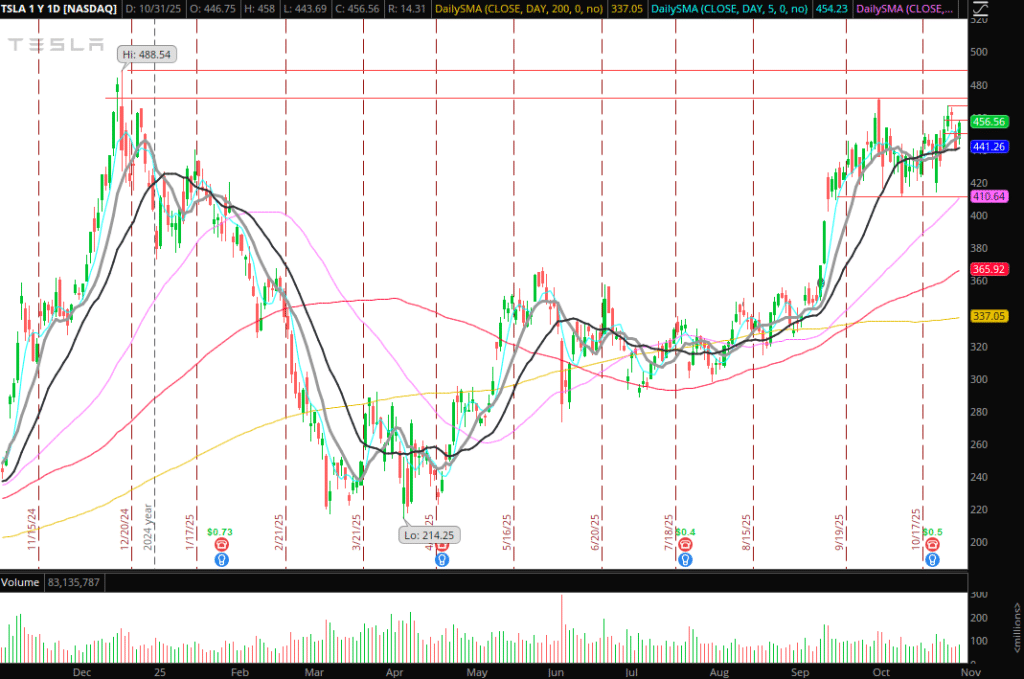

TSLA: On Watch for a Major Breakout

Similar to my thoughts last week, I’m struggling to find a chart as bullish as Tesla. Across several timeframes, it’s setting up near-perfectly for an eventual breakout above $470, testing all-time highs and beyond. Of course, the near-term catalyst on November 6 could catalyze a breakout. Before the catalyst, we could see anticipation build, leading to a potential breakout. Last week’s shakeout sub $450 further boosted my confidence in the setup.

So, going forward, I’ll be monitoring for tighter build and consolidation above $460. On a breakout above $470, I’ll be positioned long for an A+ breakout swing trade. My timeframe will be stretched, as I’ll look to hold a core for multiple weeks should this follow through to the upside. That trail could be partially against the prior LOD and the 10-day SMA.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Multi-day Bounce in NVTS: Important to note that earnings are on the horizon. In NVTS, I’m not looking for a week+ swing trade. Instead, I’m looking for 1 – multi-day bounce opportunity given the pullback and range contraction over the previous three days. Ideally, I’d like to see this in play and holding above Friday’s high / the 10-day SMA. I’d then look to get long on momentum against the prior 5-minute higher low for 1 – 2 days of continuation to the upside.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

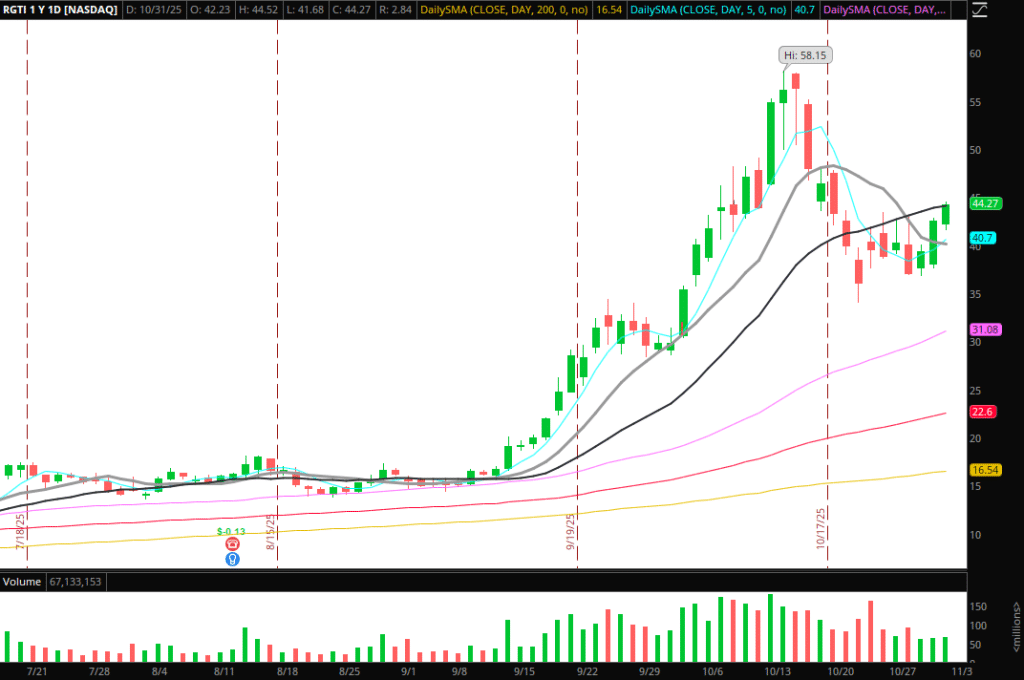

Lower High Short in Quantum (RGTI): As discussed in my recent IA meeting, I’m looking for a multi-day bounce to play out in quantum setting, setting up a potential short. Ideally, I’d like to see failed follow-through toward a resistance zone near $45-$46+ and confirmation of a lower high. If I notice that, I’ll look to position short for a multi-day swing short, targeting a move back toward key support near $40, with a core trailed against the prior day’s high.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

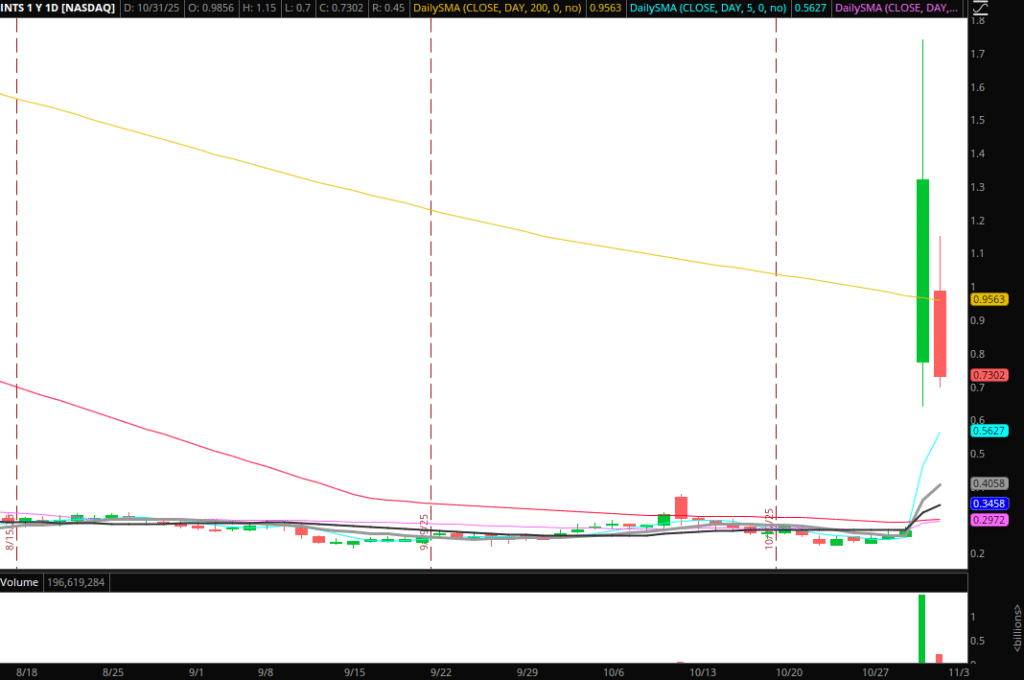

Potential Liquidity Trap / Squeeze Out in INTS: Great mover on Thursday, followed by strong pricing on Friday of the offering and selloff. 1b+ shares traded on Thursday, against 196m on Friday, and an all-day selloff rewarded shorts. The only way I’d be interested would be if this reclaimed $.80 and began to grind higher toward $1. If volume comes in above $1, I’d look to position long against a hold sub-VWAP for continuation above Friday’s high and first target a move toward the upper range from Friday.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Names on Watch:

PATH: Monitoring for Build above its 10- and 20-day SMA convergences.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

BBAI: Tight consolidation and range contraction. Looking for a push above its 10-day SMA and a firm hold above VWAP for intraday continuation to the upside.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

ACHR: Steady pullback and range contraction. Similar to BBAI, I’d look for a long if this reclaims above Friday’s high and provides a long momentum entry above VWAP.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

BB: Lovely looking chart with a multi-month consolidation above all key SMAs. $5 breakout level.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

LAES: On watch for continuation above Friday’s high and firm hold above its intraday VWAP.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.